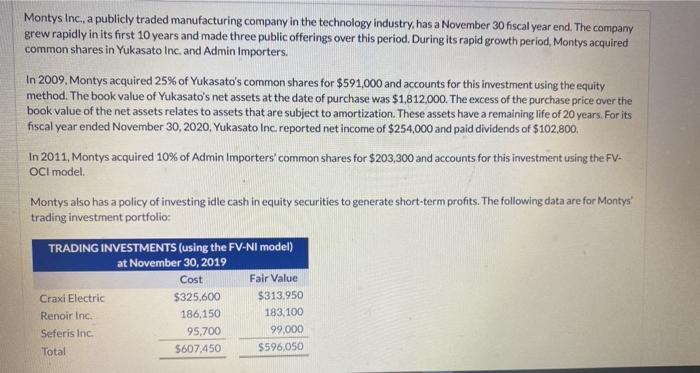

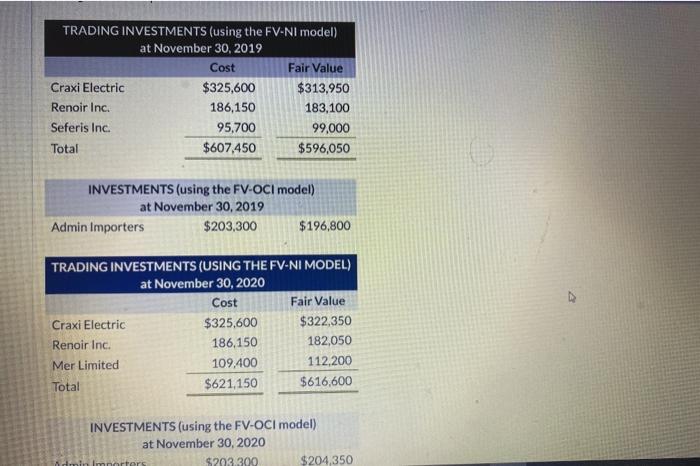

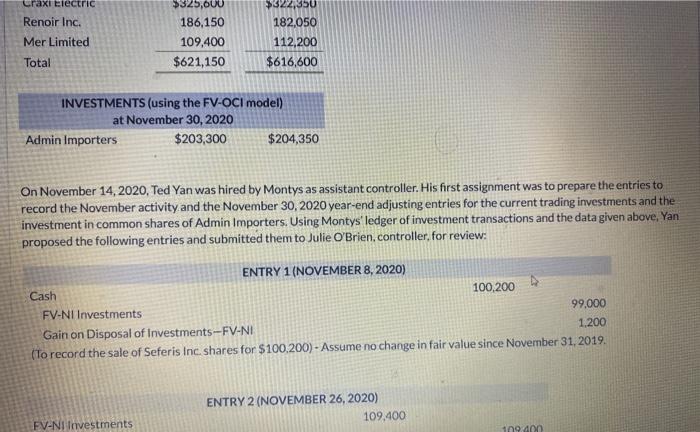

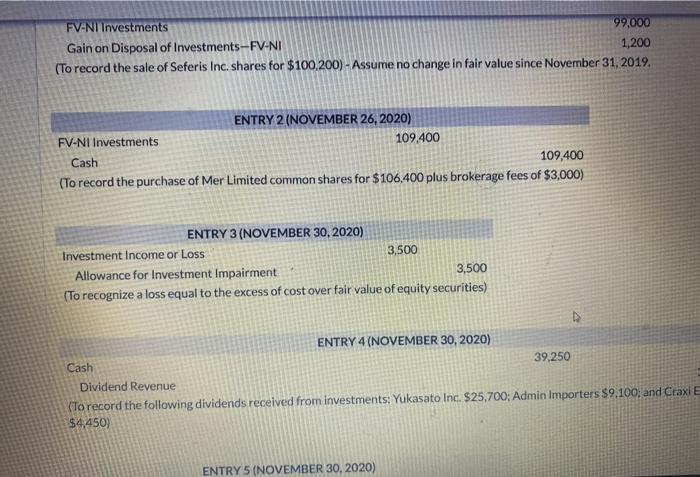

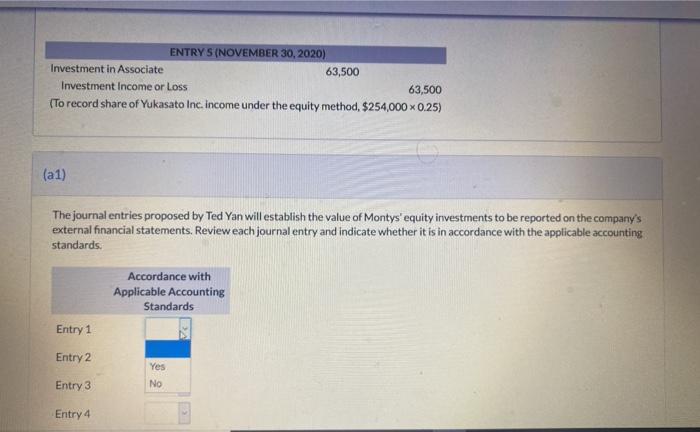

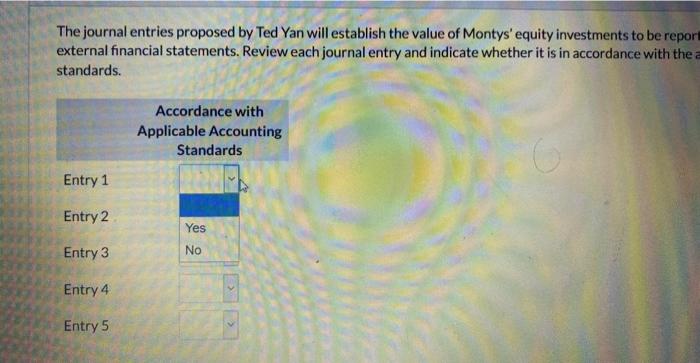

Montys Inc., a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year end. The company grew rapidly in its first 10 years and made three public offerings over this period. During its rapid growth period, Montys acquired common shares in Yukasato Inc. and Admin Importers. In 2009, Montys acquired 25% of Yukasato's common shares for $591,000 and accounts for this investment using the equity method. The book value of Yukasato's net assets at the date of purchase was $1,812,000. The excess of the purchase price over the book value of the net assets relates to assets that are subject to amortization. These assets have a remaining life of 20 years. For its fiscal year ended November 30, 2020, Yukasato Inc reported net income of $254,000 and paid dividends of $102,800 In 2011, Montys acquired 10% of Admin Importers' common shares for $203,300 and accounts for this investment using the FV- OCI model Montys also has a policy of investing idle cash in equity securities to generate short-term profits. The following data are for Montys trading investment portfolio TRADING INVESTMENTS (using the FV-NI model) at November 30, 2019 Cost Fair Value Craxi Electric $325,600 $313.950 Renoir Inc. 186,150 183.100 Seferis Inc 95,700 99,000 Total $607.450 $596,050 TRADING INVESTMENTS (using the FV-Nl model) at November 30, 2019 Cost Fair Value Craxi Electric $325,600 $313,950 Renoir Inc. 186,150 183,100 Seferis Inc 95,700 99,000 Total $607,450 $596,050 INVESTMENTS (using the FV-OCI model) at November 30, 2019 Admin Importers $203,300 $196,800 TRADING INVESTMENTS (USING THE FV-NI MODEL) at November 30, 2020 Cost Fair Value Craxi Electric $325,600 $322,350 Renoir Inc. 186,150 182,050 Mer Limited 109.400 112,200 Total $621,150 $616,600 INVESTMENTS (using the FV-OCI model) at November 30, 2020 $203.300 $204,350 drin Craxi Electric Renoir Inc. Mer Limited $325,000 186,150 109,400 $621,150 $322,350 182,050 112,200 $616,600 Total INVESTMENTS (using the FV-OCI model) at November 30, 2020 Admin Importers $203,300 $204,350 On November 14, 2020, Ted Yan was hired