Question

Mooresville Corporation manufactures reproductions of eighteenth-century, classical-style furniture. It uses a job costing system that applies factory overhead on the basis of direct labor hours.

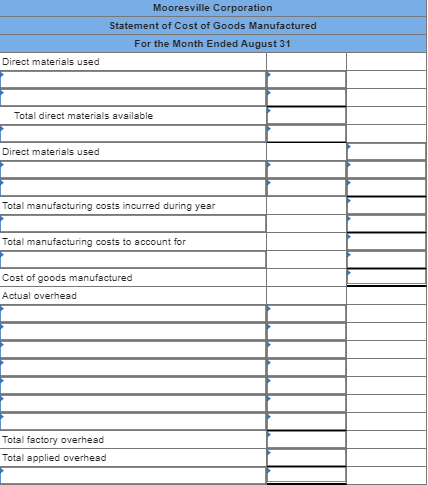

Mooresville Corporation manufactures reproductions of eighteenth-century, classical-style furniture. It uses a job costing system that applies factory overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $1,261,500, and management budgeted 87,000 direct labor hours. Mooresville had no Materials, Work-in-Process, or Finished Goods Inventory at the beginning of August. These transactions were recorded during August:

- Purchased 5,000 square feet of oak on account at $26 per square foot.

- Purchased 50 gallons of glue on account at $36 per gallon (indirect material).

- Requisitioned 3,500 square feet of oak and 31 gallons of glue for production.

- Incurred and paid payroll costs of $187,900. Of this amount, $46,000 were indirect labor costs; direct labor personnel earned $22 per hour.

- Paid factory utility bill, $15,230 in cash.

- Augusts insurance cost for the manufacturing property and equipment was $3,500. The premium had been paid in March.

- Incurred $8,500 depreciation on manufacturing equipment for August.

- Recorded $2,400 depreciation on an administrative asset.

- Paid advertising expenses in cash, $5,500.

- Incurred and paid other factory overhead costs, $13,500.

- Incurred and paid miscellaneous selling and administrative expenses, $13,250.

- Applied factory overhead to production on the basis of direct labor hours.

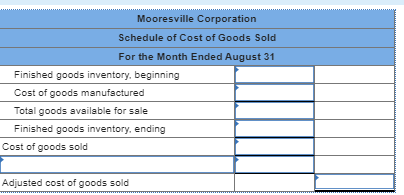

- Produced completed goods costing $146,000 during the month.

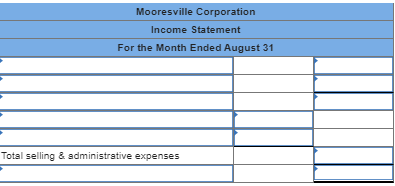

- Sales on account in August were $132,000. The Cost of Goods Sold was $112,000.

Required:

1 Prepare a schedule of Cost of Goods Manufactured

1b Prepare schedule of Cost of Goods Sold.

1c Prepare the income statement for August

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started