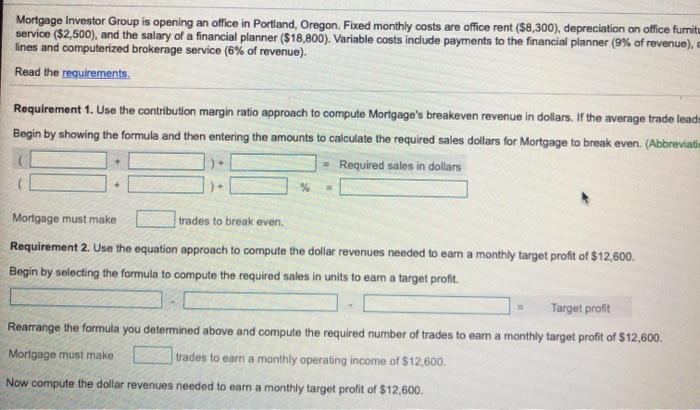

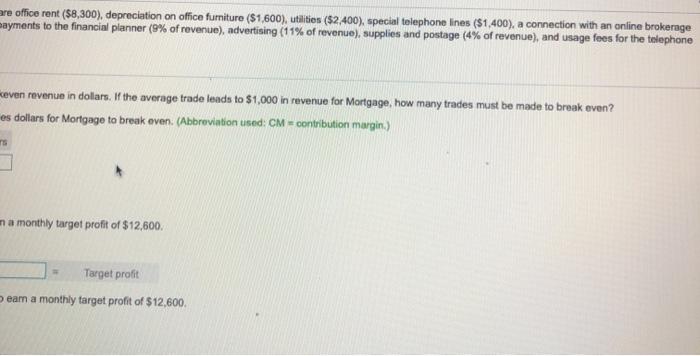

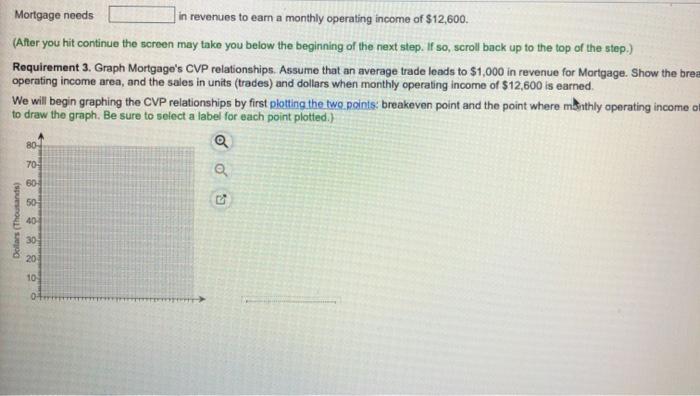

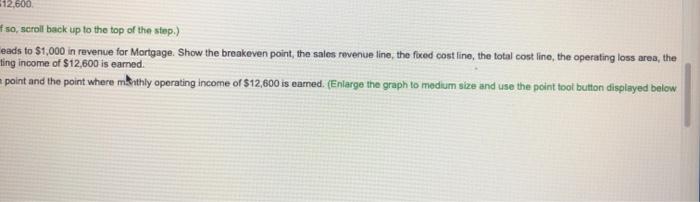

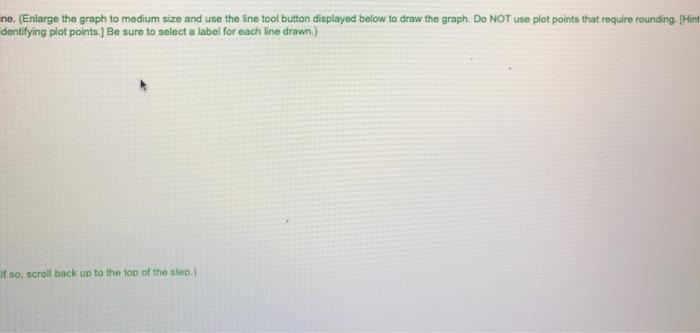

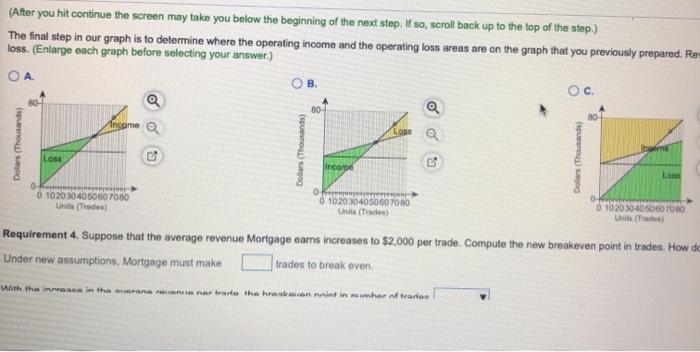

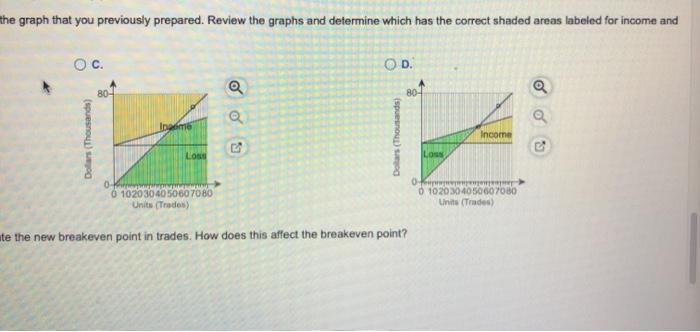

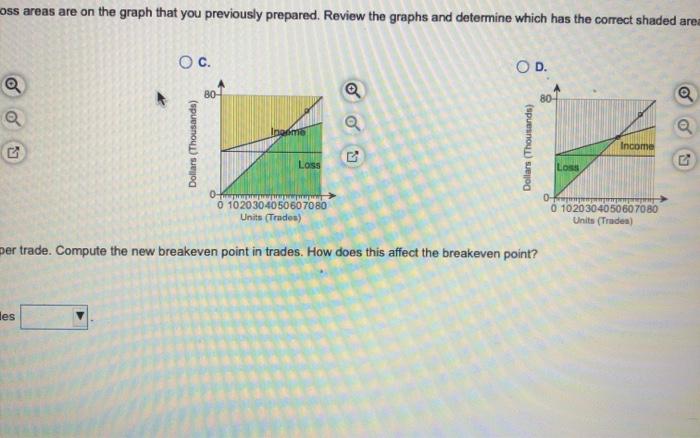

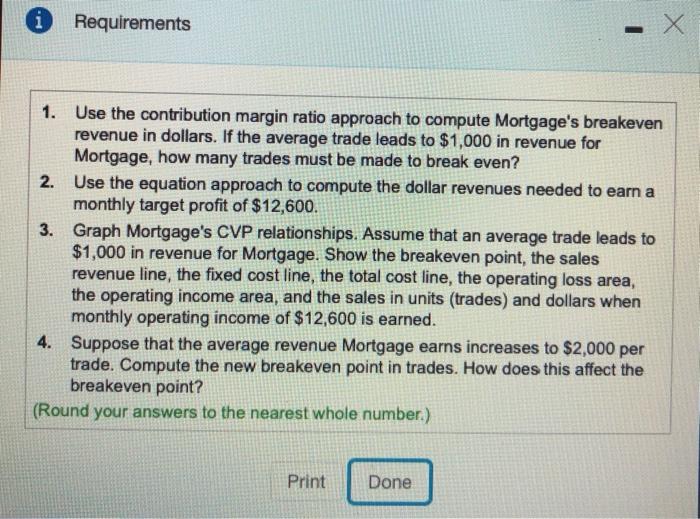

Mortgage Investor Group is opening an office in Portland, Oregon, Fixed monthly costs are office rent ($8,300), depreciation on office furnitu service ($2,500), and the salary of a financial planner ($18,800). Variable costs include payments to the financial planner (9% of revenue), lines and computerized brokerage service (6% of revenue). Read the requirements Requirement 1. Use the contribution margin ratio approach to compute Mortgage's breakeven revenue in dollars. If the average trade lead- Begin by showing the formula and then entering the amounts to calculate the required sales dollars for Mortgage to break even. (Abbreviatin Required sales in dollars % Mortgage must make trades to break even Requirement 2. Use the equation approach to compute the dollar revenues needed to earn a monthly target profit of $12,600 Begin by selecting the formula to compute the required sales in units to earn a target profit. Target profit Rearrange the formula you determined above and compute the required number of trades to earn a monthly target profit of $12,600. Mortgage must make trades to earn a monthly operating income of $12,600 Now compute the dollar revenues needed to earn a monthly target profit of $12,600. are office rent ($8,300), depreciation on office furniture ($1,600), utilities ($2,400), special telephone lines ($1,400), a connection with an online brokerage mayments to the financial planner (9% of revenue), advertising (11% of revenue), supplies and postage (4% of revenue), and usage fees for the telephone even revenue in dollars. If the average trade leads to $1,000 in revenue for Mortgage, how many trades must be made to break even? es dollars for Mortgage to break even. (Abbreviation used: CM - contribution margin.) ma monthly target profit of $12,600. Target profit eam a monthly target profit of $12,600. Mortgage needs in revenues to earn a monthly operating income of $12,600. (After you hit continue the screen may take you below the beginning of the next step. If so, scroll back up to the top of the step.) Requirement 3. Graph Mortgago's CVP relationships. Assume that an average trade leads to $1,000 in revenue for Mortgage. Show the brea operating income area, and the sales in units (trades) and dollars when monthly operating income of $12,600 is earned. We will begin graphing the CVP relationships by first plotting the two points: breakeven point and the point where monthly operating income on to draw the graph. Be sure to select a label for each point plotted.) a 80 70- 60 os 50 Dollars (Thousands) 40 30 20 10 0 12,600 of so, scroll back up to the top of the step.) leads to $1,000 in revenue for Mortgage Show the breakeven point, the sales revenue line, the faced cost lino, the total cost line, the operating loss area, the ting income of $12,600 is eamed. point and the point where mbothly operating income of $12,600 is earned. (Enlarge the graph to medium size