Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Morelli Electric Motor Corporation manufactures electric motors for commercial use. The company produces three models, designated as standard, deluxe, and heavy-duty. The company uses

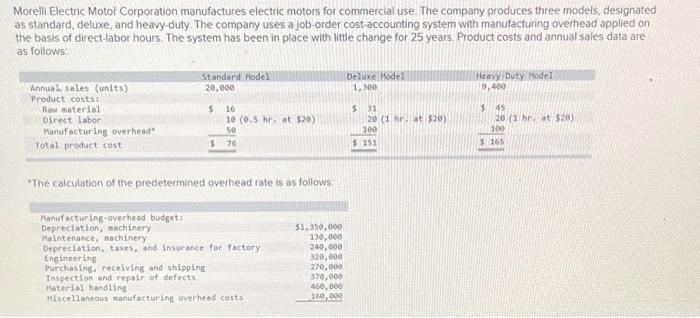

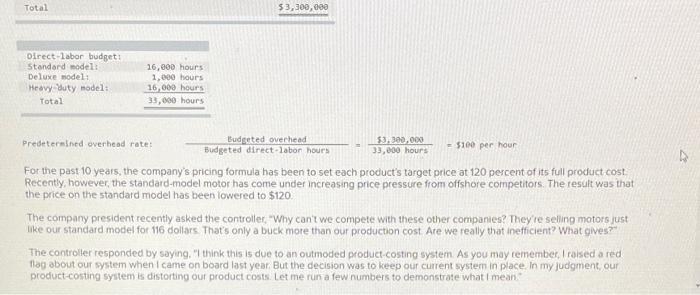

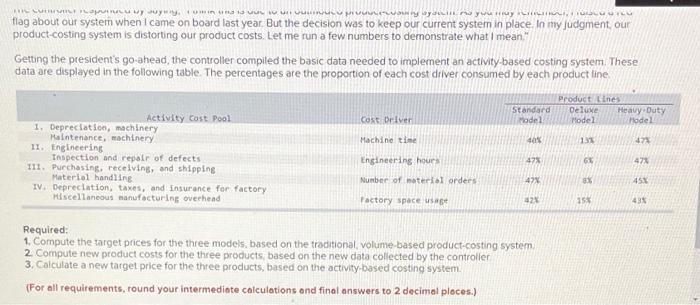

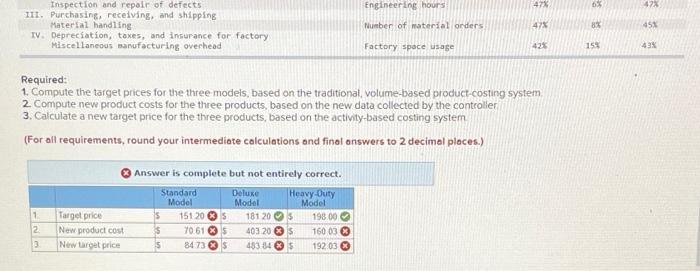

Morelli Electric Motor Corporation manufactures electric motors for commercial use. The company produces three models, designated as standard, deluxe, and heavy-duty. The company uses a job-order cost-accounting system with manufacturing overhead applied on the basis of direct-labor hours. The system has been in place with little change for 25 years. Product costs and annual sales data are as follows: Annual sales (units) Product costs: Raw material Direct labor Manufacturing overhead Total product cost Standard Hodel 20,000 $ 16 10 (0.5 hr. at $20) 50 $ 76 "The calculation of the predetermined overhead rate is as follows Manufacturing-overhead budget: Depreciation, machinery Maintenance, machinery Depreciation, taxes, and insurance for factory Engineering Purchasing, receiving and shipping Inspection and repair of defects Material handling Miscellaneous manufacturing overhead costs $1,350,000 130,000 240,000 320,000 270,000 370,000 460,000 160,000 Deluxe Model 1,300 $ 31 20 (1 hr. at $20) 100 $251 Heavy-Duty Model 9,400 $45 20 (1 hr. at $20) 100 3 165 Total Direct-labor budget: Standard model: Deluxe model: Heavy duty model: Total 16,000 hours 1,000 hours 16,000 hours 33,000 hours: $3,300,000 Budgeted overhead Budgeted direct-labor hours $3,300,000 33,000 hours Predetermined overhead rate: - $100 per hour For the past 10 years, the company's pricing formula has been to set each product's target price at 120 percent of its full product cost Recently, however, the standard-model motor has come under increasing price pressure from offshore competitors. The result was that the price on the standard model has been lowered to $120. The company president recently asked the controller, "Why can't we compete with these other companies? They're selling motors just like our standard model for 116 dollars. That's only a buck more than our production cost Are we really that inefficient? What gives?" The controller responded by saying, "I think this is due to an outmoded product-costing system. As you may remember, I raised a red flag about our system when I came on board last year. But the decision was to keep our current system in place. In my judgment, our product-costing system is distorting our product costs. Let me run a few numbers to demonstrate what I mean THE COST suyung, comin und to invoing ayawli ma you may flag about our system when I came on board last year. But the decision was to keep our current system in place. In my judgment, our product-costing system is distorting our product costs. Let me run a few numbers to demonstrate what I mean." Getting the president's go-ahead, the controller compiled the basic data needed to implement an activity-based costing system. These data are displayed in the following table. The percentages are the proportion of each cost driver consumed by each product line. Activity Cost Pool 1. Depreciation, machinery Maintenance, machinery 11. Engineering Inspection and repair of defects 111. Purchasing, receiving, and shipping Material handling IV. Depreciation, taxes, and insurance for factory Hiscellaneous manufacturing overhead Cost Driver Machine time Engineering hours Number of material orders Factory space usage Standard Model 40% 47% 47% 42% Required: 1. Compute the target prices for the three models, based on the traditional, volume-based product-costing system. 2. Compute new product costs for the three products, based on the new data collected by the controller 3. Calculate a new target price for the three products, based on the activity-based costing system. (For all requirements, round your intermediate calculations and final answers to 2 decimal places.) Product Lines Deluxe Heavy-Duty Model Model 13% 6X 8X 15% 47% 47% 45% 43% Inspection and repair of defects 111. Purchasing, receiving, and shipping Material handling IV. Depreciation, taxes, and insurance for factory Miscellaneous manufacturing overhead 1 2 3 Target price New product cost New target price Answer is complete but not entirely correct. Standard Model Required: 1. Compute the target prices for the three models, based on the traditional, volume-based product-costing system. 2. Compute new product costs for the three products, based on the new data collected by the controller 3. Calculate a new target price for the three products, based on the activity-based costing system (For all requirements, round your intermediate calculations and final answers to 2 decimal places.) S $$ s 151 20 S 70.61 84 73 S $ Deluxe Model 181 20 403 20 483 84 Heavy-Duty Model $ S $ Engineering hours Number of material orders Factory space usage 198.00 160 03 192.03 47% 47% 42% 6% 8% 15% 47% 45% 43%

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Target prices for the three models based on traditional volumebased productcosting system Standard ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started