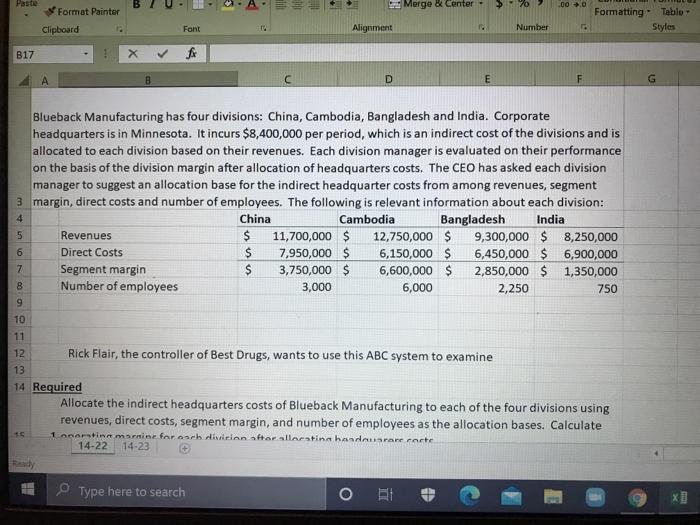

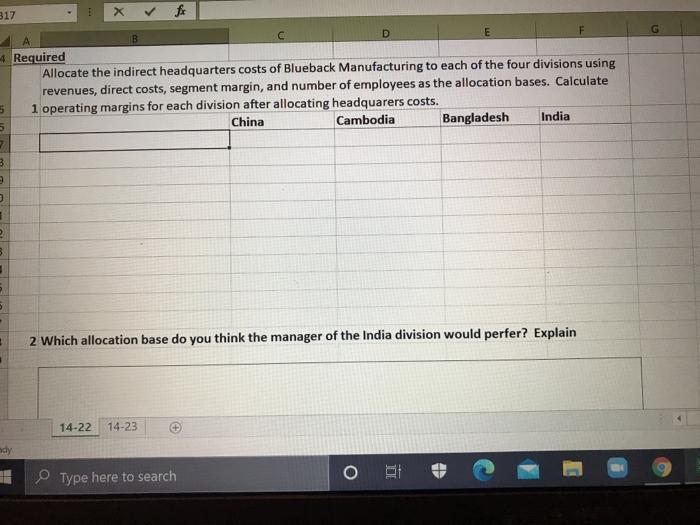

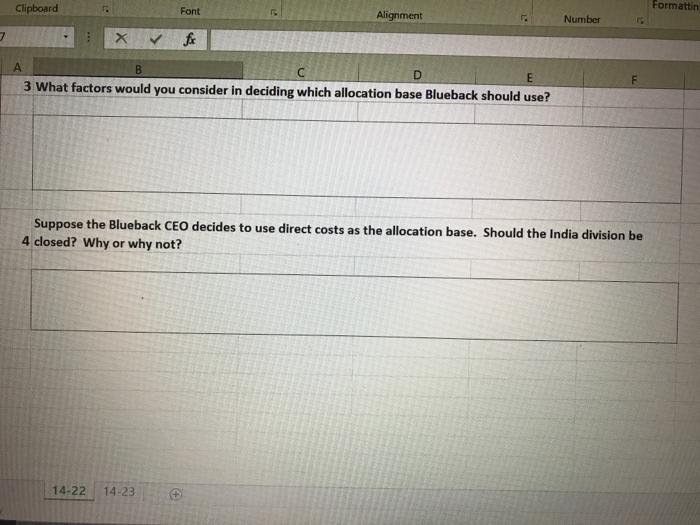

Morge & Center .000 Format Painter Clipboard Formatting Table Styles Font Alignment Number B17 f D E F G min 000 Blueback Manufacturing has four divisions: China, Cambodia, Bangladesh and India. Corporate headquarters is in Minnesota. It incurs $8,400,000 per period, which is an indirect cost of the divisions and is allocated to each division based on their revenues. Each division manager is evaluated on their performance on the basis of the division margin after allocation of headquarters costs. The CEO has asked each division manager to suggest an allocation base for the indirect headquarter costs from among revenues, segment 3 margin, direct costs and number of employees. The following is relevant information about each division: China Cambodia Bangladesh India Revenues $ 11,700,000 $ 12,750,000 $ 9,300,000 $8,250,000 Direct Costs $ 7,950,000 $ 6,150,000 $ 6,450,000 $ 6,900,000 Segment margin $ 3,750,000 $ 6,600,000 $ 2,850,000 $1,350,000 8 Number of employees 3,000 6,000 2,250 750 6 7 TO 11 12 Rick Flair, the controller of Best Drugs, wants to use this ABC system to examine 13 14 Required Allocate the indirect headquarters costs of Blueback Manufacturing to each of the four divisions using revenues, direct costs, segment margin, and number of employees as the allocation bases. Calculate Lanarstine marine for each division after allocatinn handusare corte 14-22 14-23 Type here to search o x2 317 fr B E -4 Required Allocate the indirect headquarters costs of Blueback Manufacturing to each of the four divisions using revenues, direct costs, segment margin, and number of employees as the allocation bases. Calculate 5 1 operating margins for each division after allocating headquarers costs. China Cambodia Bangladesh India 3 3 3 5 - 2 Which allocation base do you think the manager of the India division would perfer? Explain 14-22 14-23 ndy Type here to search Clipboard Formattin Font Alignment Number 7 B A D E 3 What factors would you consider in deciding which allocation base Blueback should use? F Suppose the Blueback CEO decides to use direct costs as the allocation base. Should the India division be 4 closed? Why or why not? 14-22 14-23