Answered step by step

Verified Expert Solution

Question

1 Approved Answer

month of May: May 1 May 6 May 9 May 13 and cost of $350. May 15 May 18 May 23 -Tia's Craft Shop

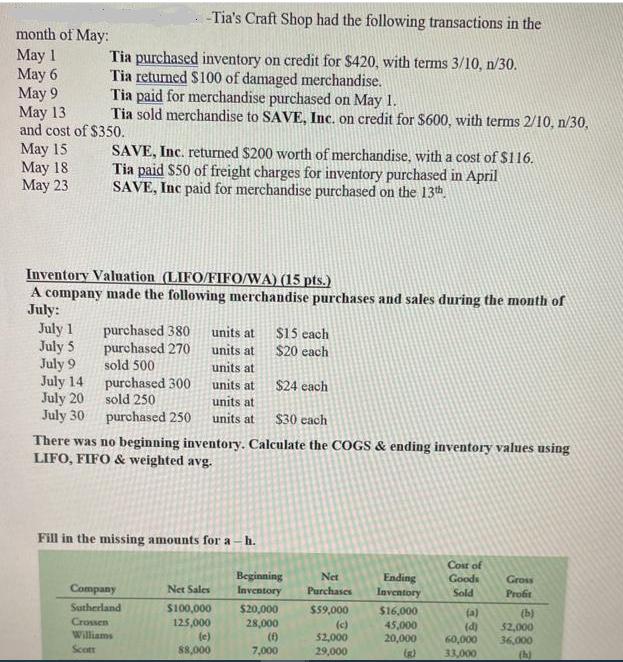

month of May: May 1 May 6 May 9 May 13 and cost of $350. May 15 May 18 May 23 -Tia's Craft Shop had the following transactions in the Tia purchased inventory on credit for $420, with terms 3/10, n/30. Tia returned $100 of damaged merchandise. Tia paid for merchandise purchased on May 1. Tia sold merchandise to SAVE, Inc. on credit for $600, with terms 2/10, n/30, SAVE, Inc. returned $200 worth of merchandise, with a cost of $116. Tia paid $50 of freight charges for inventory purchased in April SAVE, Inc paid for merchandise purchased on the 13th, Inventory Valuation (LIFO/FIFO/WA) (15 pts.) A company made the following merchandise purchases and sales during the month of July: July 1 July 5 July 9 July 14 July 20 July 30 purchased 380 units at $15 each purchased 270 units at $20 each sold 500 $24 each $30 each There was no beginning inventory. Calculate the COGS & ending inventory values using LIFO, FIFO & weighted avg. purchased 300 sold 250 purchased 250 Fill in the missing amounts for a-h. Company Sutherland Crossen Williams Scott units at units at units at units at Net Sales $100,000 125,000 (e) 88,000 Beginning Inventory $20,000 28,000 (6) 7,000 Net Purchases $59,000 (c) $2,000 29,000 Ending Inventory $16,000 45,000 20,000 (g) Cost of Goods Sold (a) (d) 60,000 33,000 Gross Profit (b) 52,000 36,000 (h)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the COGS and ending inventory values using LIFO FIFO and weighted average we need to first determine the cost of goods available f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started