and use the point tool button displayed below Next plot the following lines: the sales revenue line, fixed cost line, and the total cost line. (Enlarge the graph to medium size refer to your computations from Requirements 1 and/or 2, as appropriate, to assist in identifying plot points.) Be sure to select BO 70 0 a 60 50 Dollars (Thousands) 400 30 20- 10 04 0 10 20 30 40 50 60 70 80 Units (Trades) Click to enlarge graph (After you hit continue the screen may take you below the beginning of the next step. If so, scroll back up to the top of the step ne. (Enlarge the graph to medium size and use the line tool button displayed below to draw the graph Do NOT use plot points that require rounding. Hint dentifying plot points. Be sure to select a label for each line drawn.) If so, scroll back up to the top of the step (After you hit continue the screen may take you below the beginning of the next step. If so, scroll back up to the top of the step.) The final step in our graph is to determine where the operating income and the operating loss areas are on the graph that you previously prepared. Re loss. (Enlarge each graph before selecting your answer.) . OC a 80 Income LQ Dollars (Thousandel Dollars (Thousands Loss Dollar (Thomanda income 0 01020304050607080 Unis (Trades) 1020304050607080 Unit (Trades 0 1020304050607080 Unit (de Requirement 4. Suppose that the average revenue Mortgage carns increases to $2,000 per trade. Compute the new breakeven point in trades. How de Under new assumptions, Mortgage must make trades to break even With the increase in the rana rannarrate the roan nint in mar a trace the graph that you previously prepared. Review the graphs and determine which has the correct shaded areas labeled for income and OD Q 80- 80- Ipom Income Dollars (Thousands) Dollars (Thousands) 65 3. Lo Los 01020304050607080 Units (Trades) opreme 0 1020304050607000 Units (Trades) ate the new breakeven point in trades. How does this affect the breakeven point? Requirement 4. Suppose that the average revenue Mortgage earns increases to $2,000 per trade. Compute the new breakeven point in Under new assumptions, Mortgage must make trades to break even With the increase in the average revenue per trade, the breakeven point in number of trades moss areas are on the graph that you previously prepared. Review the graphs and determine which has the correct shaded area OC. OD. a B0- 80- Q Q Dollars (Thousands) Dollars (Thousands) Income Loss O- 0 1020304050607080 Units (Trades) O- FR 0 102030405060 70 80 Units (Tradea) Der trade. Compute the new breakeven point in trades. How does this affect the breakeven point? les i Requirements X 1. Use the contribution margin ratio approach to compute Mortgage's breakeven revenue in dollars. If the average trade leads to $1,000 in revenue for Mortgage, how many trades must be made to break even? 2. Use the equation approach to compute the dollar revenues needed to earn a monthly target profit of $12,600. 3. Graph Mortgage's CVP relationships. Assume that an average trade leads to $1,000 in revenue for Mortgage. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, the operating income area, and the sales in units (trades) and dollars when monthly operating income of $12,600 is earned. 