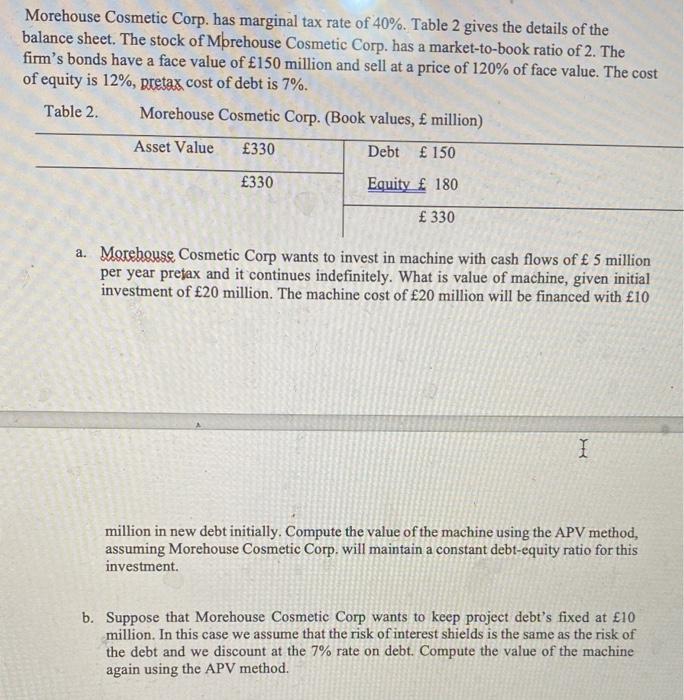

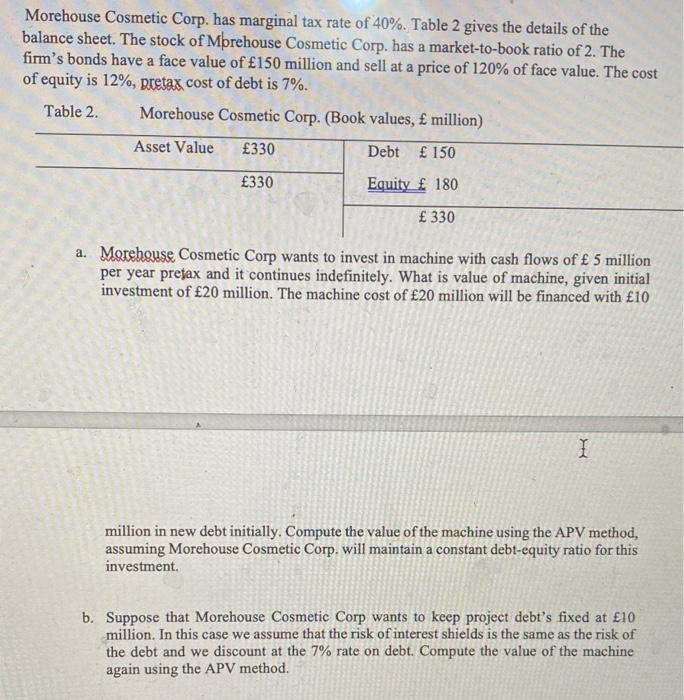

Morehouse Cosmetic Corp. has marginal tax rate of 40%. Table 2 gives the details of the balance sheet. The stock of Mbrehouse Cosmetic Corp. has a market-to-book ratio of 2. The firm's bonds have a face value of 150 million and sell at a price of 120% of face value. The cost of equity is 12%, pretax cost of debt is 7%. Table 2. Morehouse Cosmetic Corp. (Book values, million) Asset Value 330 Debt 150 330 Equity 180 330 a. Marehouse Cosmetic Corp wants to invest in machine with cash flows of 5 million per year prefax and it continues indefinitely. What is value of machine, given initial investment of 20 million. The machine cost of 20 million will be financed with 10 I million in new debt initially. Compute the value of the machine using the APV method, assuming Morehouse Cosmetic Corp. will maintain a constant debt-equity ratio for this investment. b. Suppose that Morehouse Cosmetic Corp wants to keep project debt's fixed at 10 million. In this case we assume that the risk of interest shields is the same as the risk of the debt and we discount at the 7% rate on debt. Compute the value of the machine again using the APV method. Morehouse Cosmetic Corp. has marginal tax rate of 40%. Table 2 gives the details of the balance sheet. The stock of Mbrehouse Cosmetic Corp. has a market-to-book ratio of 2. The firm's bonds have a face value of 150 million and sell at a price of 120% of face value. The cost of equity is 12%, pretax cost of debt is 7%. Table 2. Morehouse Cosmetic Corp. (Book values, million) Asset Value 330 Debt 150 330 Equity 180 330 a. Marehouse Cosmetic Corp wants to invest in machine with cash flows of 5 million per year prefax and it continues indefinitely. What is value of machine, given initial investment of 20 million. The machine cost of 20 million will be financed with 10 I million in new debt initially. Compute the value of the machine using the APV method, assuming Morehouse Cosmetic Corp. will maintain a constant debt-equity ratio for this investment. b. Suppose that Morehouse Cosmetic Corp wants to keep project debt's fixed at 10 million. In this case we assume that the risk of interest shields is the same as the risk of the debt and we discount at the 7% rate on debt. Compute the value of the machine again using the APV method. Morehouse Cosmetic Corp. has marginal tax rate of 40%. Table 2 gives the details of the balance sheet. The stock of Mbrehouse Cosmetic Corp. has a market-to-book ratio of 2. The firm's bonds have a face value of 150 million and sell at a price of 120% of face value. The cost of equity is 12%, pretax cost of debt is 7%. Table 2. Morehouse Cosmetic Corp. (Book values, million) Asset Value 330 Debt 150 330 Equity 180 330 a. Marehouse Cosmetic Corp wants to invest in machine with cash flows of 5 million per year prefax and it continues indefinitely. What is value of machine, given initial investment of 20 million. The machine cost of 20 million will be financed with 10 I million in new debt initially. Compute the value of the machine using the APV method, assuming Morehouse Cosmetic Corp. will maintain a constant debt-equity ratio for this investment. b. Suppose that Morehouse Cosmetic Corp wants to keep project debt's fixed at 10 million. In this case we assume that the risk of interest shields is the same as the risk of the debt and we discount at the 7% rate on debt. Compute the value of the machine again using the APV method. Morehouse Cosmetic Corp. has marginal tax rate of 40%. Table 2 gives the details of the balance sheet. The stock of Mbrehouse Cosmetic Corp. has a market-to-book ratio of 2. The firm's bonds have a face value of 150 million and sell at a price of 120% of face value. The cost of equity is 12%, pretax cost of debt is 7%. Table 2. Morehouse Cosmetic Corp. (Book values, million) Asset Value 330 Debt 150 330 Equity 180 330 a. Marehouse Cosmetic Corp wants to invest in machine with cash flows of 5 million per year prefax and it continues indefinitely. What is value of machine, given initial investment of 20 million. The machine cost of 20 million will be financed with 10 I million in new debt initially. Compute the value of the machine using the APV method, assuming Morehouse Cosmetic Corp. will maintain a constant debt-equity ratio for this investment. b. Suppose that Morehouse Cosmetic Corp wants to keep project debt's fixed at 10 million. In this case we assume that the risk of interest shields is the same as the risk of the debt and we discount at the 7% rate on debt. Compute the value of the machine again using the APV method