Answered step by step

Verified Expert Solution

Question

1 Approved Answer

moodle.uowplatform.edu.au FINAL ALTERNATIVE ASSESSMENT: FEBRUARY 2021 SESSION QUESTION 1 (25 MARKS) The following is a predictions of accounting data of ColdStor Company after careful

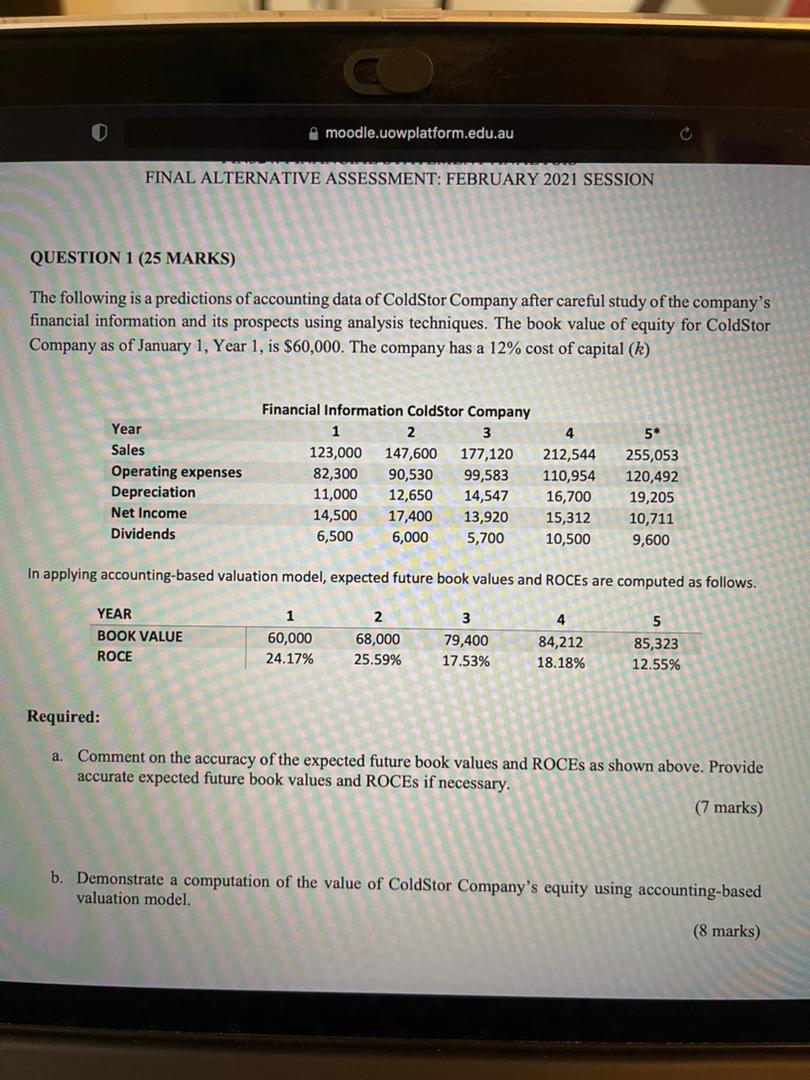

moodle.uowplatform.edu.au FINAL ALTERNATIVE ASSESSMENT: FEBRUARY 2021 SESSION QUESTION 1 (25 MARKS) The following is a predictions of accounting data of ColdStor Company after careful study of the company's financial information and its prospects using analysis techniques. The book value of equity for ColdStor Company as of January 1, Year 1, is $60,000. The company has a 12% cost of capital (k) Financial Information ColdStor Company Year Sales 1 2 3 4 5* 123,000 147,600 177,120 212,544 255,053 Operating expenses Depreciation 82,300 90,530 99,583 110,954 120,492 11,000 12,650 14,547 16,700 19,205 Net Income 14,500 17,400 13,920 15,312 10,711 Dividends 6,500 6,000 5,700 10,500 9,600 In applying accounting-based valuation model, expected future book values and ROCES are computed as follows. Required: YEAR 1 2 3 4 5 BOOK VALUE ROCE 60,000 68,000 79,400 84,212 85,323 24.17% 25.59% 17.53% 18.18% 12.55% a. Comment on the accuracy of the expected future book values and ROCES as shown above. Provide accurate expected future book values and ROCES if necessary. (7 marks) b. Demonstrate a computation of the value of ColdStor Company's equity using accounting-based valuation model. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Comment on the accuracy of the expected future book values and ROCEs as shown above Provide accura...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started