by Montys as assistant controller. His first assignment was to prepare the entries to record the November activity and the November 30, 2020 year-end adjusting entries for the current trading investments and the investment in common shares of Admin Importers. Using Montys ledger of investment transactions and the data given above, Yan proposed the following entries and submitted them to Julie O'Brien, controller, for review: ENTRY 1 (NOVEMBER 8, 2020) Cash 100,200 FV-NI Investments 99,000 Gain on Disposal of Investments --FV-NI 1,200 (To record the sale of Seferis Inc. shares for $100.200) - Assume no change in fair value since November 31, 2019. ENTRY 2 (NOVEMBER 26, 2020) 109,400 FV-NI Investments 109 400 FV-NI investments 99,000 Gain on Disposal of Investments--FV-NI 1,200 (To record the sale of Seferis Inc. shares for $100,200) - Assume no change in fair value since November 31, 2019. ENTRY 2 (NOVEMBER 26, 2020) FV-NI Investments 109.400 Cash 109,400 (To record the purchase of Mer Limited common shares for $106,400 plus brokerage fees of $3,000) ENTRY 3 (NOVEMBER 30, 2020) Investment Income or Loss 3.500 Allowance for Investment Impairment 3,500 (To recognize a loss equal to the excess of cost over fair value of equity securities) ENTRY 4 (NOVEMBER 30, 2020) Cash 39,250 Dividend Revenue (To record the following dividends received from investments: Yukasato Inc. $25,700; Admin Importers $9.100; and Craxi E $4,450) ENTRY 5 (NOVEMBER 30, 2020) ENTRY 5 (NOVEMBER 30, 2020) Investment in Associate 63,500 Investment Income or Loss 63,500 (To record share of Yukasato Inc. income under the equity method, $254,000 0.25) (a 1) The journal entries proposed by Ted Yan will establish the value of Montys' equity investments to be reported on the company's external financial statements. Review eachjournal entry and indicate whether it is in accordance with the applicable accounting standards Accordance with Applicable Accounting Standards Entry 1 Entry 2 Yes No Entry 3 Entry 4 The journal entries proposed by Ted Yan will establish the value of Montys' equity investments to be report external financial statements. Review each journal entry and indicate whether it is in accordance with the a standards. Accordance with Applicable Accounting Standards Entry 1 Entry 2 Yes Entry 3 No Entry 4 Entry 5