Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Morew Unit 3 A Assiennent: Modelling Exponentials & Flnance PART Z: FINANCE: Expectation C 3 Narne: This ossignment will be personalized to YoU using any

Morew Unit A Assiennent: Modelling Exponentials & Flnance

PART Z: FINANCE: Expectation C

Narne:

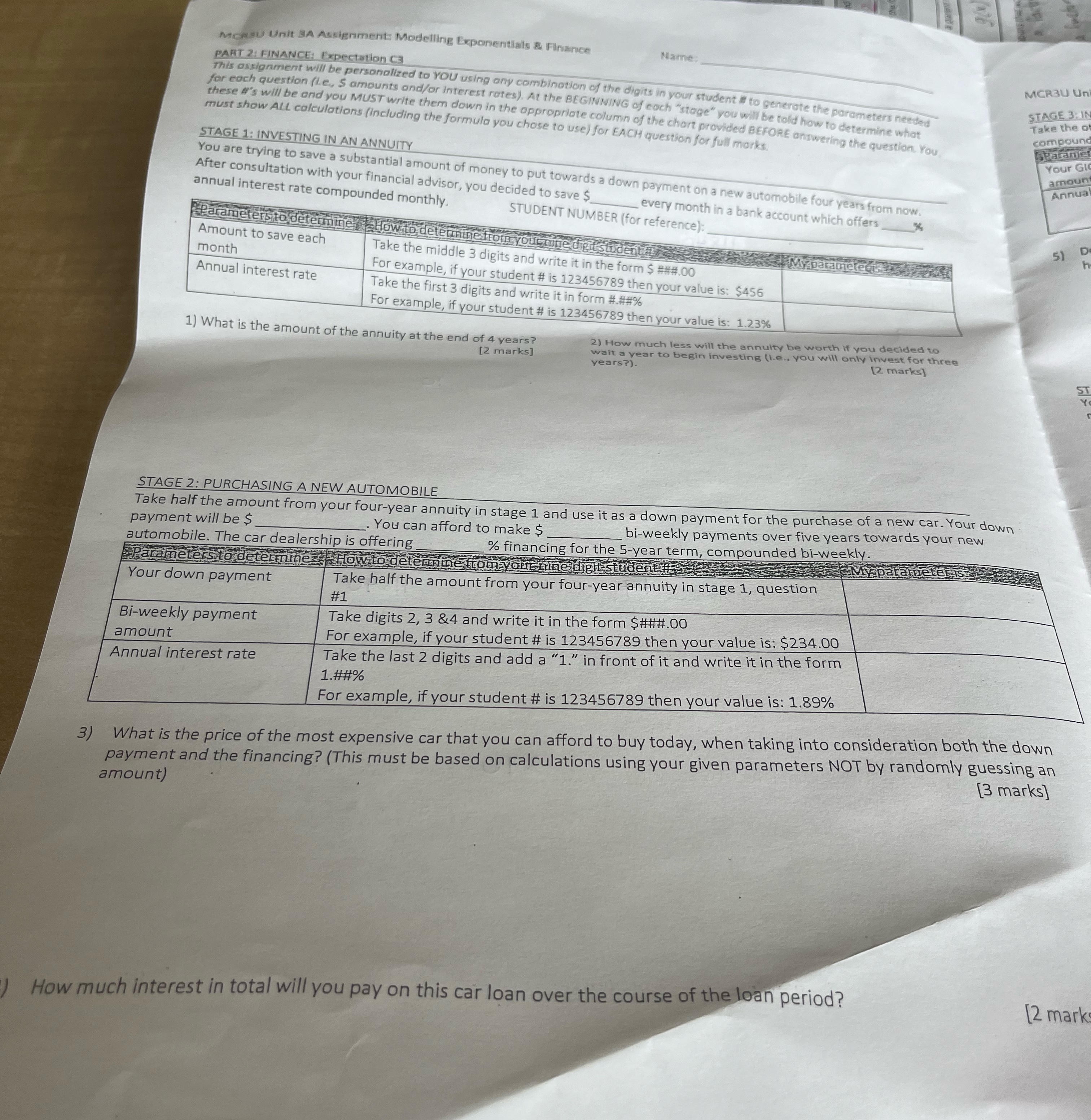

This ossignment will be personalized to YoU using any combinotion of the digits in your student af to generote the parameters needed for each question le amounts ondor Interest rotes At the BE GINNING of coch "stoge" you will be told how to determine whot these As will be and you MUST write them down in the oppropriate column of the chort provided BEFORE answering the question. You must show All calculations including the formula you chose to use for EA CH question for full morks.

STAGE : INVESTING IN AN ANNUITY

You are trying to save a substantial amount of money to put towards a down payment on a new automobile four years from now. After consultation with your financial advisor, you decided to save annual interest rate compounded monthly. every month in a bank account which offers

What is the amount of the annuity at the end of years?

marks

How much less will the annuity be worth if you decided to wait a year to begin investing ie you will only invest for three years?

marks

STAGE : PURCHASING A NEW AUTOMOBILE

Take half the amount from your fouryear annuity in stage and use it as a down payment for the purchase of a new car. Your down payment will be $ You can afford to make $ biweekly payments over five years towards your new automobile. The car dealership is offering financing for the year term, compounded biweekly. amount

How much interest in total will you pay on this car loan over the course of the loan period?

mark

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started