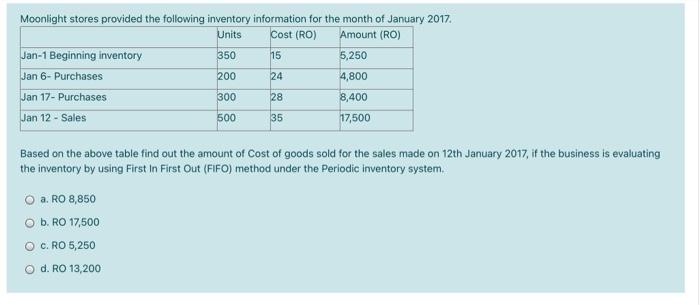

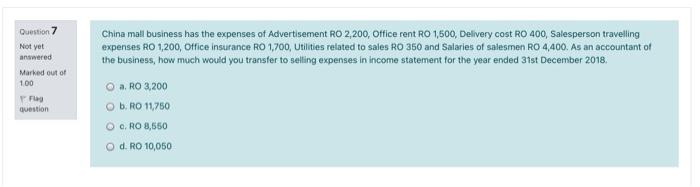

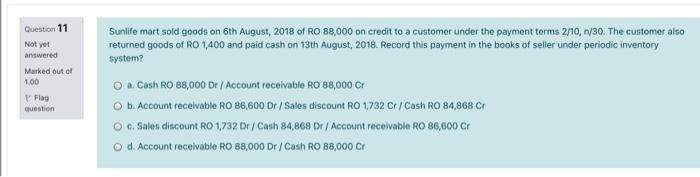

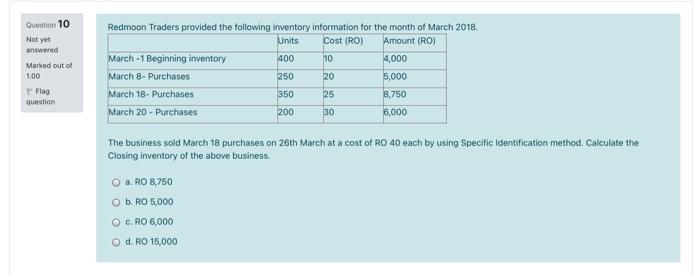

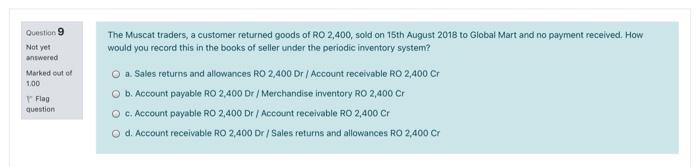

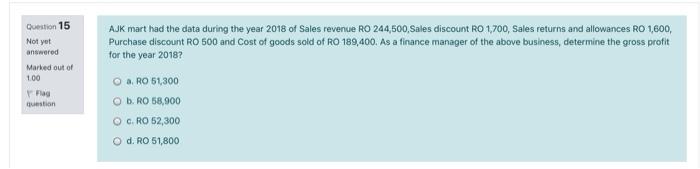

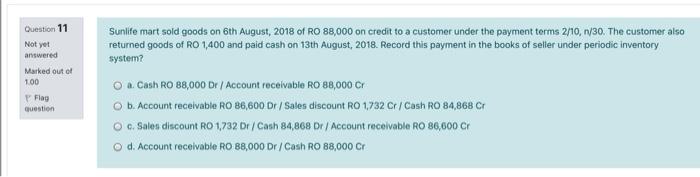

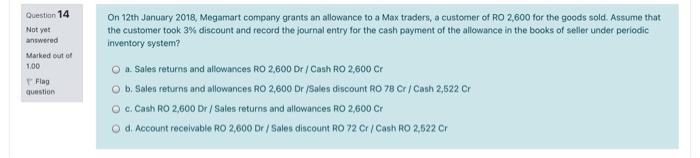

Moonlight stores provided the following inventory information for the month of January 2017 Units Cost (RO) Amount (RO) Jan-1 Beginning inventory 350 15 5,250 Jan 6-Purchases 200 4,800 Jan 17- Purchases 300 28 8,400 Jan 12 - Sales 500 35 17,500 24 Based on the above table find out the amount of Cost of goods sold for the sales made on 12th January 2017, if the business is evaluating the inventory by using First In First Out (FIFO) method under the Periodic inventory system O a. RO 8,850 O b. RO 17,500 C.RO 5,250 d. RO 13,200 Question 7 Not yet answered Marked out of 100 China mall business has the expenses of Advertisement RO 2,200, Office rent RO 1600, Delivery cost RO 400, Salesperson travelling expenses RO 1,200, Office insurance RO 1,700, Utilities related to sales RO 350 and Salaries of salesmen RO 4,400. As an accountant of the business, how much would you transfer to selling expenses in income statement for the year ended 31st December 2018, O a. RO 3,200 O b. RO 11,750 Oo, RO 8,550 O d.RO 10,050 question Question 11 Not yet answered Marked out of 100 Sunlife mart sold goods on 6th August, 2018 of RO 88,000 on credit to a customer under the payment terms 2/10, n/30. The customer also returned goods of RO 1,400 and paid cash on 13th August, 2018. Record this payment in the books of seller under periodic inventory system? Flag question O Cash RO 88,000 Dr / Account receivable RO 88,000 C O b. Account receivable RO 86,600 Dr / Sales discount RO 1732 Cr/Cash RO 84,868 CM c. Sales discount RO 1,732 Dr/Cash 84,868 Dr / Account receivable RO 86,600 Cr d. Account receivable RO 88,000 Dr / Cash RO 88,000 Cr Question 10 Not yet answered Marked out of 100 Flag question Redmoon Traders provided the following inventory information for the month of March 2018. Units Cost (RO) Amount (RO) March - 1 Beginning inventory 400 10 4,000 March 8-Purchases 250 20 5,000 March 18- Purchases 350 25 8,750 March 20 - Purchases 200 30 6,000 The business sold March 18 purchases on 26th March at a cost of RO 40 each by using Specific identification method. Calculate the Closing inventory of the above business, a, RO 8,750 O b. RO 5,000 O C. RO 6,000 