Question

More Complex Financial Statements Ragequit PC Repair specializes in computer equipment repair following incidents of gamer rage. After losing online games some gamers enter a

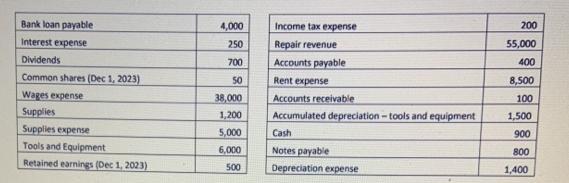

More Complex Financial Statements Ragequit PC Repair specializes in computer equipment repair following incidents of "gamer rage". After losing online games some gamers enter a fit of irrational rage, and break gaming controllers, monitors, notebook computers, mice, keyboards and televisions. This rage has been lucrative for the Ragequit PC Repair. The following account balances relate to the company's November 30, 2024 year-end financial statements:

Notes:

• There were no common shares issued or repurchased during the year.

• The current portion of the bank loan payable was $600.

Required:

a.) Prepare an income statement for the year ended November 30, 2024.

b.) Prepare a statement of changes in equity for the year ended November 30, 2024.

c.) Prepare a balance sheet as at November 30, 2024.

d.) Based on your financial statements, compute:

i. The current ratio

ii. The debt ratio

iii. The equity ratio

Bank loan payable Income tax expense Repair revenue Accounts payable 4,000 200 Interest expense 250 55,000 Dividends 700 400 Common shares (Dec 1, 2023) 50 Rent expense 8,500 Wages expense Accounts receivable Accumulated depreciation - tools and equipment 38,000 100 Supplies 1,200 1,500 Supplies expense 5,000 Cash 900 Tools and Equipment 6,000 Notes payable 800 Retained earnings (Dec 1, 2023) 500 Depreciation expense 1,400

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ragequit PC repair Ragequit PC repair Income Statement For the year ended November 30 2024 Repair Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started