Moonglow a broadway publicity firm uses the balance sheet

Moonglow a broadway publicity firm uses the balance sheet

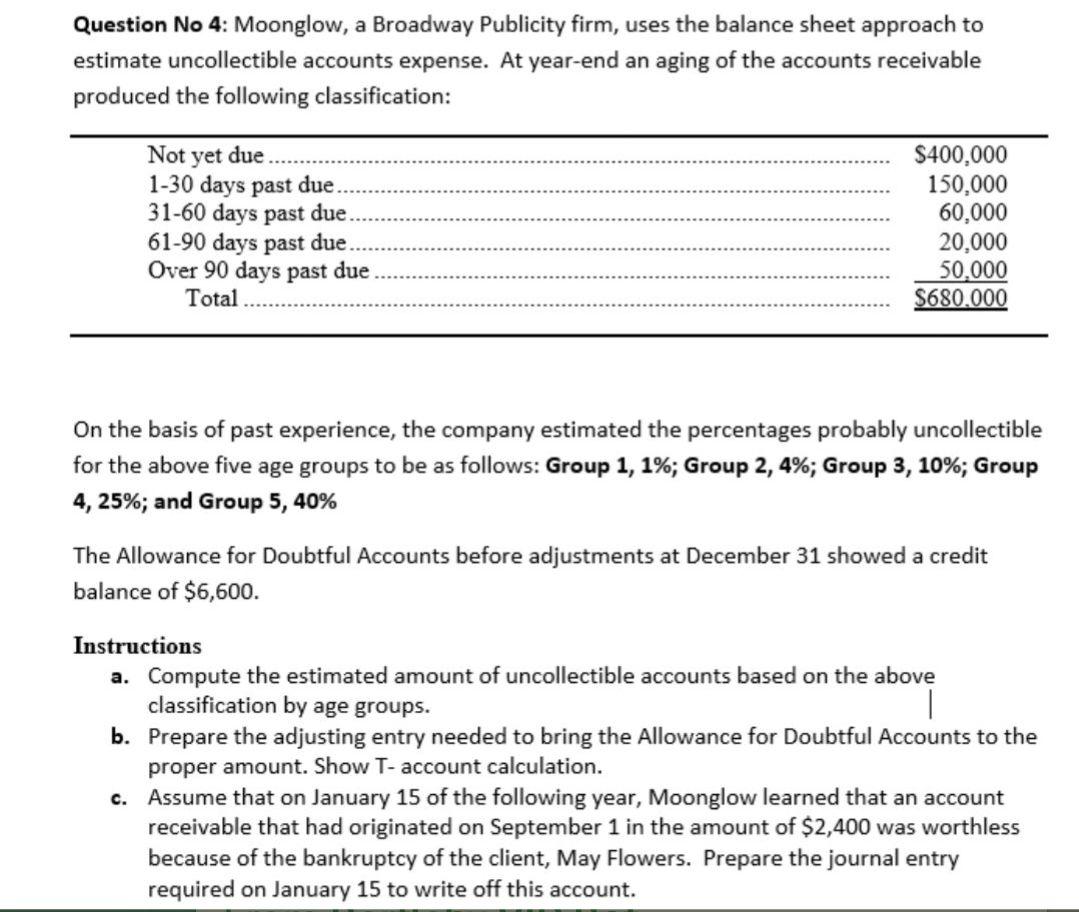

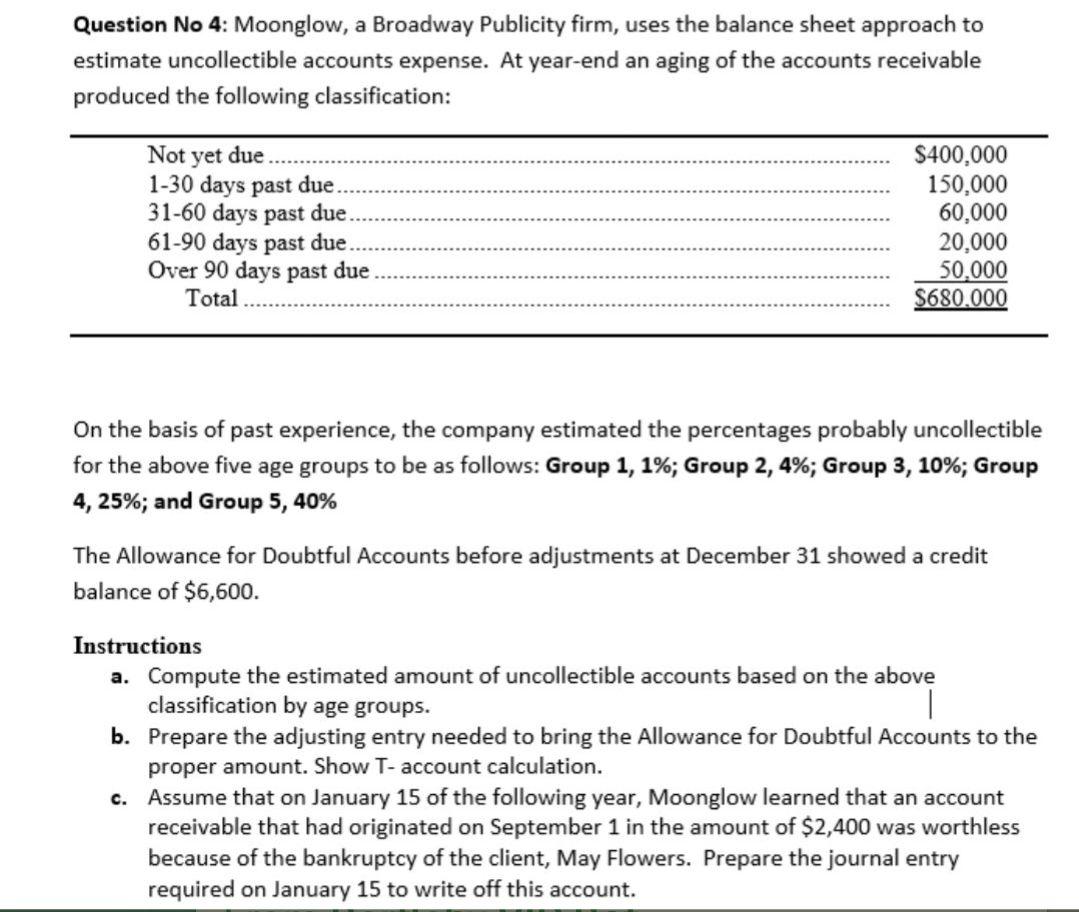

Question No 4: Moonglow, a Broadway Publicity firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year-end an aging of the accounts receivable produced the following classification: Not yet due. 1-30 days past due. 31-60 days past due 61-90 days past due Over 90 days past due $400,000 150,000 60,000 20,000 50.000 $680.000 Total On the basis of past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group 1, 1%; Group 2,4%; Group 3, 10%; Group 4, 25%; and Group 5, 40% The Allowance for Doubtful Accounts before adjustments at December 31 showed a credit balance of $6,600. Instructions a. Compute the estimated amount of uncollectible accounts based on the above classification by age groups. 1 b. Prepare the adjusting entry needed to bring the Allowance for Doubtful Accounts to the proper amount. Show T-account calculation. c. Assume that on January 15 of the following year, Moonglow learned that an account receivable that had originated on September 1 in the amount of $2,400 was worthless because of the bankruptcy of the client, May Flowers. Prepare the journal entry required on January 15 to write off this account. Question No 4: Moonglow, a Broadway Publicity firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year-end an aging of the accounts receivable produced the following classification: Not yet due. 1-30 days past due. 31-60 days past due 61-90 days past due Over 90 days past due $400,000 150,000 60,000 20,000 50.000 $680.000 Total On the basis of past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group 1, 1%; Group 2,4%; Group 3, 10%; Group 4, 25%; and Group 5, 40% The Allowance for Doubtful Accounts before adjustments at December 31 showed a credit balance of $6,600. Instructions a. Compute the estimated amount of uncollectible accounts based on the above classification by age groups. 1 b. Prepare the adjusting entry needed to bring the Allowance for Doubtful Accounts to the proper amount. Show T-account calculation. c. Assume that on January 15 of the following year, Moonglow learned that an account receivable that had originated on September 1 in the amount of $2,400 was worthless because of the bankruptcy of the client, May Flowers. Prepare the journal entry required on January 15 to write off this account

Moonglow a broadway publicity firm uses the balance sheet

Moonglow a broadway publicity firm uses the balance sheet