Answered step by step

Verified Expert Solution

Question

1 Approved Answer

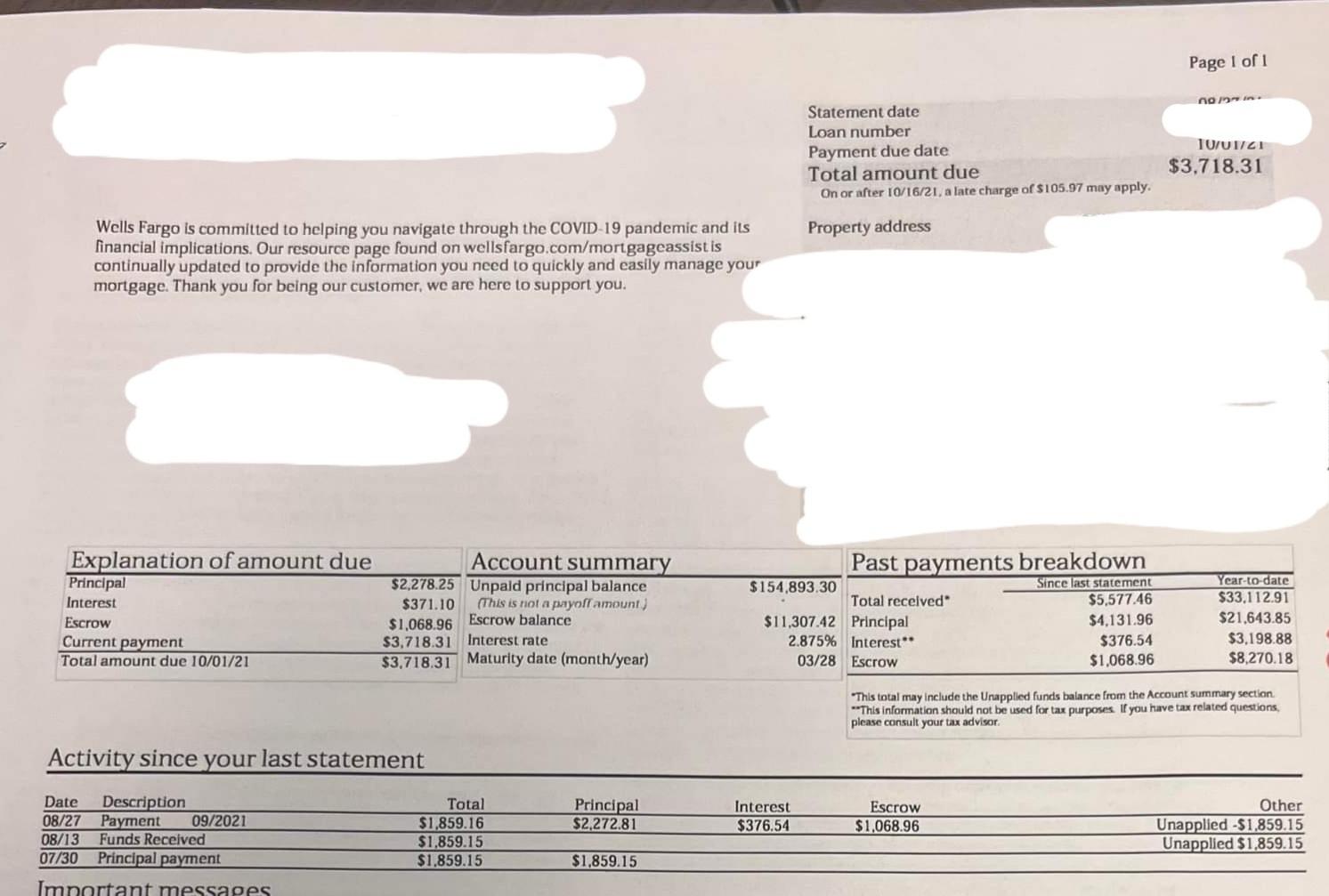

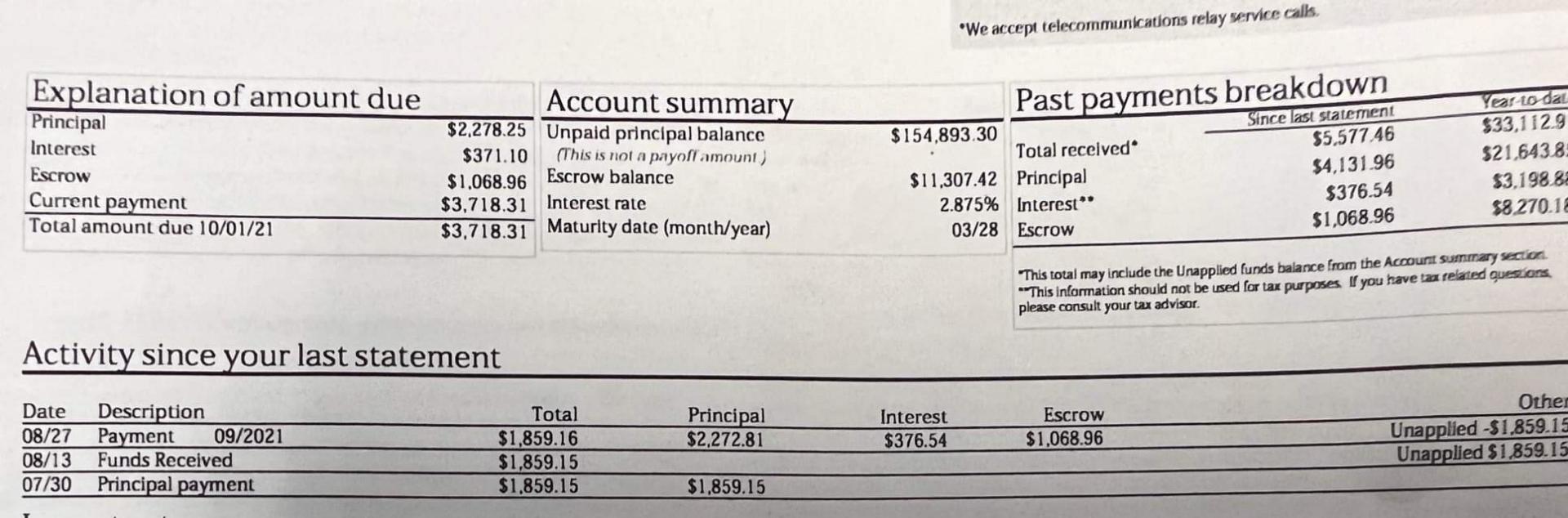

Mortgage Financing/Accounting Trying to figure out the outstanding balance since 7/30 when client passed away. The difference in the interest as being taken off the

Mortgage Financing/Accounting

Trying to figure out the outstanding balance since 7/30 when client passed away. The difference in the interest as being taken off the principal is 9.9. Not sure if that caries through each month. It's a fixed rate mortgage.