O d.RO 15,000 Question 9 Not yet answered Marked out of 100 Flag question The Muscat traders, a customer returned goods of RO 2,400, sold on 15th August 2018 to Global Mart and no payment received. How would you record this in the books of seller under the periodic inventory system? O a Sales returns and allowances RO 2,400 Dr Account receivable RO 2,400 Cr b. Account payable RO 2,400 Dr / Merchandise inventory RO 2,400 Cr OC. Account payable RO 2,400 Dr / Account receivable RO 2,400 Cr Od. Account receivable RO 2,400 Dr / Sales returns and allowances RO 2,400 C Question 15 Not yet answered Marked out of 100 AJK mart had the data during the year 2018 of Sales revenue RO 244,500, Sales discount RO 1,700, Sales returns and allowances RO 1,600, Purchase discount Ro 500 and Cost of goods sold of RO 189,400. As a finance manager of the above business, determine the gross profit for the year 2018? a. RO 51300 O b.RO 58,900 OG RO 52,300 O d. RO 51,800 question Question 13 Not yet answered Ibri mart purchased goods on 12th March, 2018 for RO 84,000 from Nizwa mart. If the credit term is followed as 3/EOM, Calculate the discount amount paid by the business. O a. RO 84,000 O b. RO 81,480 Marked out of 100 Flag question O CRO 2,520 O d. RO 86,620 Question 11 Not yet answered Marked out of 100 Sunlife mart sold goods on 6th August, 2018 of RO 88,000 on credit to a customer under the payment terms 2/10, n/30. The customer also returned goods of RO 1,400 and paid cash on 13th August, 2018. Record this payment in the books of seller under periodic inventory system? Flag question O a Cash RO 88,000 Dr Account receivable RO 88,000 CY O b. Account receivable RO 86,600 Dr / Sales discount RO 1732 Cr/Cash RO 84,868 CM c. Sales discount RO 1,732 Dr / Cash 84,868 Dr / Account receivable RO 86,600 Cr od Account receivable RO 88,000 Dr / Cash RO 88,000 Cr Question 14 Not yet answered Marked out of 1.00 Flag question On 12th January 2018, Megamart company grants an allowance to a Max traders, a customer of RO 2,600 for the goods sold. Assume that the customer took 3% discount and record the Journal entry for the cash payment of the allowance in the books of seller under periodic inventory system? On Sales returns and allowances RO 2,600 Dr / Cash RO 2,600 Cr b. Sales returns and allowances RO 2,600 Dr /Sales discount RO 78 Ct/Cash 2,522 Cr O c. Cash RO 2,600 Dr/Sales returns and allowances RO 2,600 C Od Account receivable RO 2,600 Dr / Sales discount RO 72 Cr/Cash RO 2,622 Cr