Answered step by step

Verified Expert Solution

Question

1 Approved Answer

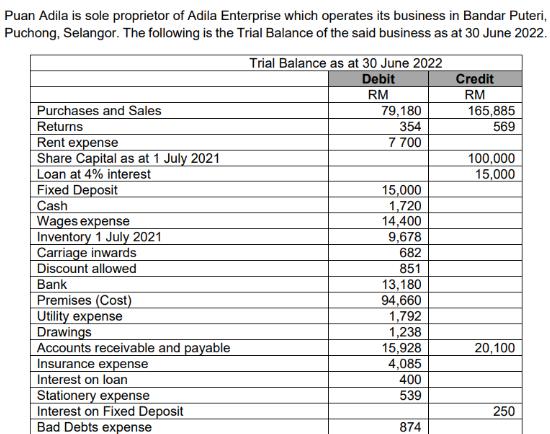

Puan Adila is sole proprietor of Adila Enterprise which operates its business in Bandar Puteri, Puchong, Selangor. The following is the Trial Balance of

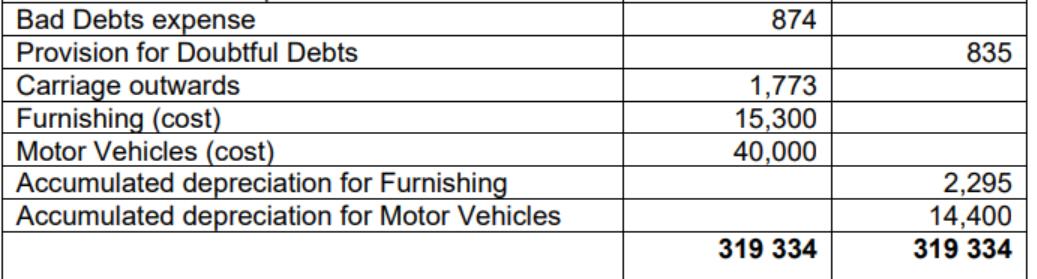

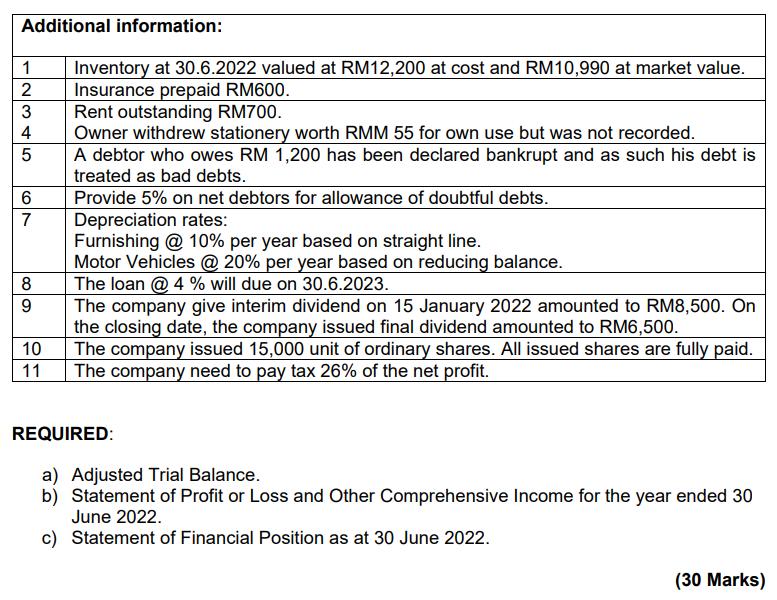

Puan Adila is sole proprietor of Adila Enterprise which operates its business in Bandar Puteri, Puchong, Selangor. The following is the Trial Balance of the said business as at 30 June 2022. Purchases and Sales Returns Rent expense Share Capital as at 1 July 2021 Loan at 4% interest Fixed Deposit Cash Wages expense Inventory 1 July 2021 Carriage inwards Discount allowed Bank Premises (Cost) Utility expense Drawings Accounts receivable and payable Insurance expense Interest on loan Stationery expense Interest on Fixed Deposit Bad Debts expense Trial Balance as at 30 June 2022 Debit RM 79,180 354 7 700 15,000 1,720 14,400 9,678 682 851 13,180 94,660 1,792 1,238 15,928 4,085 400 539 874 Credit RM 165,885 569 100,000 15,000 20,100 250 Bad Debts expense Provision for Doubtful Debts Carriage outwards Furnishing (cost) Motor Vehicles (cost) Accumulated depreciation for Furnishing Accumulated depreciation for Motor Vehicles 874 1,773 15,300 40,000 319 334 835 2,295 14,400 319 334 Additional information: 1 Inventory at 30.6.2022 valued at RM12,200 at cost and RM10,990 at market value. 2 Insurance prepaid RM600. 3 4 5 6 7 8 9 10 11 Rent outstanding RM700. Owner withdrew stationery worth RMM 55 for own use but was not recorded. A debtor who owes RM 1,200 has been declared bankrupt and as such his debt is treated as bad debts. Provide 5% on net debtors for allowance of doubtful debts. Depreciation rates: Furnishing @ 10% per year based on straight line. Motor Vehicles @ 20% per year based on reducing balance. The loan @ 4 % will due on 30.6.2023. The company give interim dividend on 15 January 2022 amounted to RM8,500. On the closing date, the company issued final dividend amounted to RM6,500. The company issued 15,000 unit of ordinary shares. All issued shares are fully paid. The company need to pay tax 26% of the net profit. REQUIRED: a) Adjusted Trial Balance. b) Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2022. c) Statement of Financial Position as at 30 June 2022. (30 Marks)

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Adjusted Trial Balance Accounts Debit Credit Purchases and Sales 79180 165885 Returns 354 569 Rent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started