Question

Moron Technology is an information technology services provider. It currently operates primarily within the European marketplaces, and therefore are not active or traded on any

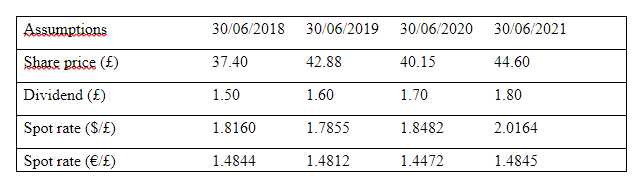

Moron Technology is an information technology services provider. It currently operates primarily within the European marketplaces, and therefore are not active or traded on any North American Stock Exchanges. The companys share price and dividend distributions have been as follows in recent years:

Questions:

1 British-based Investors Using the data above, calculate the annual average capital appreciation rate on Moron shares, as well as the average total return (including dividends) to a British pound-based investor holding the shares for the entire period shown (2018-2021).

2 Euro-based Investors (Part 1) Using the data above, calculate the annual average total return (including dividends) to a euro-based investor holding the shares for the entire period shown (2018-2021). Assume an investment of 100,000. What is the average return, including dividend distributions, to a euro-based investor for the period shown?

3.Euro-based Investors (Part 2) Using the data above-but assume an exchange rate which began at 1.4844/ in June 2018, and the consistently appreciated versus the euro 1.5% per year for the entire period. Calculate thr annual average total return (including dividends) to a euro-based investor holding the shares for the entire period shown. What is the average return, including dividend distributions, to a euro-based investor for the period shown?

4. US-dollar based Investors (Part 1) Using the data above, calculate the annual average total return (including dividends) to a USdollar based investor holding the shares for the entire period shown (2018-2021). Assume an investment of $100,000. What is the average return, including dividend distributions, to a US-dollar based investor for the period shown?

5. US-dollar based Investors (Part 2) Using the data above-but assume an exchange rate which began at $1.8160/ in June 2018, and the consistently appreciated versus the U.S. dollar 3.0% per year for the entire period. Calculate thr annual average total return (including dividends) to a US dollar-based investor holding the shares for the entire period shown. What is the average return, including dividend distributions, to a US dollar-based investor for the period shown?

\begin{tabular}{|lllll|} \hline Assumptions & 30/06/2018 & 30/06/2019 & 30/06/2020 & 30/06/2021 \\ \hline Share price ( A) & 37.40 & 42.88 & 40.15 & 44.60 \\ \hline Dividend (f) & 1.50 & 1.60 & 1.70 & 1.80 \\ \hline Spot rate ($/f) & 1.8160 & 1.7855 & 1.8482 & 2.0164 \\ \hline Spot rate (/f) & 1.4844 & 1.4812 & 1.4472 & 1.4845 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started