Answered step by step

Verified Expert Solution

Question

1 Approved Answer

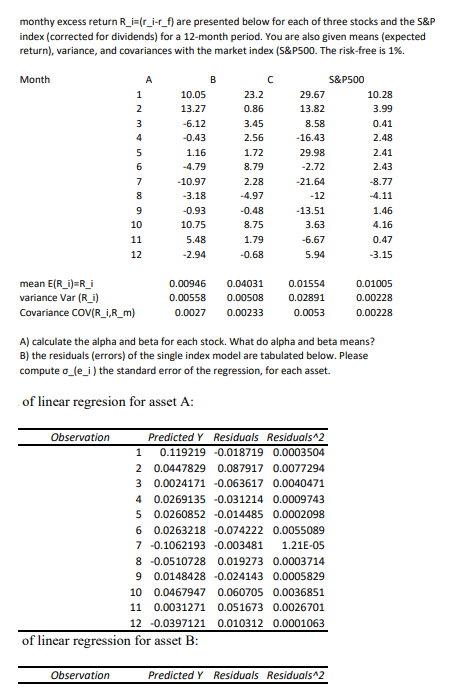

monthy excess return Ri=(rirf) are presented below for each of three stocks and the S&P index (corrected for dividends) for a 12-month period. You are

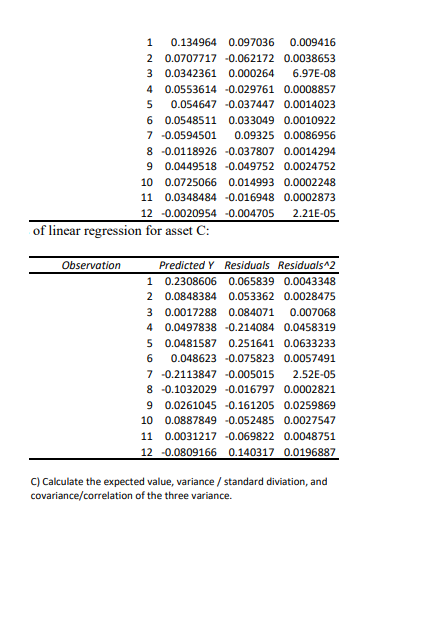

monthy excess return Ri=(rirf) are presented below for each of three stocks and the S\&P index (corrected for dividends) for a 12-month period. You are also given means (expected return), variance, and covariances with the market index (S\&PS00. The risk-free is 1%. A) calculate the alpha and beta for each stock. What do alpha and beta means? B) the residuals (errors) of the single index model are tabulated below. Please compute o_(e_i ) the standard error of the regression, for each asset. of linear regresion for asset A: of linear regression for asset B : of linear regression for asset C : C) Calculate the expected value, variance / standard diviation, and covariance/correlation of the three variance

monthy excess return Ri=(rirf) are presented below for each of three stocks and the S\&P index (corrected for dividends) for a 12-month period. You are also given means (expected return), variance, and covariances with the market index (S\&PS00. The risk-free is 1%. A) calculate the alpha and beta for each stock. What do alpha and beta means? B) the residuals (errors) of the single index model are tabulated below. Please compute o_(e_i ) the standard error of the regression, for each asset. of linear regresion for asset A: of linear regression for asset B : of linear regression for asset C : C) Calculate the expected value, variance / standard diviation, and covariance/correlation of the three variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started