Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Morgana Ltd is preparing its consolidated statement of cash flows for the year ended 30 June 2021. The following summarised information is taken from

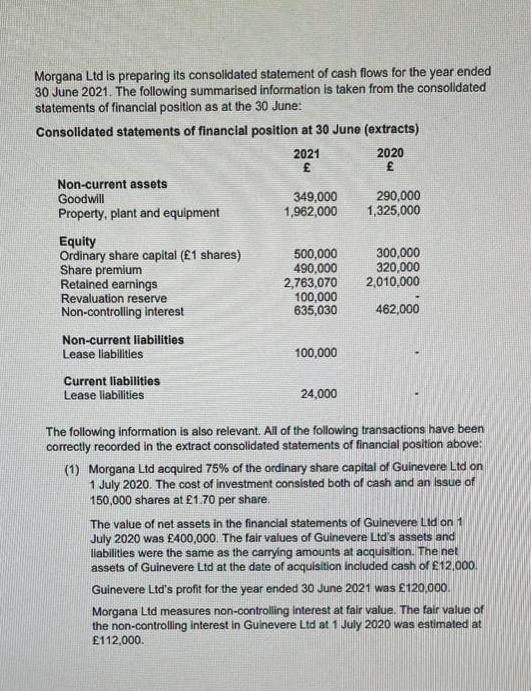

Morgana Ltd is preparing its consolidated statement of cash flows for the year ended 30 June 2021. The following summarised information is taken from the consolidated statements of financial position as at the 30 June: Consollidated statements of financial position at 30 June (extracts) 2021 2020 Non-current assets Goodwill Property, plant and equipment 349,000 1,962,000 290,000 1,325,000 Equity Ordinary share capital (1 shares) Share premium Retained earnings Revaluation reserve Non-controlling interest 500,000 490,000 2,763,070 100,000 635,030 300,000 320,000 2,010,000 462,000 Non-current liabilities Lease liabilities 100,000 Current liabilities Lease liabilities 24,000 The following information is also relevant. All of the following transactions have been correctly recorded in the extract consolidated statements of financial position above: (1) Morgana Ltd acquired 75% of the ordinary share capital of Guinevere Ltd on 1 July 2020. The cost of investment consisted both of cash and an issue of 150,000 shares at 1.70 per share. The value of net assets in the financial statements of Guinevere Ltd on1 July 2020 was 400,000. The fair values of Guinevere Ltd's assets and liabilities were the same as the carrying amounts at acquisition. The net assets of Guinevere Ltd at the date of acquisition included cash of 12,000. Guinevere Ltd's profit for the year ended 30 June 2021 was 120,000. Morgana Ltd measures non-controlling interest at fair value. The fair value of the non-controlling interest in Guinevere Ltd at 1 July 2020 was estimated at 112,000.

Step by Step Solution

★★★★★

3.28 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Cash flows from investing activities Acquisition of a subsidiary 323000 Acquisition ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started