Question

Morton Company's variable manufacturing overhead should be $4.40 per standard direct labor hour and fixed manufacturing should be $270,000 per year. The company manufacturers a

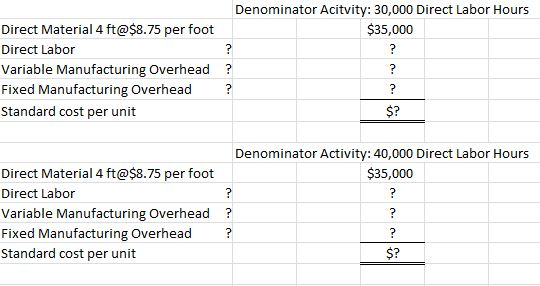

Morton Company's variable manufacturing overhead should be $4.40 per standard direct labor hour and fixed manufacturing should be $270,000 per year. The company manufacturers a single product that requires two direct labor hours to complete. The direct labor wage rate is $15 per hour. Four feet of raw material are required for each unit of product; the standard cost of the material is $8.75 per foot. Although normal activity is 30,000 direct labor hours each year, the company expects to operate at a 40,000 hour level of activity this year.

REQUIRED:

1. Assume that the company chooses 30,000 direct labor hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements.

2. Assume that the company chooses 40,000 direct labor hours as the denominator level of activity. Repeat the computation in (1) above.

3. Complete two standard cost cards as outlined below.

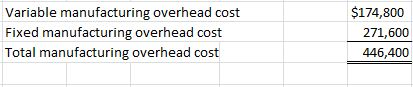

4. Assume that the company actually produces 18,000 units and works 38,000 direct labor hours during the year. Actual manufacturing overhead costs for the year are:

Do the following:

a. Compute the standard direct labor hours allowed for this year's production.

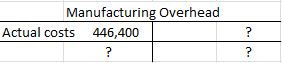

b. Complete the Manufacturing Overhead account below. Assume that the company uses 30,000 direct labor hours (normal activity) as the denominator activity figured in computing predetermined overhead rates, as you have done in (1) above.

c. Determine the cause of the underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances.

5. Looking at the variances you have completed, what appears to be the major disadvantage of using normal activity rather than expected actual activity as a denominator in computing the predetermined overhead rate? What advantages can you see to offset this disadvantage?

Morton Company's variable manufacturing overhead should be $4.40 per standard direct labor hour and fixed manufacturing should be $270,000 per year. The company manufacturers a single product that requires two direct labor hours to complete. The direct labor wage rate is $15 per hour. Four feet of raw material are required for each unit of product; the standard cost of the material is $8.75 per foot. Although normal activity is 30,000 direct labor hours each year, the company expects to operate at a 40,000 hour level of activity this year. REQUIRED: 1. Assume that the company chooses 30,000 direct labor hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. 2. Assume that the company chooses 40,000 direct labor hours as the denominator level of activity. Repeat the computation in (1) above. 3. Complete two standard cost cards as outlined below.c. Determine the cause of the underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances. 5. Looking at the variances you have completed, what appears to be the major disadvantage of using normal activity rather than expected actual activity as a denominator in computing the predetermined overhead rate? What advantages can you see to offset this disadvantage?Do the following: a. Compute the standard direct labor hours allowed for this year's production. b. Complete the Manufacturing Overhead account below. Assume that the company uses 30,000 direct labor hours (normal activity) as the denominator activity figured in computing predetermined overhead rates, as you have done in (1) above.4. Assume that the company actually produces 18,000 units and works 38,000 direct labor hours during the year. Actual manufacturing overhead costs for the year are: Morton Company's variable manufacturing overhead should be $4.40 per standard direct labor hour and fixed manufacturing should be $270,000 per year. The company manufacturers a single product that requires two direct labor hours to complete. The direct labor wage rate is $15 per hour. Four feet of raw material are required for each unit of product; the standard cost of the material is $8.75 per foot. Although normal activity is 30,000 direct labor hours each year, the company expects to operate at a 40,000 hour level of activity this year. REQUIRED: 1. Assume that the company chooses 30,000 direct labor hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. 2. Assume that the company chooses 40,000 direct labor hours as the denominator level of activity. Repeat the computation in (1) above. 3. Complete two standard cost cards as outlined below.c. Determine the cause of the underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances. 5. Looking at the variances you have completed, what appears to be the major disadvantage of using normal activity rather than expected actual activity as a denominator in computing the predetermined overhead rate? What advantages can you see to offset this disadvantage?Do the following: a. Compute the standard direct labor hours allowed for this year's production. b. Complete the Manufacturing Overhead account below. Assume that the company uses 30,000 direct labor hours (normal activity) as the denominator activity figured in computing predetermined overhead rates, as you have done in (1) above.4. Assume that the company actually produces 18,000 units and works 38,000 direct labor hours during the year. Actual manufacturing overhead costs for the year areStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started