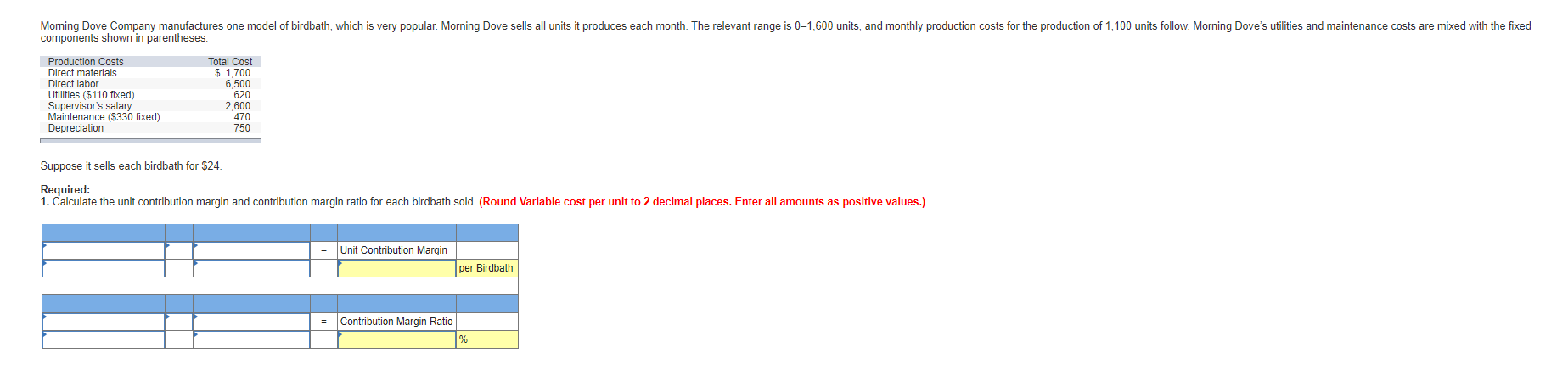

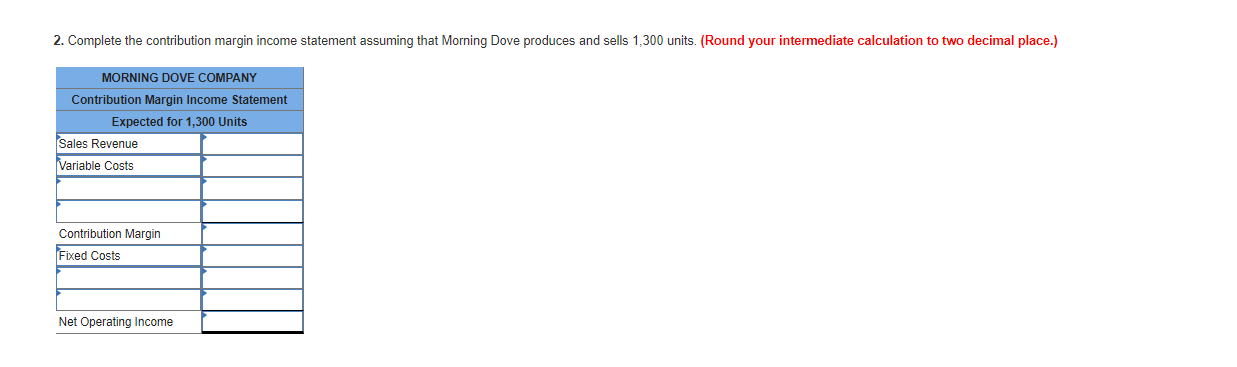

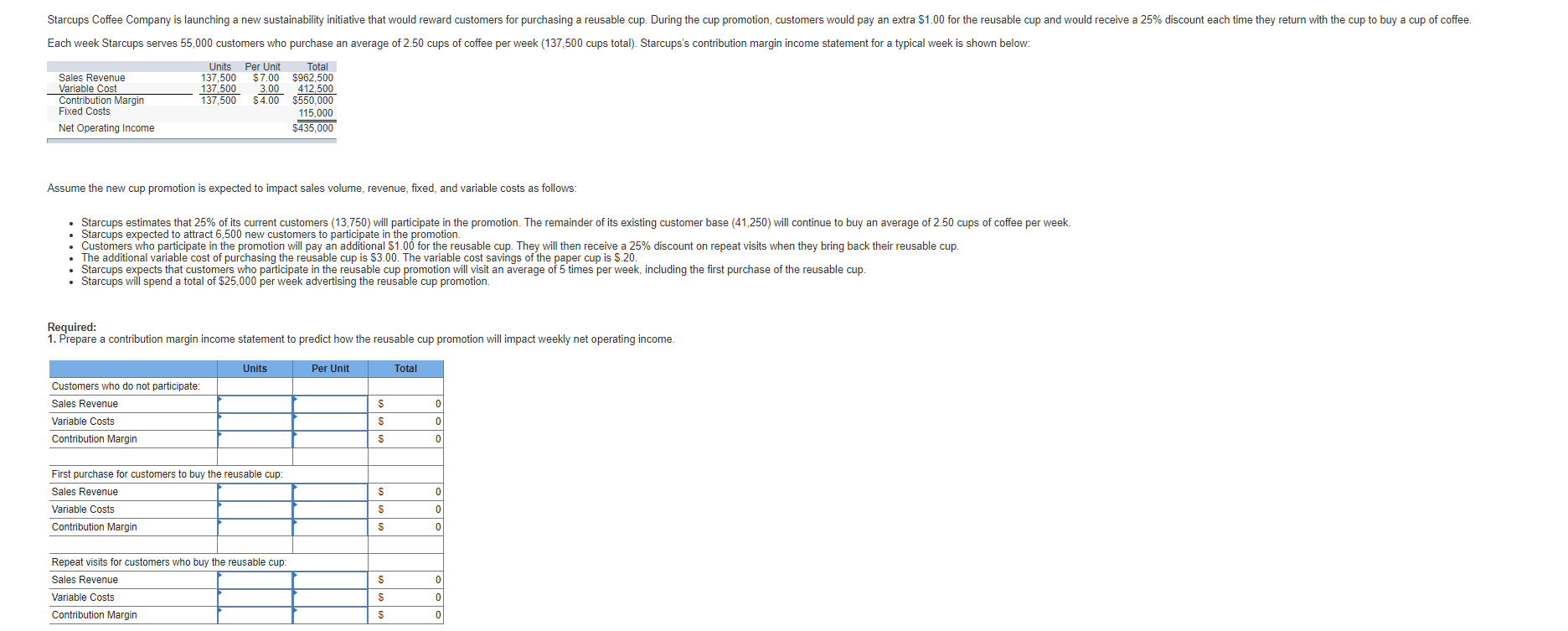

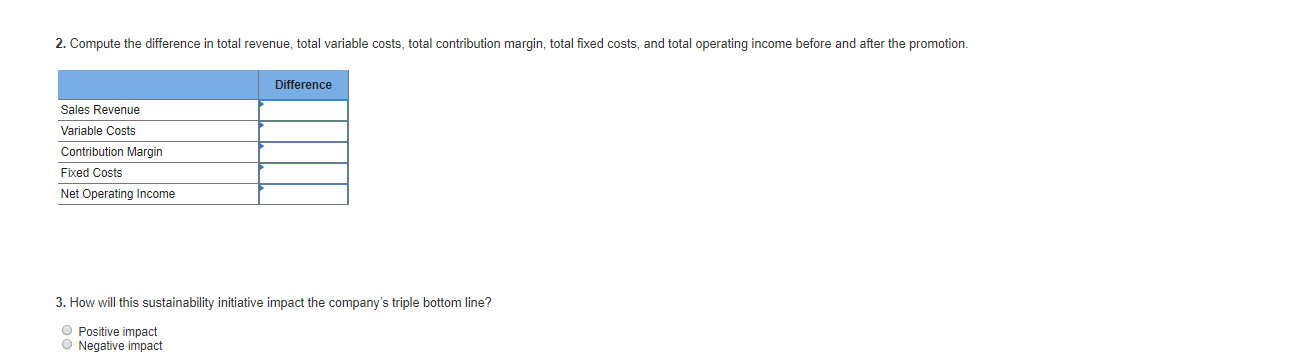

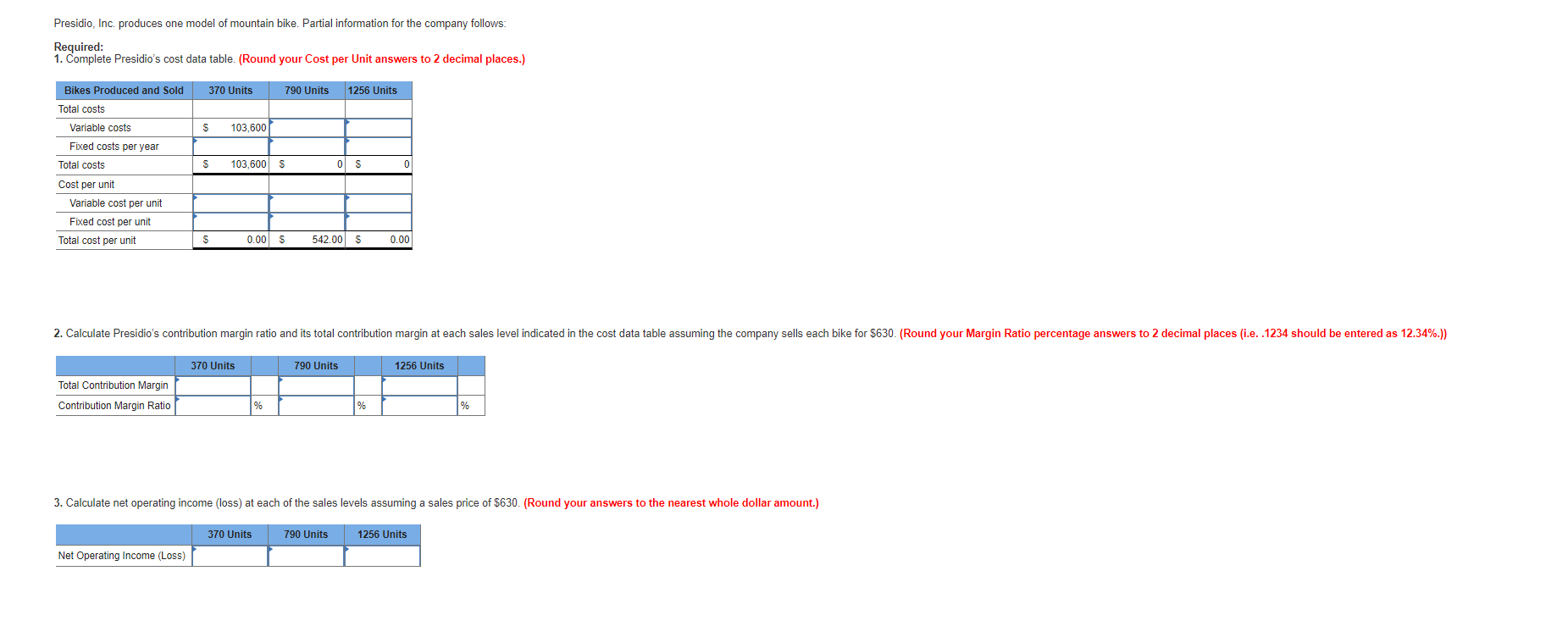

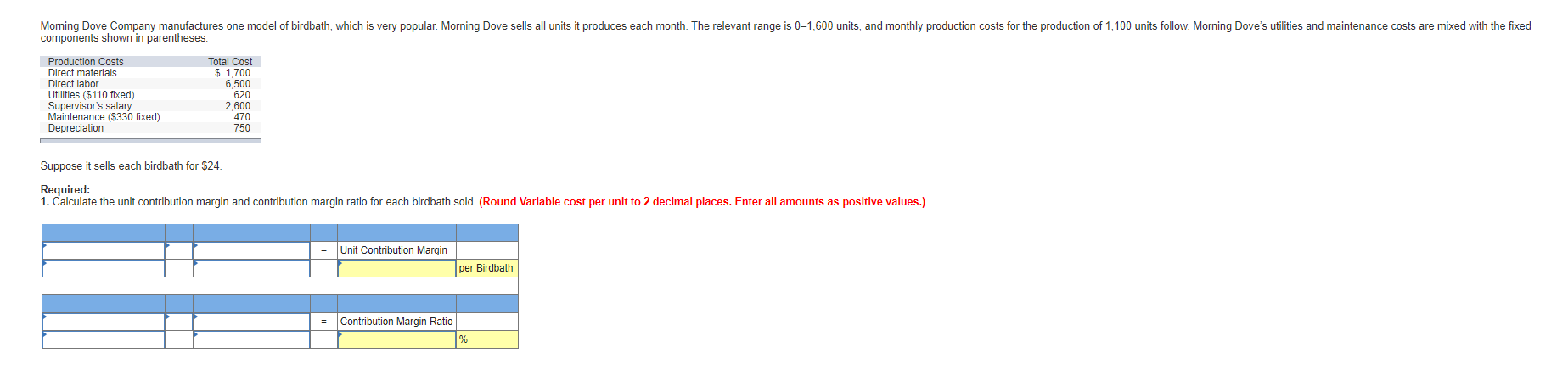

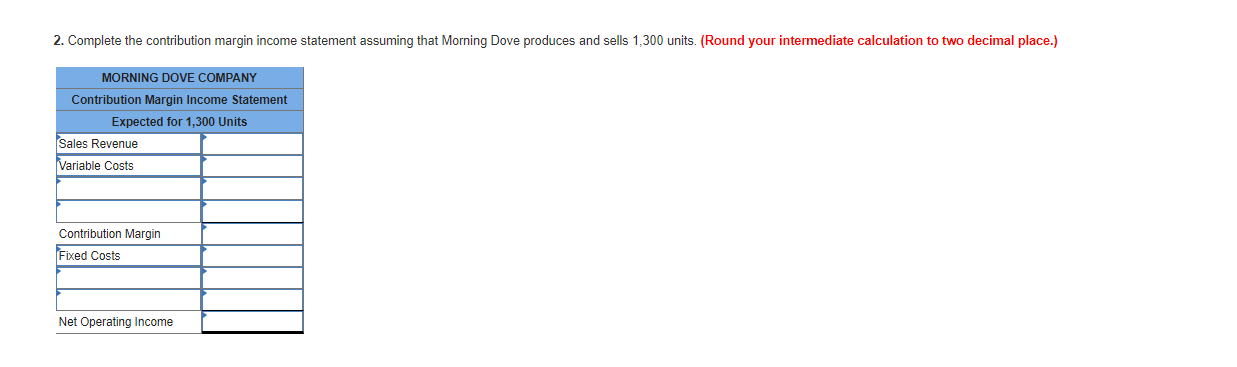

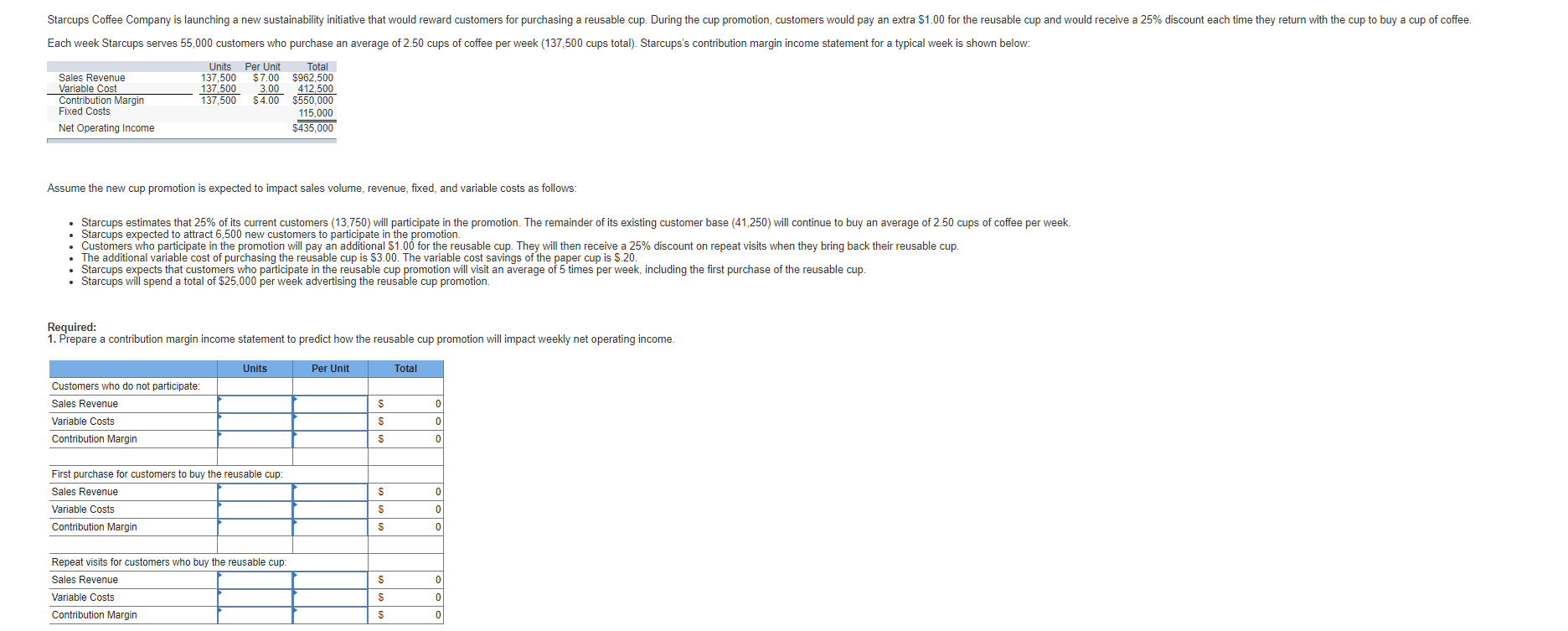

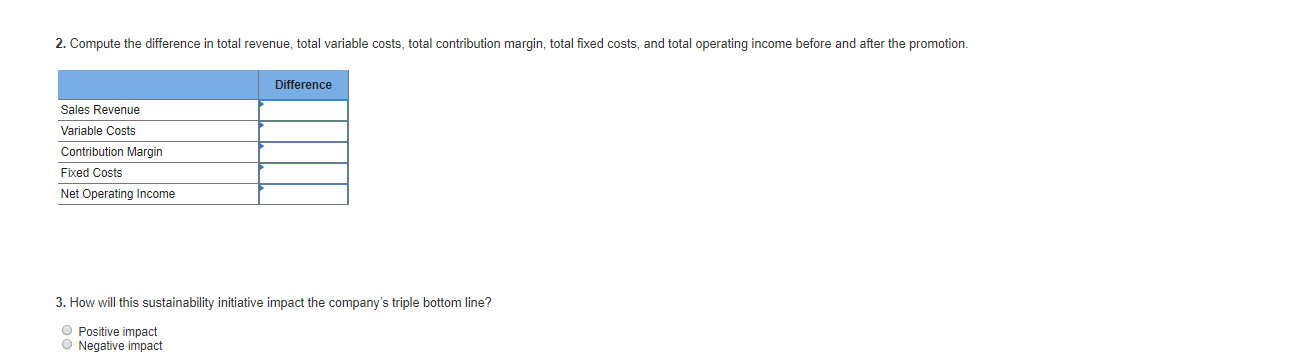

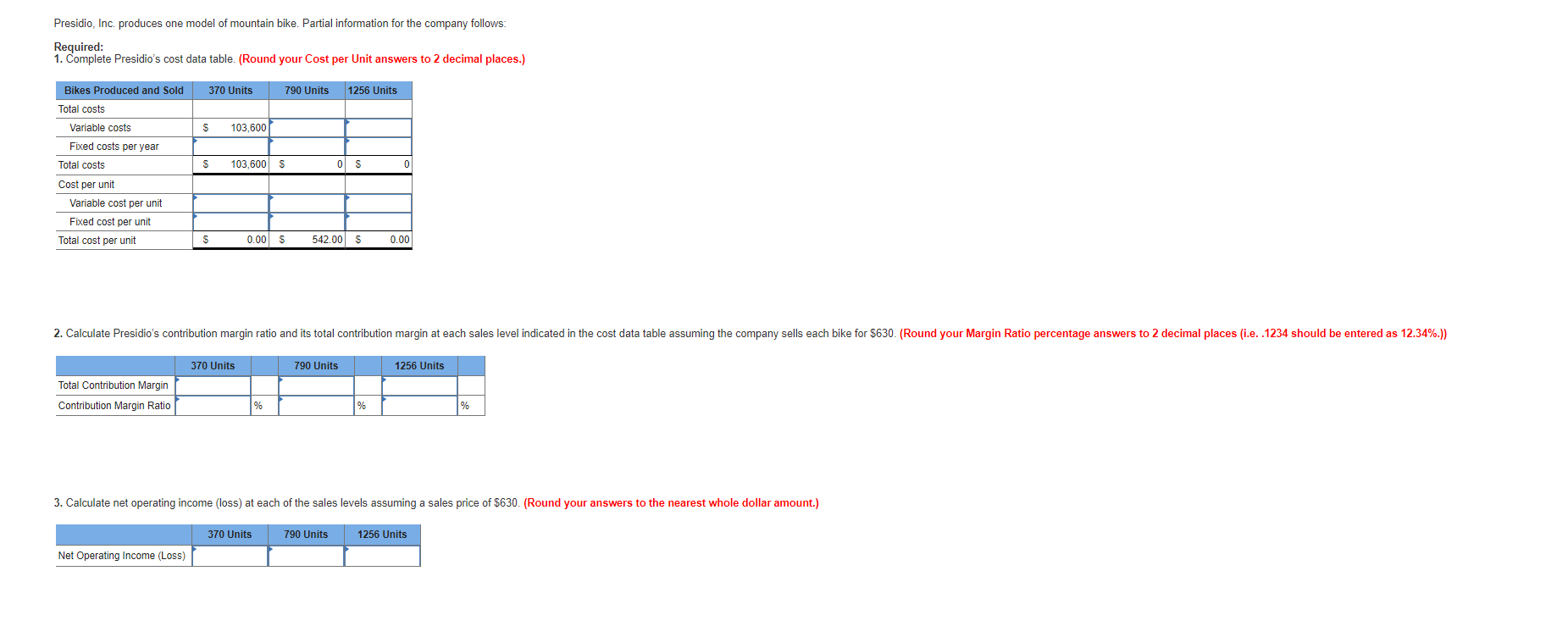

Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-1,600 units, and monthly production costs for the production of 1,100 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Total Cost $ 1,700 6,500 Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance (S330 fixed) Depreciation 620 2,600 470 750 Suppose it sells each birdbath for $24. