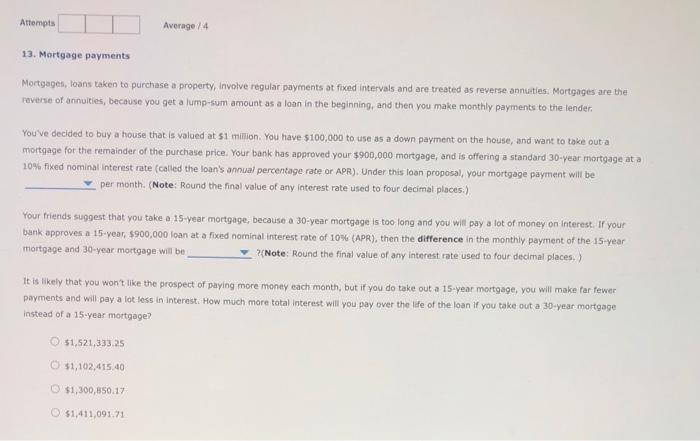

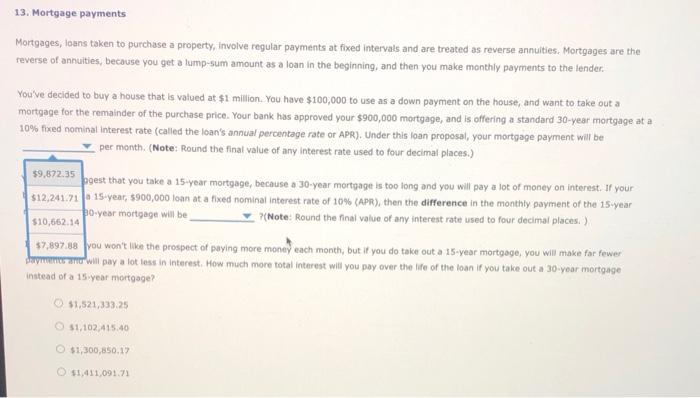

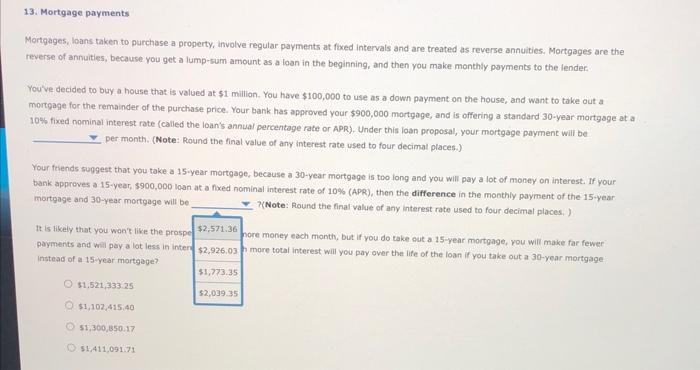

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuties, Mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. You ve decided to buy a house that is valued at 51 milion. You have $100,000 to use as a down payment on the house, and want to take out a mortgage for thie remainder of the purchase price, Your bank has approved your $900,000 mortgage, and is offering a standard 30 -year mortgage at a 10\%, fixed nominal interest rate (called the loan's annual percentage fate or APR). Under this loan proposal, your mortgage payment will be per month. (Note; Round the final value of any interest rate tused to four decimal places.) Your friends suggest that you take a 15 -vear mortgage, because a 30 -year mortgage is too-long and you will pay a lot of money on interest. If your bank approves a 15 -year, $900,000 loan at a fixed nominal interest rate of 10%6 (APR), then the difference in the monthly payment of the 15 -year mortgage and 30 -year mottgage will be (Note: Round the final value of any interest rate used to four decimal places.) It is likely that you won' like the prospect of paying more money each month, but if you do take out a 15 -year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 -year mortgage instead of a 15 -year mortgage? $1,521,333,25 $1,102,415,40 $1,300,850.17 $1,411,091.71 Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the feverse of annuities, because you get a lump-5um amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 million. You have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $900,000 mortgage, and is offering a standard 30 -year mortgage at a 10% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment wil be per month. (Note: Round the final value of any interest rate used to four decimal places.) gest that you take a 15-year mortgage, because a 30 -year mortgage is too long and you will pay a lok of money on interest. If your I.15-year, 5900,000 loan at a fixed nominal interest rate of 10% (APR), then the difference in the monthly payment of the 15 -year 0-yesr mortgage will be ?(Note: Round the final value of any interest rate used to four decimal places. ) you won't like the prospect of paying more money each month, but if you do take out a 15 -year mortgoge, you will make far fewer yaymunne mu wili pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 -year mortgage instead of a 15y year mortgage? $1,521,333.25$1,102,415.40$1,300,850,17$1,411,091.71 Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 milion. You have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $900,000 mortgage, and is offering a standard 30 -year mortgage at a 10% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal; your mortgage payment will be per month. (Note: Round the final value of any interest rate used to four decimal places.) Your ftiends suggest that you take a 15 -year mortgage, because a 30 -year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15 -year, $900,000 loan at a fxed nominal interest rate of 10% (APR), then the difference in the monthly payrment of the 15 year mortgage and 30 -year mortgage will be ?(Note: Round the final value of any interest rate used to four decimal places, ) It is Hikely that you won' like the prospe payments and wil pay a lot less in inter ore money eech month, but if you do take out a 15 -year mortgage, you will make far fewer Instead of a 15 -year mortgage? more total interest will you pay over the life of the loan if you take out a 30 -year mortgage. 31,521,333.25 $1,102,415,40 51,300,350.17 51,411,091.71