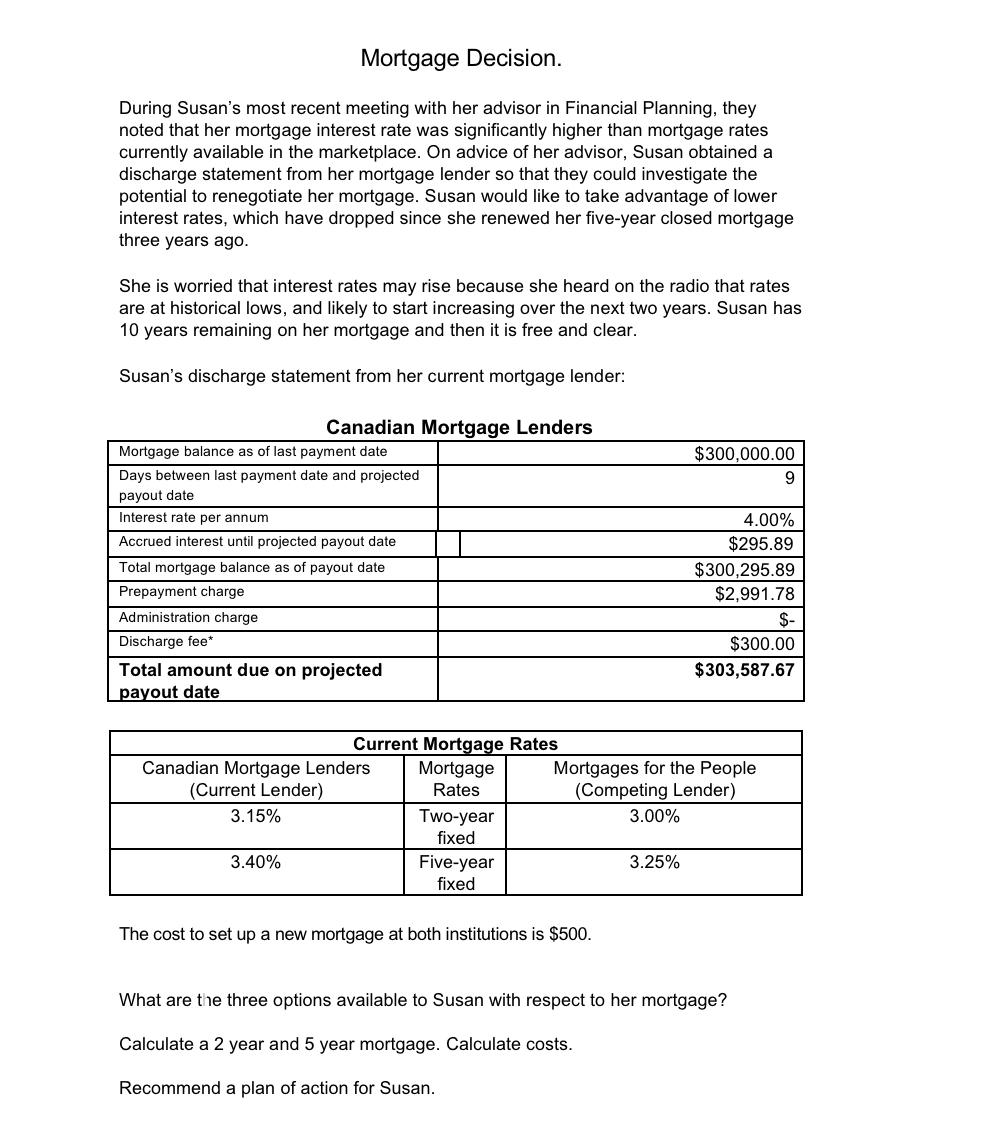

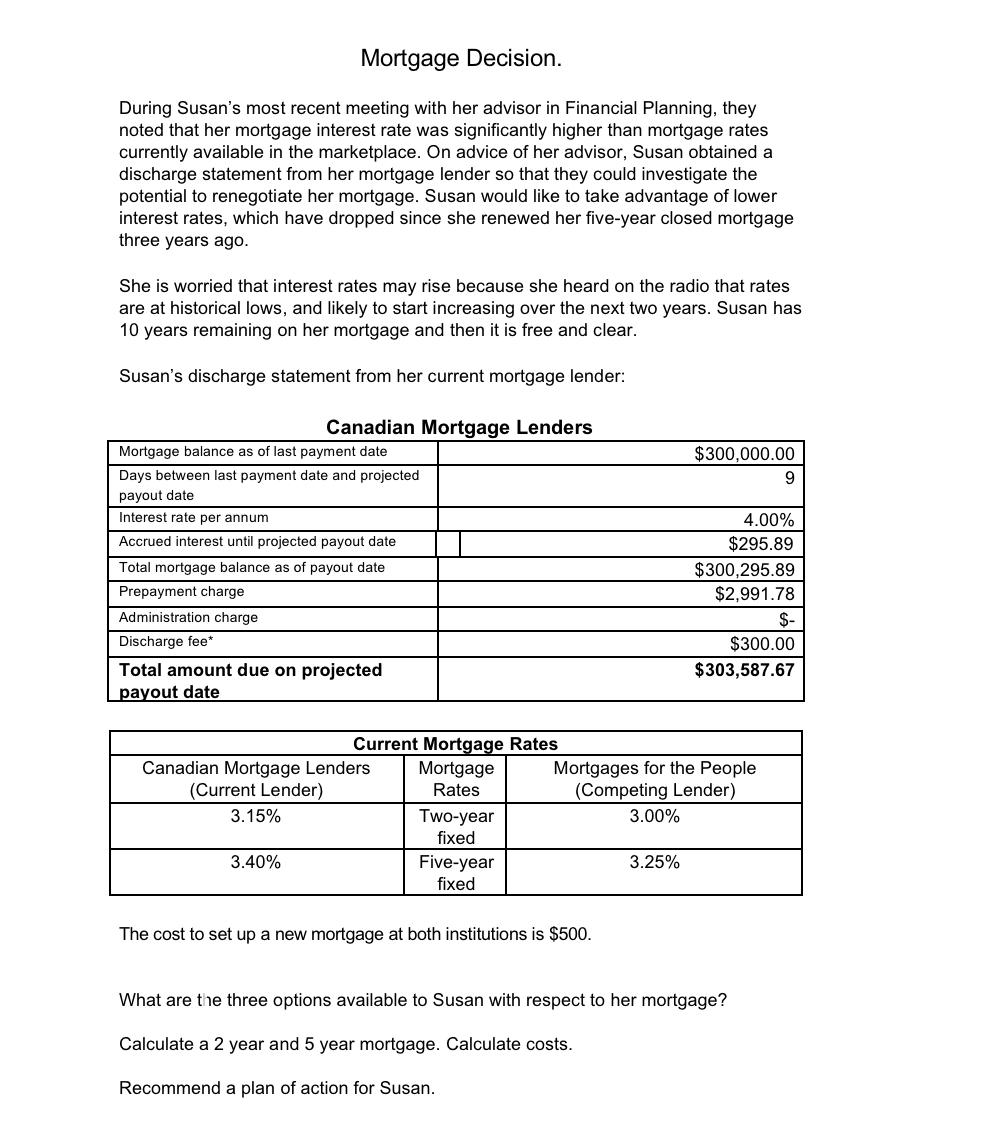

Mortgage Decision. During Susan's most recent meeting with her advisor in Financial Planning, they noted that her mortgage interest rate was significantly higher than mortgage rates currently available in the marketplace. On advice of her advisor, Susan obtained a discharge statement from her mortgage lender so that they could investigate the potential to renegotiate her mortgage. Susan would like to take advantage of lower interest rates, which have dropped since she renewed her five-year closed mortgage three years ago. She is worried that interest rates may rise because she heard on the radio that rates are at historical lows, and likely to start increasing over the next two years. Susan has 10 years remaining on her mortgage and then it is free and clear. Susan's discharge statement from her current mortgage lender: $300,000.00 9 Canadian Mortgage Lenders Mortgage balance as of last payment date Days between last payment date and projected payout date Interest rate per annum Accrued interest until projected payout date Total mortgage balance as of payout date Prepayment charge Administration charge Discharge fee* Total amount due on projected payout date 4.00% $295.89 $300,295.89 $2,991.78 $- $300.00 $303,587.67 Current Mortgage Rates Canadian Mortgage Lenders Mortgage Mortgages for the People (Current Lender) Rates (Competing Lender) 3.15% Two-year 3.00% fixed 3.40% Five-year 3.25% fixed The cost to set up a new mortgage at both institutions is $500. What are the three options available to Susan with respect to her mortgage? Calculate a 2 year and 5 year mortgage. Calculate