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. (Round Variable cost per unit to 2 decimal places. Enter all amounts as positive values.) = Unit Contribution Margin per Birdbath = Contribution Margin Ratio 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,300 units. (Round your intermediate calculation to two decimal place.) MORNING DOVE COMPANY Contribution Margin Income Statement Expected for 1,300 Units Sales Revenue Variable Costs Contribution Margin Fixed Costs Net Operating Income Starcups Coffee Company is launching a new sustainability initiative that would reward customers for purchasing a reusable cup. During the cup promotion, customers would pay an extra $1.00 for the reusable cup and would receive a 25% discount each time they return with the cup to buy a cup of coffee. Each week Starcups serves 55,000 customers who purchase an average of 2.50 cups of coffee per week (137,500 cups total). Starcups's contribution margin income statement for a typical week is shown below. Sales Revenue Variable Cost Contribution Margin Fixed Costs Net Operating Income Units 137,500 137.500 137,500 Per Unit $7.00 3.00 $4.00 Total $962,500 412.500 $550,000 115,000 $435,000 Assume the new cup promotion is expected to impact sales volume, revenue, fixed, and variable costs as follows: Starcups estimates that 25% of its current customers (13,750) will participate in the promotion. The remainder of its existing customer base (41,250) will continue to buy an average of 2.50 cups of coffee per week. Starcups