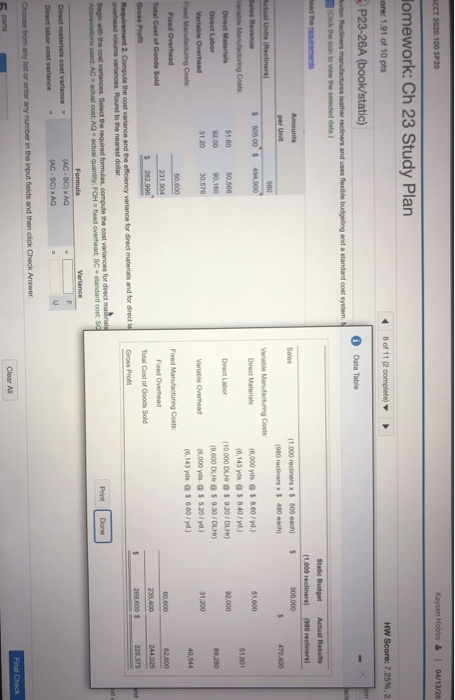

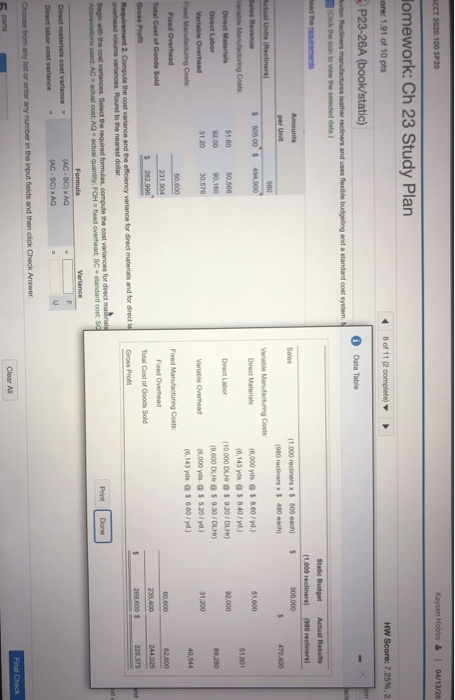

morton recliners manufacturers

CCT 2020,100 SP20 Kaysen Hobbs & 04/13/20 lomework: Ch 23 Study Plan ore: 1.91 of 10 pts P23-26A (book/static) 8 of 11 (2 complete) HW Score: 7.25%, 2 * Data Table orton Recliners manufactures leather recliners and uses ferible budgeting and a standard cost system o the con to view the selected data) T Read the direments State Budget (1,000 recliners) 5 505.000 Actual Results 100 recliners) 470400 51,600 51.001 92.000 Sales (1,000 recliners x $ 505 each) (080 recliners 480 sch) Variable Manufacturing Costs Direct Materials (6.000 yds 58.607 yd) (6,143 yds 5 8.40/yd.) Direct Labor (10.000 DLH 5 9.20/DM) (9,600 D @ $ 9.30 / DLH) Variable Overhead 16.000 yds @ $ 5.20/yd) (6,143 yds @ $ 6.60 /yd) Food Manufacturing Costs Fred Overhead Total Cost of Goods Sold 31,200 Amounts per Unit Actual Units Recliners Sales Revenue $ 505.00$ 404,000 Varble Manufacturing Costs Direct Materials 51.00 50.500 Direct Labor 92.00 9 0160 Variable Overhead 31.20 30,576 Fred Manufacturing Costs Fixed Overhead 50.800 Total Cost of Goods Sold 231,904 $ Gross Profit 202.996 Requirement 2. Compute the cost variance and the efficiency variance for direct materials and for direct overhead volume vanances. Round to the nearest dollar Begin with the cool variances Select the required formulas, compute the cost variances for direct manals Abbreviations used. AC actual cost; AQ actual quantity: FOH foed overhead, standard cost 50 Formula Direct materials cost variance (AC-SC) AD Direct labor cost variance (AC-SC) AD 40,544 50.000 62,600 244,025 226.375 Gross Profit Pront Done Choose from any list or enter any number in the input fields and then click Check Answer Final Check Clear Al 5 parts CCT 2020,100 SP20 Kaysen Hobbs & 04/13/20 lomework: Ch 23 Study Plan ore: 1.91 of 10 pts P23-26A (book/static) 8 of 11 (2 complete) HW Score: 7.25%, 2 * Data Table orton Recliners manufactures leather recliners and uses ferible budgeting and a standard cost system o the con to view the selected data) T Read the direments State Budget (1,000 recliners) 5 505.000 Actual Results 100 recliners) 470400 51,600 51.001 92.000 Sales (1,000 recliners x $ 505 each) (080 recliners 480 sch) Variable Manufacturing Costs Direct Materials (6.000 yds 58.607 yd) (6,143 yds 5 8.40/yd.) Direct Labor (10.000 DLH 5 9.20/DM) (9,600 D @ $ 9.30 / DLH) Variable Overhead 16.000 yds @ $ 5.20/yd) (6,143 yds @ $ 6.60 /yd) Food Manufacturing Costs Fred Overhead Total Cost of Goods Sold 31,200 Amounts per Unit Actual Units Recliners Sales Revenue $ 505.00$ 404,000 Varble Manufacturing Costs Direct Materials 51.00 50.500 Direct Labor 92.00 9 0160 Variable Overhead 31.20 30,576 Fred Manufacturing Costs Fixed Overhead 50.800 Total Cost of Goods Sold 231,904 $ Gross Profit 202.996 Requirement 2. Compute the cost variance and the efficiency variance for direct materials and for direct overhead volume vanances. Round to the nearest dollar Begin with the cool variances Select the required formulas, compute the cost variances for direct manals Abbreviations used. AC actual cost; AQ actual quantity: FOH foed overhead, standard cost 50 Formula Direct materials cost variance (AC-SC) AD Direct labor cost variance (AC-SC) AD 40,544 50.000 62,600 244,025 226.375 Gross Profit Pront Done Choose from any list or enter any number in the input fields and then click Check Answer Final Check Clear Al 5 parts