Answered step by step

Verified Expert Solution

Question

1 Approved Answer

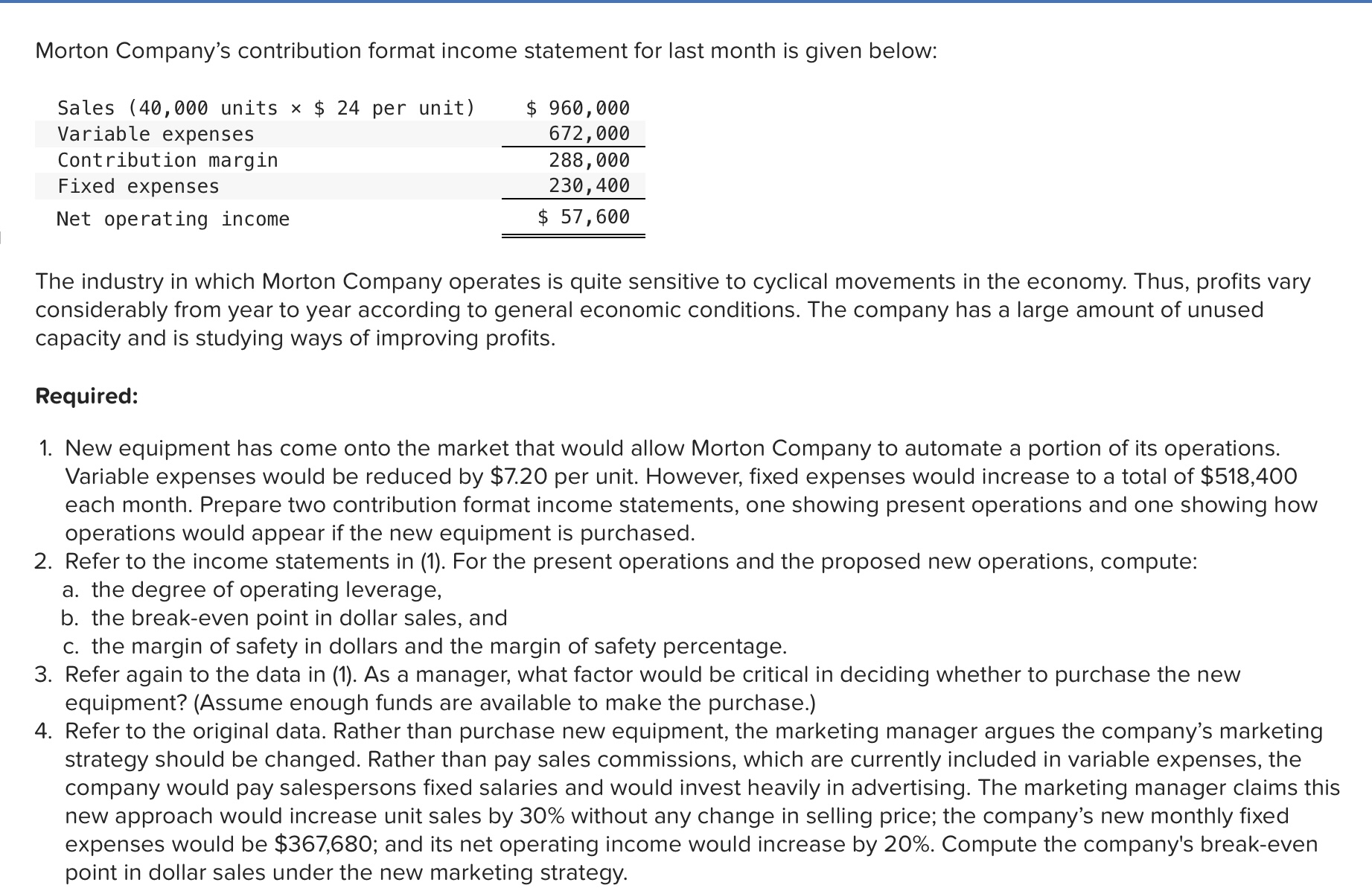

Morton Company's contribution format income statement for last month is given below: The industry in which Morton Company operates is quite sensitive to cyclical movements

Morton Company's contribution format income statement for last month is given below:

The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary

considerably from year to year according to general economic conditions. The company has a large amount of unused

capacity and is studying ways of improving profits.

Required:

New equipment has come onto the market that would allow Morton Company to automate a portion of its operations.

Variable expenses would be reduced by $ per unit. However, fixed expenses would increase to a total of $

each month. Prepare two contribution format income statements, one showing present operations and one showing how

operations would appear if the new equipment is purchased.

Refer to the income statements in For the present operations and the proposed new operations, compute:

a the degree of operating leverage,

b the breakeven point in dollar sales, and

c the margin of safety in dollars and the margin of safety percentage.

Refer again to the data in As a manager, what factor would be critical in deciding whether to purchase the new

equipment? Assume enough funds are available to make the purchase.

Refer to the original data. Rather than purchase new equipment, the marketing manager argues the company's marketing

strategy should be changed. Rather than pay sales commissions, which are currently included in variable expenses, the

company would pay salespersons fixed salaries and would invest heavily in advertising. The marketing manager claims this

new approach would increase unit sales by without any change in selling price; the company's new monthly fixed

expenses would be $; and its net operating income would increase by Compute the company's breakeven

point in dollar sales under the new marketing strategy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started