expected to attract 6,500 new customers to participate in the promotion. Customers who participate in the promotion will pay an additional $1.00 for the reusable cup. They will then receive a 25% discount on repeat visits when they bring back their reusable cup. The additional variable cost of purchasing the reusable cup is $3.00. The variable cost savings of the paper cup is $.20. Starcups expects that customers who participate in the reusable cup promotion will visit an average of 5 times per week, including the first purchase of the reusable cup. Starcups will spend a total of $25,000 per week advertising the reusable cup promotion. Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. Units Per Unit Total Customers who do not participate Sales Revenue Variable Costs Contribution Margin First purchase for customers to buy the reusable cup: Sales Revenue Variable Costs Contribution Margin Repeat visits for customers who buy the reusable cup: Sales Revenue Variable Costs Contribution Margin s 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. Difference Sales Revenue Variable Costs Contribution Margin Fixed Costs Net Operating Income 3. How will this sustainability initiative impact the company's triple bottom line? Positive impact O Negative impact Presidio, Inc. produces one model of mountain bike. Partial information for the company follows: Required: 1. Complete Presidio's cost data table. (Round your Cost per Unit answers to 2 decimal places.) 370 Units 7 90 Units 1256 Units $ 103,600 Bikes Produced and Sold Total costs Variable costs Fixed costs per year Total costs Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit $ 103,600S 0S 0 $ 0.00 $ 542.00 S 0.00 2. Calculate Presidio's contribution margin ratio and its total contribution margin at each sales level indicated in the cost data table assuming the company sells each bike for $630. (Round your Margin Ratio percentage answers to 2 decimal places (ie. .1234 should be entered as 12.34%.)) 370 Units 7 90 Units 1256 Units Total Contribution Margin Contribution Margin Ratio % % % 3. Calculate net operating income (loss) at each of the sales levels assuming a sales price of $630. (Round your answers to the nearest whole dollar amount.) 370 Units 790 Units 1256 Units Net Operating Income (Loss)