Page 1 of 1 in Statement date Loan number Payment due date Total amount due On or after 10/16/21, a late charge of $105.97 may apply. 10/11 $3.718.31 Property address Wells Fargo is committed to helping you navigate through the COVID-19 pandemic and its financial implications. Our resource page found on wellsfargo.com/mortgageassist is continually updated to provide the information you need to quickly and easily manage your mortgage. Thank you for being our customer, we are here to support you. Explanation of amount due Account summary Principal $2,278.25 Unpaid principal balance Interest $371.10 (This is not a payoff amount Escrow $1,068.96 Escrow balance Current payment $3,718.31 Interest rate Total amount due 10/01/21 $3,718.31 Maturity date (month/year) Past payments breakdown $154,893.30 Since last statement Total received $5,577.46 $11,307.42 Principal $4.131.96 2.875% Interest ** $376.54 03/28 Escrow $1,068.96 Year-to-date $33.112.91 $21.643.85 $3.198.88 $8,270.18 This total may include the Unapplied funds balance from the Account summary section **This information should not be used for tax purposes. If you have tax related questions, please consult your tax advisor Activity since your last statement Date Description 08/27 Payment 09/2021 08/13 Funds Received 07/30 Principal payment Principal $2,272.81 Total $1,859.16 $1,859.15 $1,859.15 Interest $376.54 Escrow $1,068.96 Other Unapplied -51.859.15 Unapplied $1,859.15 $1,859.15 Imnortant messages. *We accept telecommunications relay service calls, Explanation of amount due Principal Interest Escrow Current payment Total amount due 10/01/21 Account summary $2,278.25 Unpaid principal balance $371.10 (This is not a payoff amount) $1.068.96 Escrow balance $3,718.31 Interest rate $3,718.31 Maturity date (month/year) Past payments breakdown $154,893.30 Since last statement Total received $5,577.46 $11.307.42 Principal $4,131.96 2.875% Interest** $376,54 03/28 Escrow $1,068.96 Year to dal $33,1129 $21,6438 $3.198.82 58 27012 This total may include the Unapplied funds balance from the Account Summary scho "This information should not be used for tax purposes. If you have ta related questions please consult your tax advisor. Activity since your last statement Date Description 08/27 Payment 09/2021 08/13 Funds Received 07/30 Principal payment Principal $2,272.81 Interest $376.54 Escrow $1,068.96 Total $1,859.16 $1,859.15 $1.859.15 Other Unapplied -$1.859.15 Unapplied $1,859.15 $1,859.15 Page 1 of 1 in Statement date Loan number Payment due date Total amount due On or after 10/16/21, a late charge of $105.97 may apply. 10/11 $3.718.31 Property address Wells Fargo is committed to helping you navigate through the COVID-19 pandemic and its financial implications. Our resource page found on wellsfargo.com/mortgageassist is continually updated to provide the information you need to quickly and easily manage your mortgage. Thank you for being our customer, we are here to support you. Explanation of amount due Account summary Principal $2,278.25 Unpaid principal balance Interest $371.10 (This is not a payoff amount Escrow $1,068.96 Escrow balance Current payment $3,718.31 Interest rate Total amount due 10/01/21 $3,718.31 Maturity date (month/year) Past payments breakdown $154,893.30 Since last statement Total received $5,577.46 $11,307.42 Principal $4.131.96 2.875% Interest ** $376.54 03/28 Escrow $1,068.96 Year-to-date $33.112.91 $21.643.85 $3.198.88 $8,270.18 This total may include the Unapplied funds balance from the Account summary section **This information should not be used for tax purposes. If you have tax related questions, please consult your tax advisor Activity since your last statement Date Description 08/27 Payment 09/2021 08/13 Funds Received 07/30 Principal payment Principal $2,272.81 Total $1,859.16 $1,859.15 $1,859.15 Interest $376.54 Escrow $1,068.96 Other Unapplied -51.859.15 Unapplied $1,859.15 $1,859.15 Imnortant messages. *We accept telecommunications relay service calls, Explanation of amount due Principal Interest Escrow Current payment Total amount due 10/01/21 Account summary $2,278.25 Unpaid principal balance $371.10 (This is not a payoff amount) $1.068.96 Escrow balance $3,718.31 Interest rate $3,718.31 Maturity date (month/year) Past payments breakdown $154,893.30 Since last statement Total received $5,577.46 $11.307.42 Principal $4,131.96 2.875% Interest** $376,54 03/28 Escrow $1,068.96 Year to dal $33,1129 $21,6438 $3.198.82 58 27012 This total may include the Unapplied funds balance from the Account Summary scho "This information should not be used for tax purposes. If you have ta related questions please consult your tax advisor. Activity since your last statement Date Description 08/27 Payment 09/2021 08/13 Funds Received 07/30 Principal payment Principal $2,272.81 Interest $376.54 Escrow $1,068.96 Total $1,859.16 $1,859.15 $1.859.15 Other Unapplied -$1.859.15 Unapplied $1,859.15 $1,859.15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started