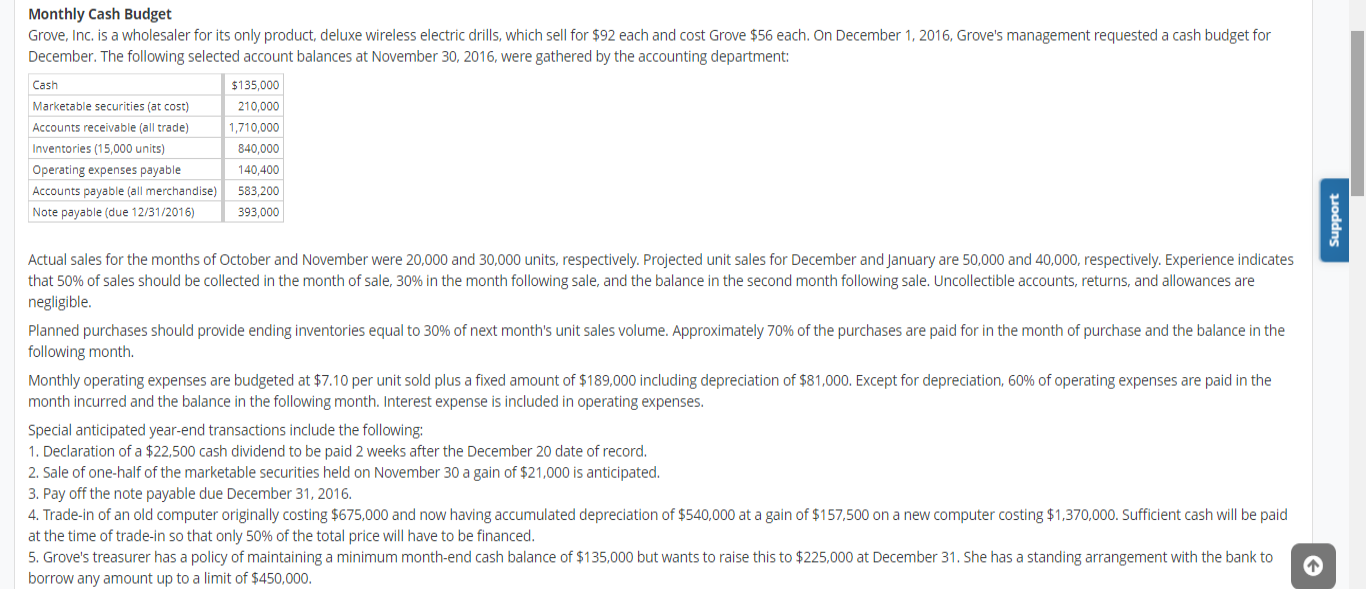

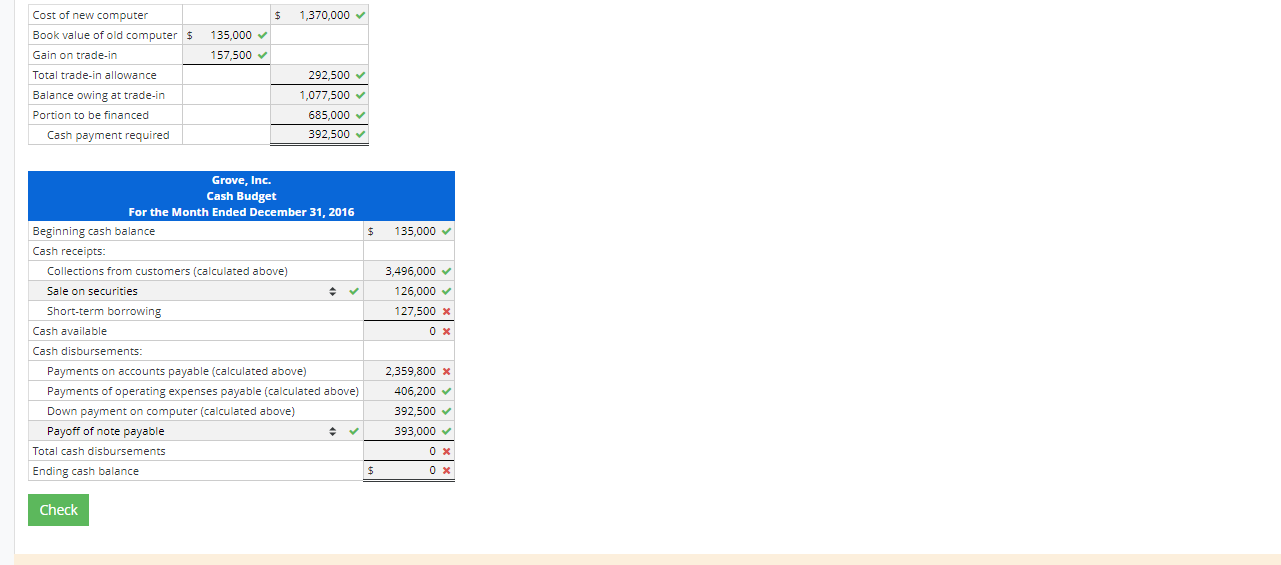

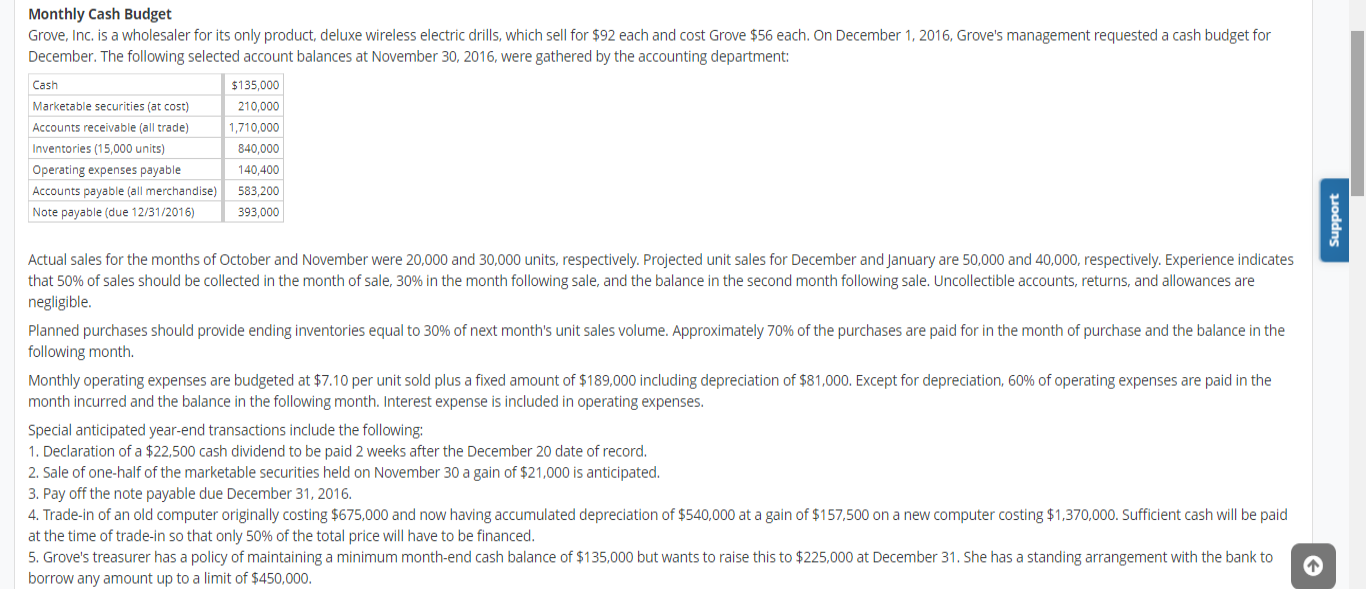

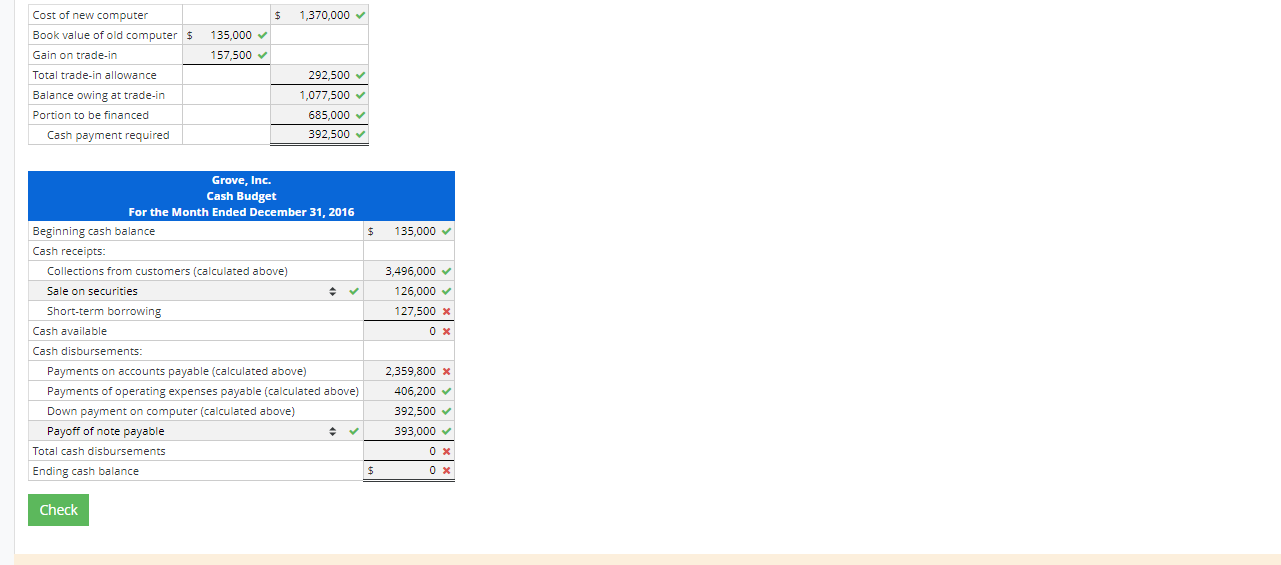

Monthly Cash Budget Grove, Inc. is a wholesaler for its only product, deluxe wireless electric drills, which sell for $92 each and cost Grove $56 each. On December 1, 2016, Grove's management requested a cash budget for December. The following selected account balances at November 30, 2016, were gathered by the accounting department: Cash $135,000 Marketable securities (at cost) 210,000 Accounts receivable (all trade) 1,710,000 Inventories (15,000 units) 840,000 Operating expenses payable 140,400 Accounts payable (all merchandise) 583,200 Note payable (due 12/31/2016) 393,000 Support Actual sales for the months of October and November were 20,000 and 30,000 units, respectively. Projected unit sales for December and January are 50,000 and 40,000, respectively. Experience indicates that 50% of sales should be collected in the month of sale, 30% in the month following sale, and the balance in the second month following sale. Uncollectible accounts, returns, and allowances are negligible. Planned purchases should provide ending inventories equal to 30% of next month's unit sales volume. Approximately 70% of the purchases are paid for in the month of purchase and the balance in the following month. Monthly