costs. Recommend a plan of action for Susan. Mortgage Decision. During Susan's most recent meeting with her advisor in Financial Planning, they noted that her mortgage interest rate was significantly higher than mortgage rates currently available in the marketplace. On advice of her advisor, Susan obtained a discharge statement from her mortgage lender so that they could investigate the potential to renegotiate her mortgage. Susan would like to take advantage of lower interest rates, which have dropped since she renewed her five-year closed mortgage three years ago. She is worried that interest rates may rise because she heard on the radio that rates are at historical lows, and likely to start increasing over the next two years. Susan has 10 years remaining on her mortgage and then it is free and clear. Susan's discharge statement from her current mortgage lender: $300,000.00 9 Canadian Mortgage Lenders Mortgage balance as of last payment date Days between last payment date and projected payout date Interest rate per annum Accrued interest until projected payout date Total mortgage balance as of payout date Prepayment charge Administration charge Discharge fee* Total amount due on projected payout date 4.00% $295.89 $300,295.89 $2,991.78 $- $300.00 $303,587.67 Current Mortgage Rates Canadian Mortgage Lenders Mortgage Mortgages for the People (Current Lender) Rates (Competing Lender) 3.15% Two-year 3.00% fixed 3.40% Five-year 3.25% fixed The cost to set up a new mortgage at both institutions is $500. What are the three options available to Susan with respect to her mortgage? Calculate a 2 year and 5 year mortgage. Calculate costs. Recommend a plan of action for Susan