Question

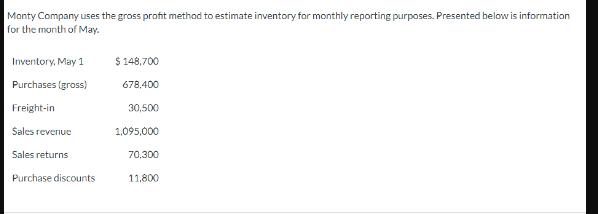

Monty Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory,

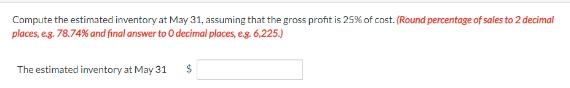

Monty Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory, May 1 Purchases (gross) Freight-in Sales revenue Sales returns Purchase discounts $ 148,700 678,400 30,500 1,095,000 70,300 11,800. Compute the estimated inventory at May 31, assuming that the gross profit is 25% of cost. (Round percentage of sales to 2 decimal places, e.g. 78.74% and final answer to O decimal places, e.g. 6,225.) The estimated inventory at May 31 $

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To compute the estimated inventory at May 31 1 Calculate the cost of goods sold COGS COGS Sales revenue Sales returns Purchase discounts COGS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

15th edition

978-1118159644, 9781118562185, 1118159640, 1118147294, 978-1118147290

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App