Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mortgage Amortization Schedule Loans are part of our lives today. You might have Student Loans, Auto Loans, and Home Mortgage Loans, etc. Banks make

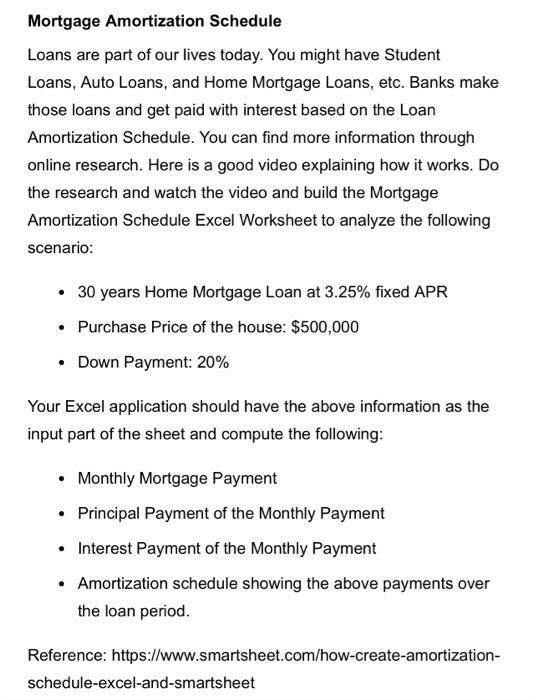

Mortgage Amortization Schedule Loans are part of our lives today. You might have Student Loans, Auto Loans, and Home Mortgage Loans, etc. Banks make those loans and get paid with interest based on the Loan Amortization Schedule. You can find more information through online research. Here is a good video explaining how it works. Do the research and watch the video and build the Mortgage Amortization Schedule Excel Worksheet to analyze the following scenario: 30 years Home Mortgage Loan at 3.25% fixed APR Purchase Price of the house: $500,000 Down Payment: 20% Your Excel application should have the above information as the input part of the sheet and compute the following: Monthly Mortgage Payment Principal Payment of the Monthly Payment Interest Payment of the Monthly Payment Amortization schedule showing the above payments over the loan period. Reference: https://www.smartsheet.com/how-create-amortization- schedule-excel-and-smartsheet

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

It seems that you are looking to create a mortgage amortization schedule for a home loan using Excel According to the scenario provided the details of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started