Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MORTAGE AMORTIZATION Complete the loan amortization schedule for a mortgage that will be repaid over 360 months and answer the following questions: 1) what is

MORTAGE AMORTIZATION

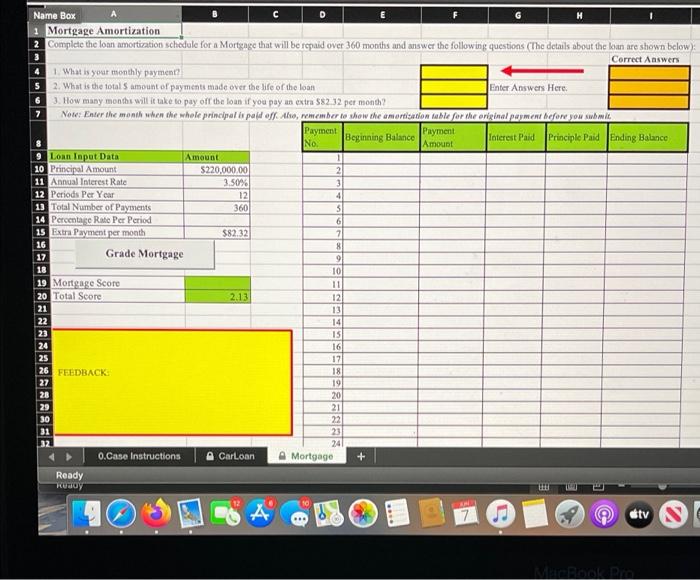

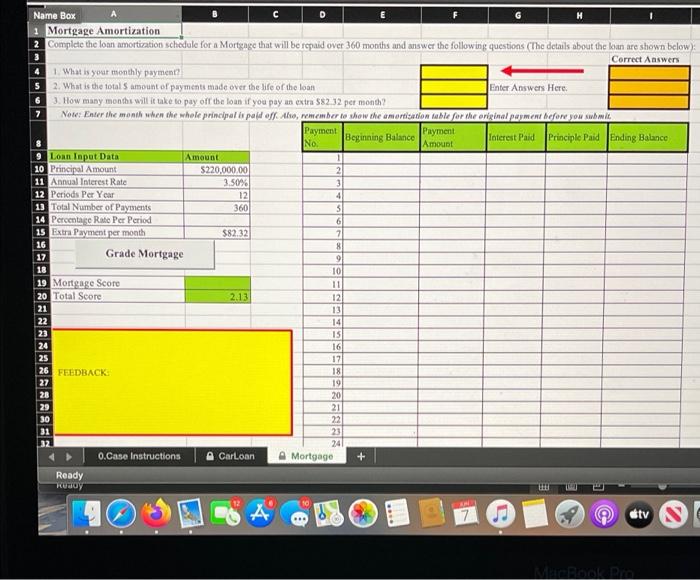

Name Box D 1 Mortgage Amortization 2 Complete the loan amortization schedule for a Mortgage that will be repaid over 360 months and answer the following questions (The details about the loan are shown below): 3 Correct Answers 4 1. What is your monthly payment? 5 2. What is the total 5 amount of payments made over the life of the loan Enter Answers Here. 63. How many months will it take to pay off the loan if you pay an extra $82.32 per month? 7 Note: Enter the month when the whole principal is paid off. Also, remember to show the amortization table for the original payment before you submit. Payment No. Beginning Balance Payment Amount Interest Paid Principle Paid Ending Balance Loan Input Data Amount 1 10 Principal Amount 2 $220,000,00 3.50% 11 Annual Interest Rate 3 12 Periods Per Year 12 4 13 Total Number of Payments 360 5 14 Percentage Rate Per Period 15 Extra Payment per month $82.32 16 17 18 19 Mortgage Score 20 Total Score 2.13 21 22 23 24 25 26 FEEDBACK: 27 28 29 CarLoan E tv S MacBook Pro Ready Ready Grade Mortgage 0.Case Instructions 6 7 8 9 10 11 12 Mortgage 13 14 15 16 17 18 19 20 21 22 23 241 + Complete the loan amortization schedule for a mortgage that will be repaid over 360 months and answer the following questions:

1) what is your monthly payment?

2) what is the total $ amount of payments made over the life of the loan

3) how many months will it take to pay off the loan if you pay an extra $82.32 per month?

note: enter the month when the whole principal is paid off. Also, remember to show the amortization table for the original payment before you submit.

principal amount: $220,000

annual interest rate: 3.50%

periods per year: 12

total number of payments: 360

percentage rate per period:

extra payment per month: $82.32

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started