operating expenses are budgeted at $7.10 per unit sold plus a fixed amount of $189,000 including depreciation of $81,000. Except for depreciation, 60% of operating expenses are paid in the month incurred and the balance in the following month. Interest expense is included in operating expenses. Special anticipated year-end transactions include the following: 1. Declaration of a $22,500 cash dividend to be paid 2 weeks after the December 20 date of record. 2. Sale of one-half of the marketable securities held on November 30 a gain of $21,000 is anticipated. 3. Pay off the note payable due December 31, 2016. 4. Trade-in of an old computer originally costing $675,000 and now having accumulated depreciation of $540,000 at a gain of $157,500 on a new computer costing $1,370,000. Sufficient cash will be paid at the time of trade-in so that only 50% of the total price will have to be financed. 5. Grove's treasurer has a policy of maintaining a minimum month-end cash balance of $135,000 but wants to raise this to $225,000 at December 31. She has a standing arrangement with the bank to borrow any amount up to a limit of $450,000. Prepare a cash budget for Grove, Inc., for December 2016. Collections in December from customers: From October sales $ 368,000 From November sales 828,000 From December sales 2,300,000 Total collections $ 3,496,000 Payments on account for merchandise purchases: November December Unit Sales 30,000 50,000 Ending inventories 15,000 12,000 Total units to be available 45,000 62,000 Beginning inventories 9,000 15,000 Units to be purchased 36,000 47,000 Total dollar purchases $ 1,944,000 X $ 2,558,000 X Portion paid in December $ Ox $ 0x ased $ Payment of operating expenses: November Total variable operating expenses $ 213,000 Fixed operating expenses 189,000 Total operating expenses 402,000 Monthly depreciation 81,000 Operating expenses requiring payment $ 321,000 Amounts to be paid in December $ 128,400 December 355,000 189,000 544,000 81,000 463,000 277,800 $ $ $ 1,370,000 135,000 157,500 Cost of new computer Book value of old computer $ Gain on trade-in Total trade-in allowance Balance owing at trade-in Portion to be financed Cash payment required 292,500 1,077,500 685,000 392,500 135,000 3,496,000 126,000 127,500 x Grove, Inc. Cash Budget For the Month Ended December 31, 2016 Beginning cash balance Cash receipts: Collections from customers (calculated above) Sale on securities Short-term borrowing Cash available Cash disbursements: Payments on accounts payable calculated above) Payments of operating expenses payable (calculated above) Down payment on computer (calculated above) Payoff of note payable Total cash disbursements Ending cash balance OX 2,359,800 x 406,200 392,500 393,000 OX $ 0x Check