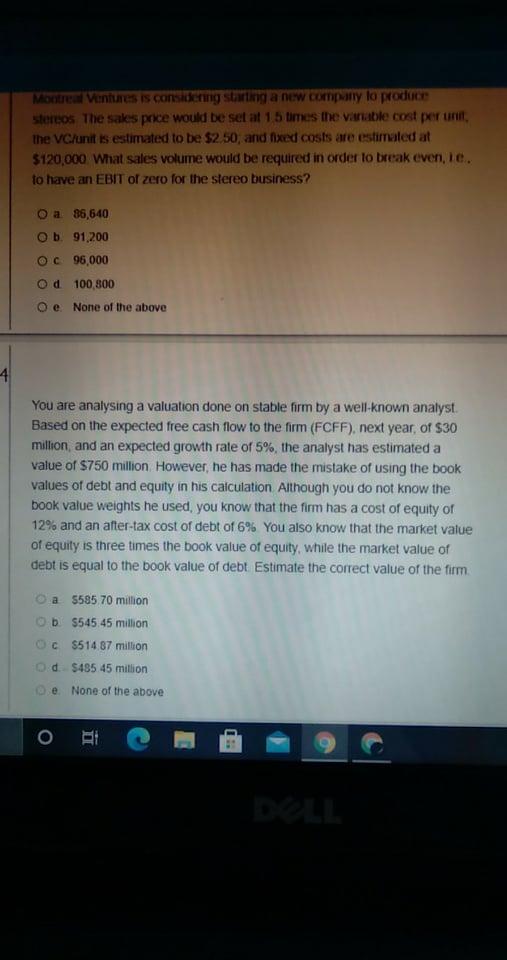

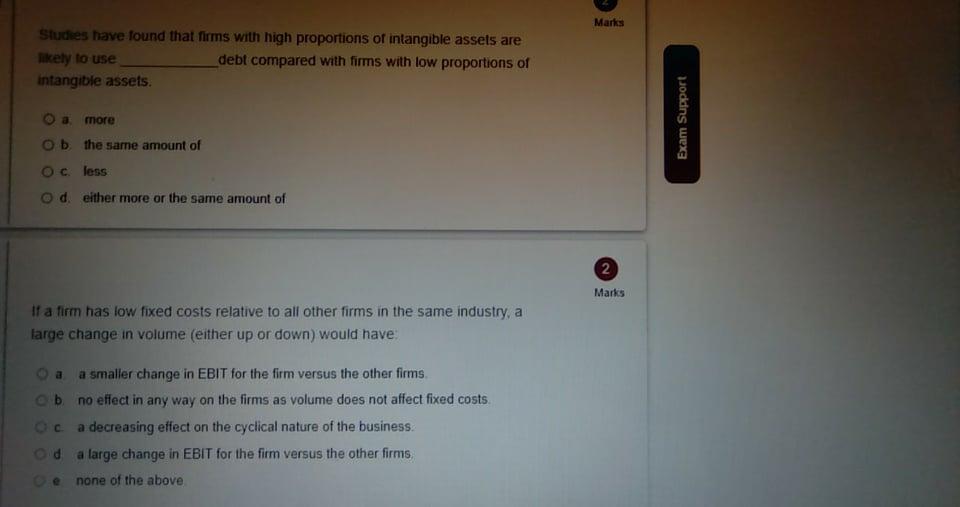

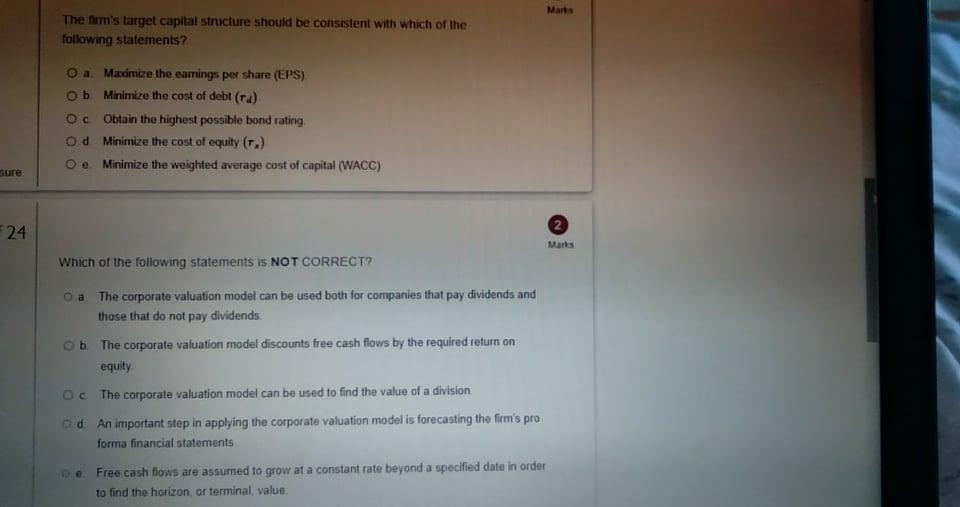

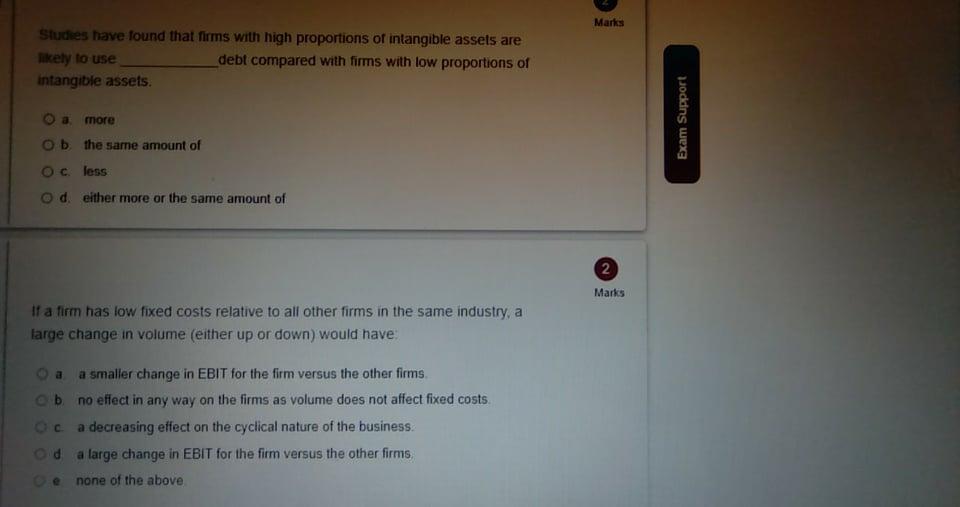

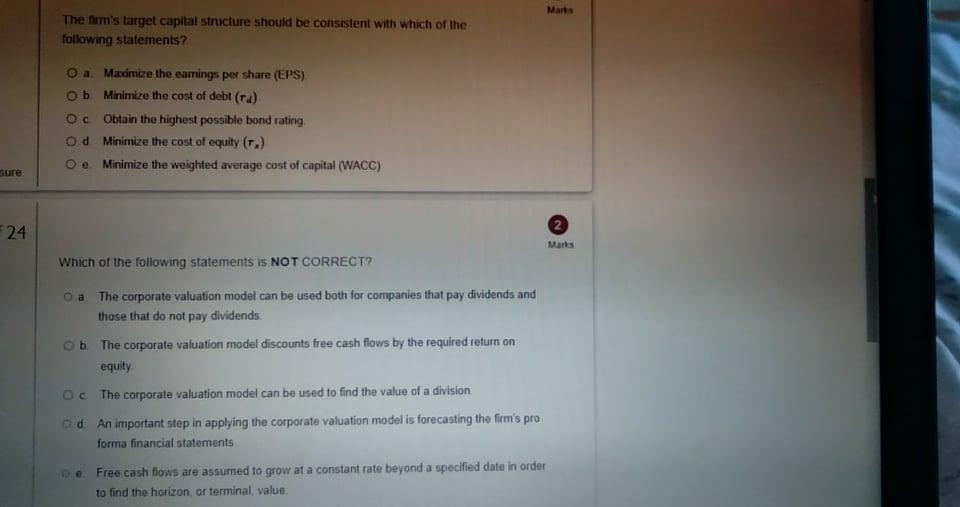

Monte Ventures is considering starting a new company lo produce Stereos The sales porce would be set at 15 times the variable cost per un the VC unit is estimated to be $2.50, and fixed costs are estimated at $120,000 What sales volume would be required in order to break even, le. to have an EBIT of zero for the stereo business? oa 86,640 Ob. 91,200 Oc95,000 od 100,800 O e None of the above 4 You are analysing a valuation done on stable firm by a well-known analyst. Based on the expected free cash flow to the firm (FCFF), next year, of $30 million and an expected growth rate of 5%, the analyst has estimated a value of $750 million However, he has made the mistake of using the book values of debt and equity in his calculation Although you do not know the book value weights he used, you know that the firm has a cost of equity of 12% and an after-tax cost of debt of 6% You also know that the market value of equity is three times the book value of equity, while the market value of debt is equal to the book value of debt. Estimate the correct value of the firm a 5585 70 million Ob $545,45 million OC $514 87 million d $485 45 million e None of the above Marks Studies have found that firms with high proportions of intangible assets are likely to use debt compared with firms with low proportions of intangible assets. Oa more Ob the same amount of Oc. less Exam Support Od either more or the same amount of 2 Marks If a firm has low fixed costs relative to all other firms in the same industry, a large change in volume (either up or down) would have a a smaller change in EBIT for the firm versus the other firms b. no effect in any way on the firms as volume does not affect fixed costs Oc a decreasing effect on the cyclical nature of the business. Od a large change in EBIT for the firm versus the other firms cenone of the above Marts The firm's target capital structure should be consistent with which of the following statements ? O a Maximize the earings per share (EPS) Ob Minimize the cost of debt (ra) Oc Obtain the highest possible bond rating Od Minimize the cost of equity (r.) e Minimize the weighted average cost of capital (WACC) sure 24 Marks Which of the following statements is NOT CORRECT? O a. The corporate valuation model can be used both for companies that pay dividends and those that do not pay dividends. ob. The corporate valuation model discounts free cash flows by the required return on equity Oc The corporate valuation model can be used to find the value of a division od An important step in applying the corporate valuation model is forecasting the firm's pro forma financial statements e Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon or terminal value