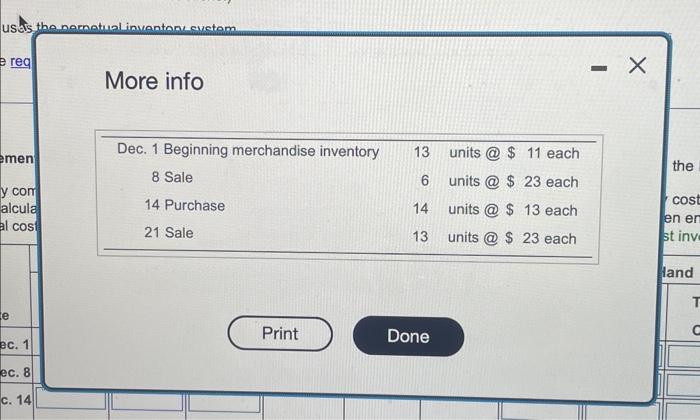

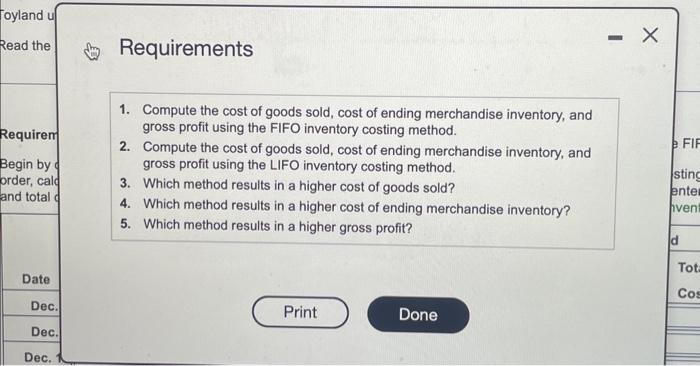

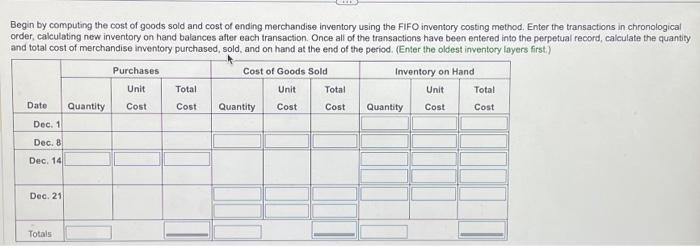

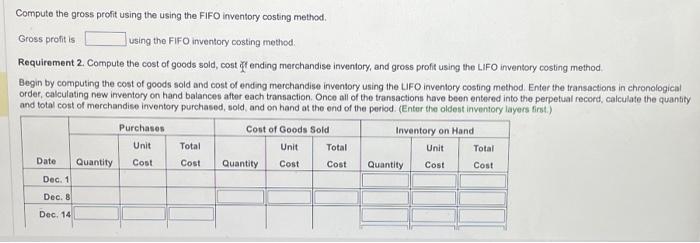

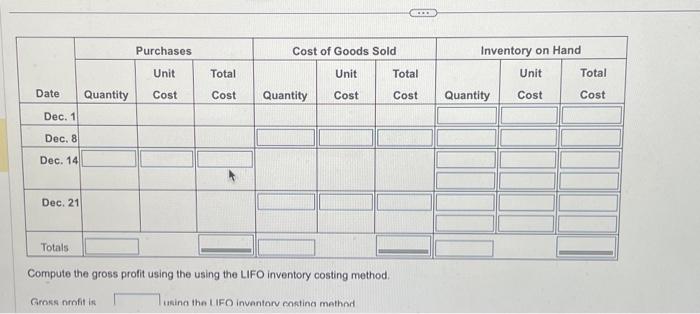

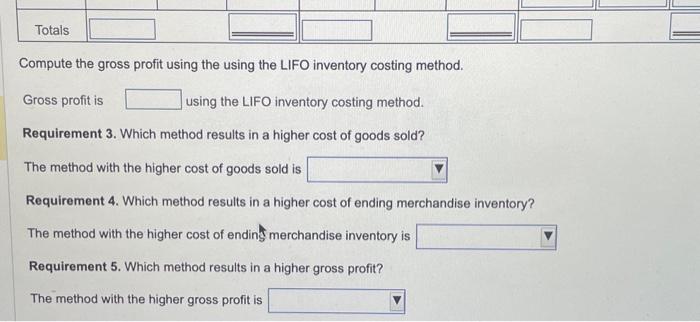

More info Requirements 1. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the FIFO inventory costing method. 2. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the LIFO inventory costing method. 3. Which method results in a higher cost of goods sold? 4. Which method results in a higher cost of ending merchandise inventory? 5. Which method results in a higher gross profit? Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantiy and total cost of merchandise irventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first) Compute the gross profit using the using the FIFO inventory costing method. Gross prolit is using the FIFO inventory costing method: Requirement 2. Compute the cost of goods sold, cost cf ending merchandise inventory, and gross profit using the L.FO inventory costing method Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, caiculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Compute the gross profit using the using the LIFO inventory costing method Sirose nomit is usine the I IFO inventorv costina methed Compute the gross profit using the using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method. Requirement 3. Which method results in a higher cost of goods sold? The method with the higher cost of goods sold is Requirement 4. Which method results in a higher cost of ending merchandise inventory? The method with the higher cost of ending merchandise inventory is Requirement 5. Which method results in a higher gross profit? The method with the higher gross profit is