Answered step by step

Verified Expert Solution

Question

1 Approved Answer

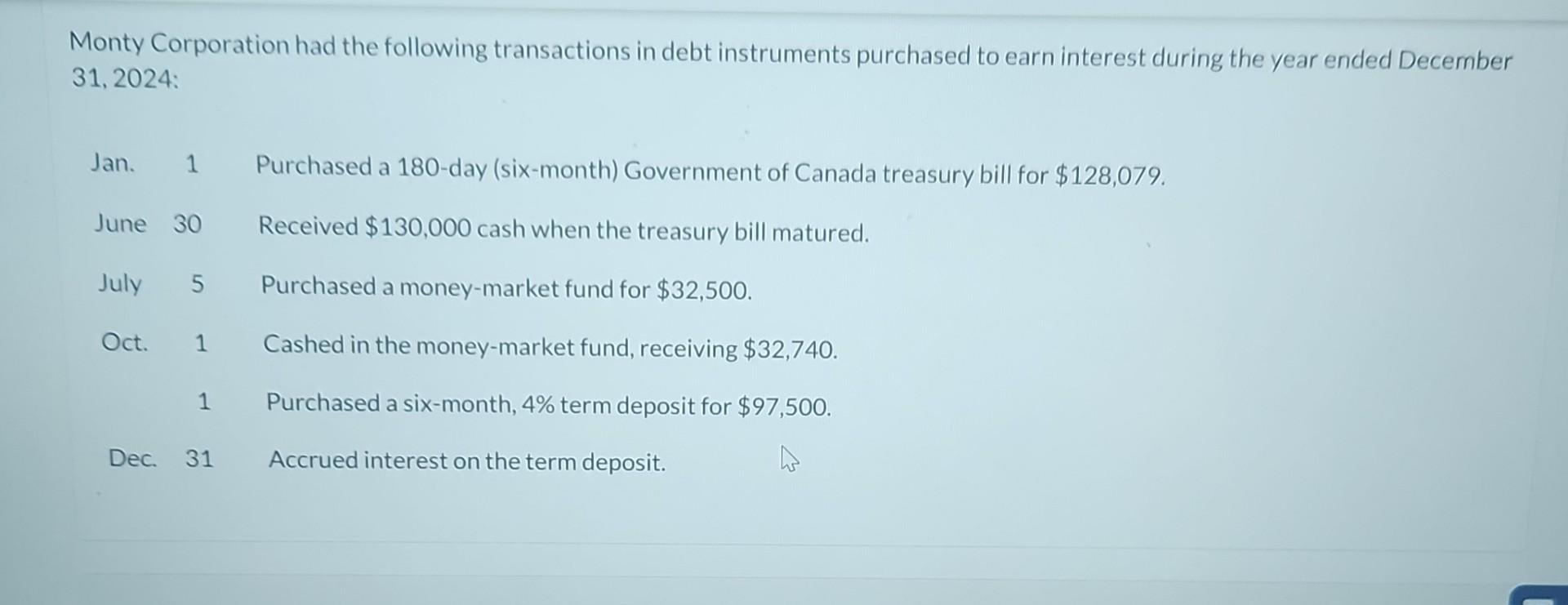

Monty Corporation had the following transactions in debt instruments purchased to earn interest during the year ended December 31,2024 : Jan. 1 Purchased a 180-day

