Moravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is

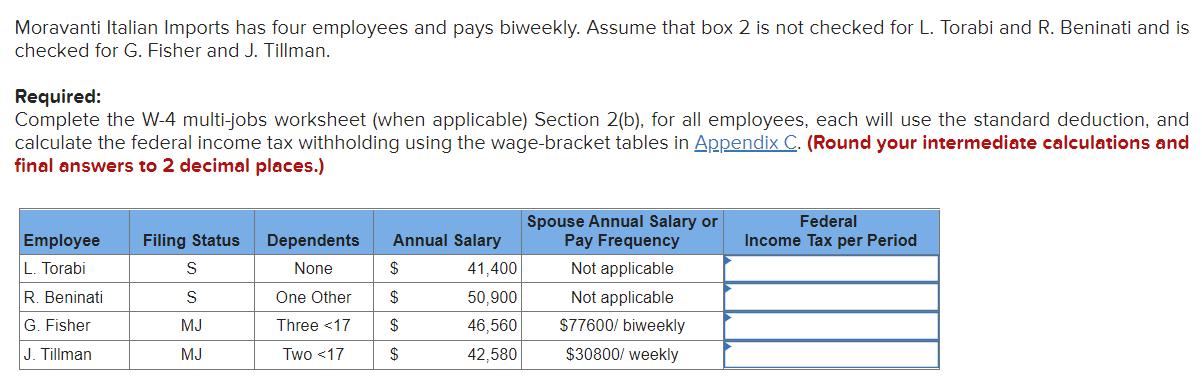

Moravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is checked for G. Fisher and J. Tillman. Required: Complete the W-4 multi-jobs worksheet (when applicable) Section 2(b), for all employees, each will use the standard deduction, and calculate the federal income tax withholding using the wage-bracket tables in Appendix C. (Round your intermediate calculations and final answers to 2 decimal places.) Federal Spouse Annual Salary or Pay Frequency Employee Filing Status Dependents Annual Salary Income Tax per Period L. Torabi None $ 41,400 Not applicable R. Beninati S One Other 2$ 50,900 Not applicable G. Fisher MJ Three

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Wage bracket method tells the exact amount of tax that is to be withholding during the peri...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started