4. Suppose that the average revenue Mortgage earns increases to $2,000 per trade. Compute the new breakeven point in trades. How does this affect the breakeven point? (Round your answers to the nearest whole number.) Print Done Mortgage Investor Group is opening an office in Portland, Oregon, Fixed monthly costs are office rent ($8,300), depreciation on office furnitu service ($2,500), and the salary of a financial planner ($18,800). Variable costs include payments to the financial planner (9% of revenue), lines and computerized brokerage service (6% of revenue). Read the requirements Requirement 1. Use the contribution margin ratio approach to compute Mortgage's breakeven revenue in dollars. If the average trade lead- Begin by showing the formula and then entering the amounts to calculate the required sales dollars for Mortgage to break even. (Abbreviatin Required sales in dollars % Mortgage must make trades to break even Requirement 2. Use the equation approach to compute the dollar revenues needed to earn a monthly target profit of $12,600 Begin by selecting the formula to compute the required sales in units to earn a target profit. Target profit Rearrange the formula you determined above and compute the required number of trades to earn a monthly target profit of $12,600. Mortgage must make trades to earn a monthly operating income of $12,600 Now compute the dollar revenues needed to earn a monthly target profit of $12,600. are office rent ($8,300), depreciation on office furniture ($1,600), utilities ($2,400), special telephone lines ($1,400), a connection with an online brokerage mayments to the financial planner (9% of revenue), advertising (11% of revenue), supplies and postage (4% of revenue), and usage fees for the telephone even revenue in dollars. If the average trade leads to $1,000 in revenue for Mortgage, how many trades must be made to break even? es dollars for Mortgage to break even. (Abbreviation used: CM - contribution margin.) ma monthly target profit of $12,600. Target profit eam a monthly target profit of $12,600. Mortgage needs in revenues to earn a monthly operating income of $12,600. (After you hit continue the screen may take you below the beginning of the next step. If so, scroll back up to the top of the step.) Requirement 3. Graph Mortgago's CVP relationships. Assume that an average trade leads to $1,000 in revenue for Mortgage. Show the brea operating income area, and the sales in units (trades) and dollars when monthly operating income of $12,600 is earned. We will begin graphing the CVP relationships by first plotting the two points: breakeven point and the point where monthly operating income on to draw the graph. Be sure to select a label for each point plotted.) a 80 70- 60 os 50 Dollars (Thousands) 40 30 20 10 0 12,600 of so, scroll back up to the top of the step.) leads to $1,000 in revenue for Mortgage Show the breakeven point, the sales revenue line, the faced cost lino, the total cost line, the operating loss area, the ting income of $12,600 is eamed. point and the point where mbothly operating income of $12,600 is earned. (Enlarge the graph to medium size and use the point tool button displayed below Next plot the following lines: the sales revenue line, fixed cost line, and the total cost line. (Enlarge the graph to medium size refer to