Answered step by step

Verified Expert Solution

Question

1 Approved Answer

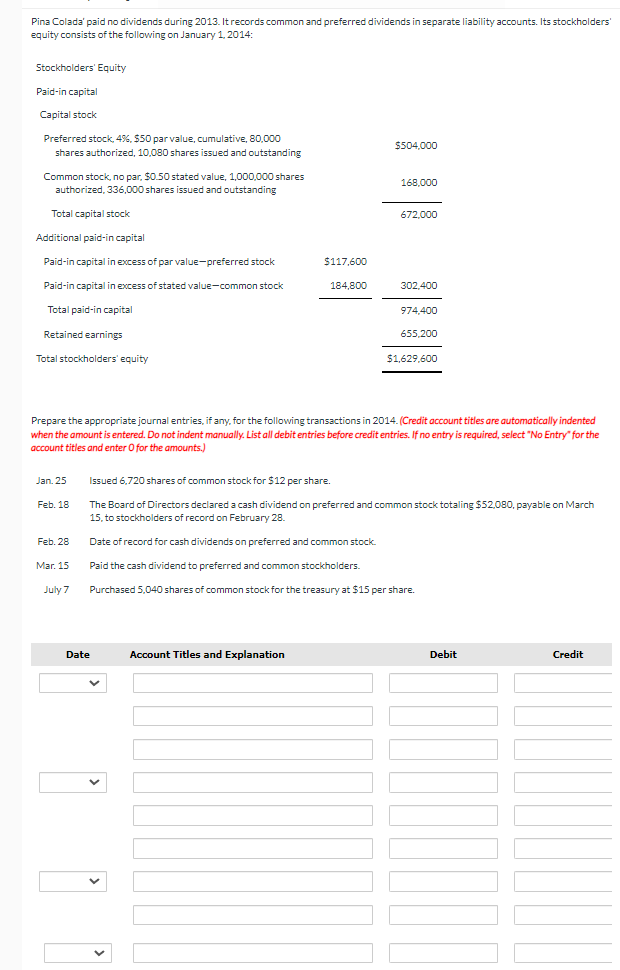

more columns are shown at the bottom but could not be squeezed into the picture. Pina Colada' paid no dividends during 2013. It records common

more columns are shown at the bottom but could not be squeezed into the picture.

Pina Colada' paid no dividends during 2013. It records common and preferred dividends in separate liability accounts. Its stockholders equity consists of the following on January 1, 2014: Stockholders' Equity ' Paid-in capital Capital stock Preferred stock. 496. $50 par value, cumulative, 80.000 shares authorized, 10,080 shares issued and outstanding $504,000 Common stock, no par $0.50 stated value, 1,000,000 shares authorized, 336,000 shares issued and outstanding 168,000 Total capital stock 672.000 Additional paid-in capital Paid-in capital in excess of par value-preferred stock $117.600 Paid-in capital in excess of stated value-common stock 184,800 302.400 Total paid-in capital 974,400 Retained earnings 655,200 Total stockholders' equity $1,629,600 Prepare the appropriate journal entries, if any, for the following transactions in 2014. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Jan. 25 Issued 6.720 shares of common stock for $12 per share. Feb. 18 The Board of Directors declared a cash dividend on preferred and common stock totaling $52,080, payable on March 15. to stockholders of record on February 28. . Date of record for cash dividends on preferred and common stock Feb. 28 Mar. 15 Paid the cash dividend to preferred and common stockholders. Purchased 5.040 shares of common stock for the treasury at $15 per share. $. July 7 Date Account Titles and Explanation Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started