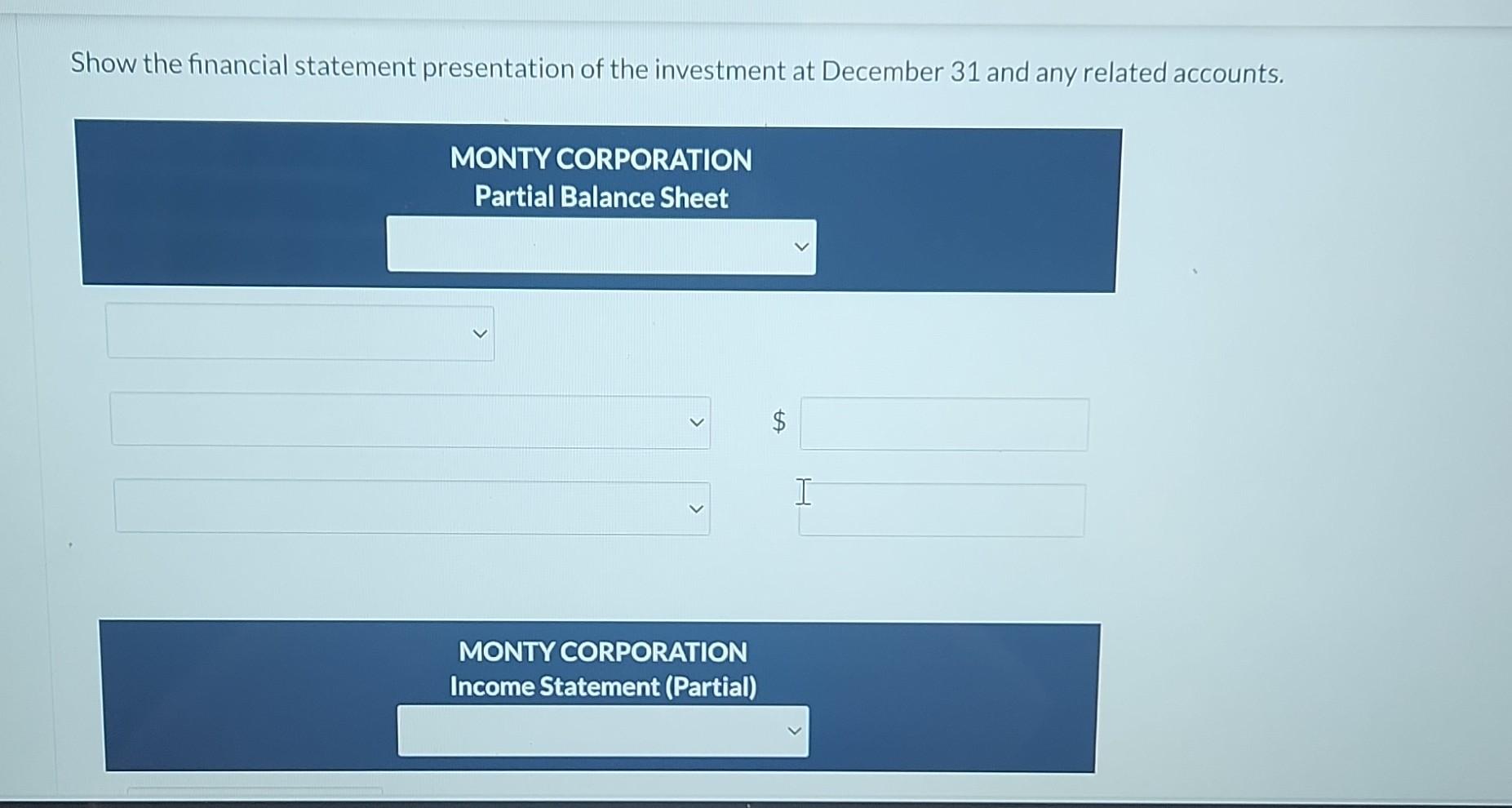

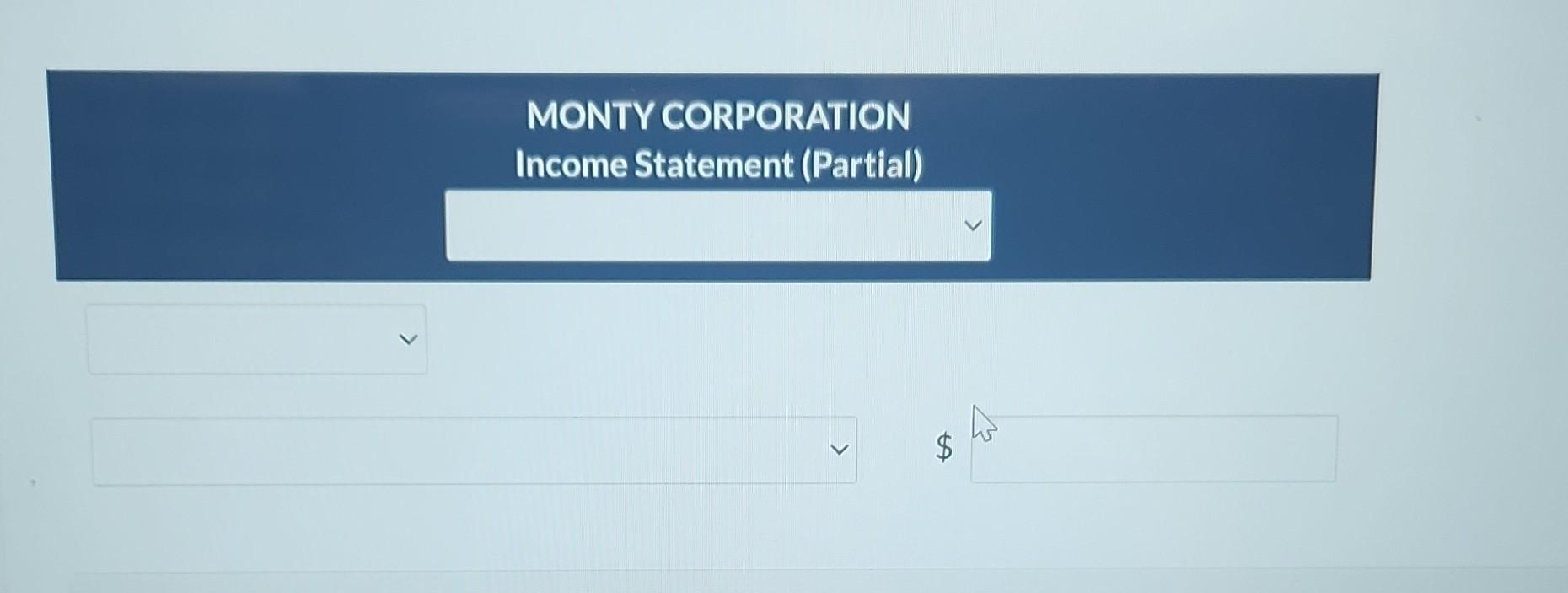

Monty Corporation had the following transactions in debt instruments purchased to earn interest during the year ended December 31,2024 : Jan. 1 Purchased a 180-day (six-month) Government of Canada treasury bill for \$128,079. June 30 Received $130,000 cash when the treasury bill matured. July 5 Purchased a money-market fund for $32,500. Oct. 1 Cashed in the money-market fund, receiving $32,740. 1 Purchased a six-month, 4% term deposit for $97,500. Dec. 31 Accrued interest on the term deposit. MONTY CORPORATION Income Statement (Partial) $ Show the financial statement presentation of the investment at December 31 and any related accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started