your computations from Requirements 1 and/or 2, as appropriate, to assist in identifying plot points.) Be sure to select BO 70 0 a 60 50 Dollars (Thousands) 400 30 20- 10 04 0 10 20 30 40 50 60 70 80 Units (Trades) Click to enlarge graph (After you hit continue the screen may take you below the beginning of the next step. If so, scroll back up to the top of the step ne. (Enlarge the graph to medium size and use the line tool button displayed below to draw the graph Do NOT use plot points that require rounding. Hint dentifying plot points. Be sure to select a label for each line drawn.) If so, scroll back up to the top of the step (After you hit continue the screen may take you below the beginning of the next step. If so, scroll back up to the top of the step.) The final step in our graph is to determine where the operating income and the operating loss areas are on the graph that you previously prepared. Re loss. (Enlarge each graph before selecting your answer.) . OC a 80 Income LQ Dollars (Thousandel Dollars (Thousands Loss Dollar (Thomanda income 0 01020304050607080 Unis (Trades) 1020304050607080 Unit (Trades 0 1020304050607080 Unit (de Requirement 4. Suppose that the average revenue Mortgage carns increases to $2,000 per trade. Compute the new breakeven point in trades. How de Under new assumptions, Mortgage must make trades to break even With the increase in the rana rannarrate the roan nint in mar a trace the graph that you previously prepared. Review the graphs and determine which has the correct shaded areas labeled for income and OD Q 80- 80- Ipom Income Dollars (Thousands) Dollars (Thousands) 65 3. Lo Los 01020304050607080 Units (Trades) opreme 0 1020304050607000 Units (Trades) ate the new breakeven point in trades. How does this affect the breakeven point? Requirement 4. Suppose that the average revenue Mortgage earns increases to $2,000 per trade. Compute the new breakeven point in Under new assumptions, Mortgage must make trades to break even With the increase in the average revenue per trade, the breakeven point in number of trades moss areas are on the graph that you previously prepared. Review the graphs and determine which has the correct shaded area OC. OD. a B0- 80- Q Q Dollars (Thousands) Dollars (Thousands) Income Loss O- 0 1020304050607080 Units (Trades) O- FR 0 102030405060 70 80 Units (Tradea) Der trade. Compute the new breakeven point in trades. How does this affect the breakeven point? les i Requirements X 1. Use the contribution margin ratio approach to compute Mortgage's breakeven revenue in dollars. If the average trade leads to $1,000 in revenue for Mortgage, how many trades must be made to break even? 2. Use the equation approach to compute the dollar revenues needed to earn a monthly target profit of $12,600. 3. Graph Mortgage's CVP relationships. Assume that an average trade leads to $1,000 in revenue for Mortgage. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, the operating income area, and the sales in units (trades) and dollars when monthly operating income of $12,600 is earned. 4. Suppose that the average revenue Mortgage earns increases to $2,000 per trade. Compute the new breakeven point in trades. How does this affect the breakeven point? (Round your answers to the nearest whole number.) Print Done