Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MORTGAGE WITH ANNUAL PAYMENTS Mortgage principal 100,000 Annual interest rate 10% Mortgage term (years) 20 Annual mortgage payment 11,745.96 In the Rate function set the

| MORTGAGE WITH ANNUAL PAYMENTS | |||||||||

| Mortgage principal | 100,000 | ||||||||

| Annual interest rate | 10% | ||||||||

| Mortgage term (years) | 20 | ||||||||

| Annual mortgage payment | 11,745.96 | In the Rate function set the PV (meaning: the amount actually received) to the mortgage principal net of the points [100,000*(1-1.2%) ] minus the processing costs. | |||||||

| Mortgage points |

| ||||||||

| Processing costs ($) | 750.00 | ||||||||

| Net mortgage received | 97,750.00 | ||||||||

| Annual IRR (EAIR) | 10.34% | ||||||||

| Check: Build an amortization table for the Mortgage | |||||||||

| Year | Principal at beginning of year | Payment at end of year | Interest component of payment (use EAIR) | Repayment of principal | Principal at end of year | ||||

| 1 | |||||||||

| 2 | |||||||||

| 3 | |||||||||

| 4 | |||||||||

| 5 | |||||||||

| 6 | |||||||||

| 7 | |||||||||

| 8 | |||||||||

| 9 | |||||||||

| 10 | |||||||||

| 11 | |||||||||

| 12 | |||||||||

| 13 | |||||||||

| 14 | |||||||||

| 15 | |||||||||

| 16 | |||||||||

| 17 | |||||||||

| 18 | |||||||||

| 19 | |||||||||

| 20 |

Please fill out amortization table

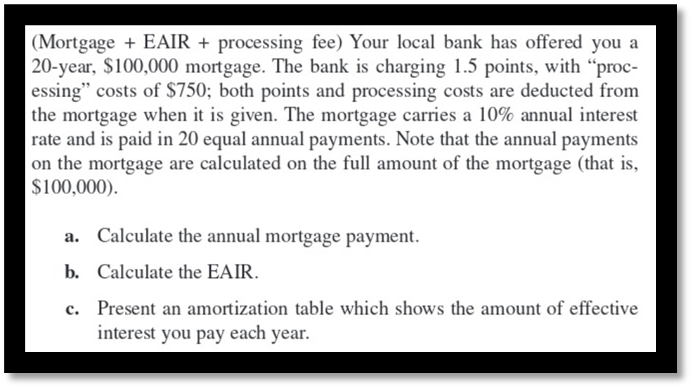

(Mortgage + EAIR + processing fee) Your local bank has offered you a 20 -year, $100,000 mortgage. The bank is charging 1.5 points, with "processing" costs of $750; both points and processing costs are deducted from the mortgage when it is given. The mortgage carries a 10% annual interest rate and is paid in 20 equal annual payments. Note that the annual payments on the mortgage are calculated on the full amount of the mortgage (that is, $100,000). a. Calculate the annual mortgage payment. b. Calculate the EAIR. c. Present an amortization table which shows the amount of effective interest you pay each yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started