Answered step by step

Verified Expert Solution

Question

1 Approved Answer

morv ( 3 . 5 % ) Chapter > 1 0 0 - 0 b - 0 3 6 5 d = 1 7 -

morv

Chapter

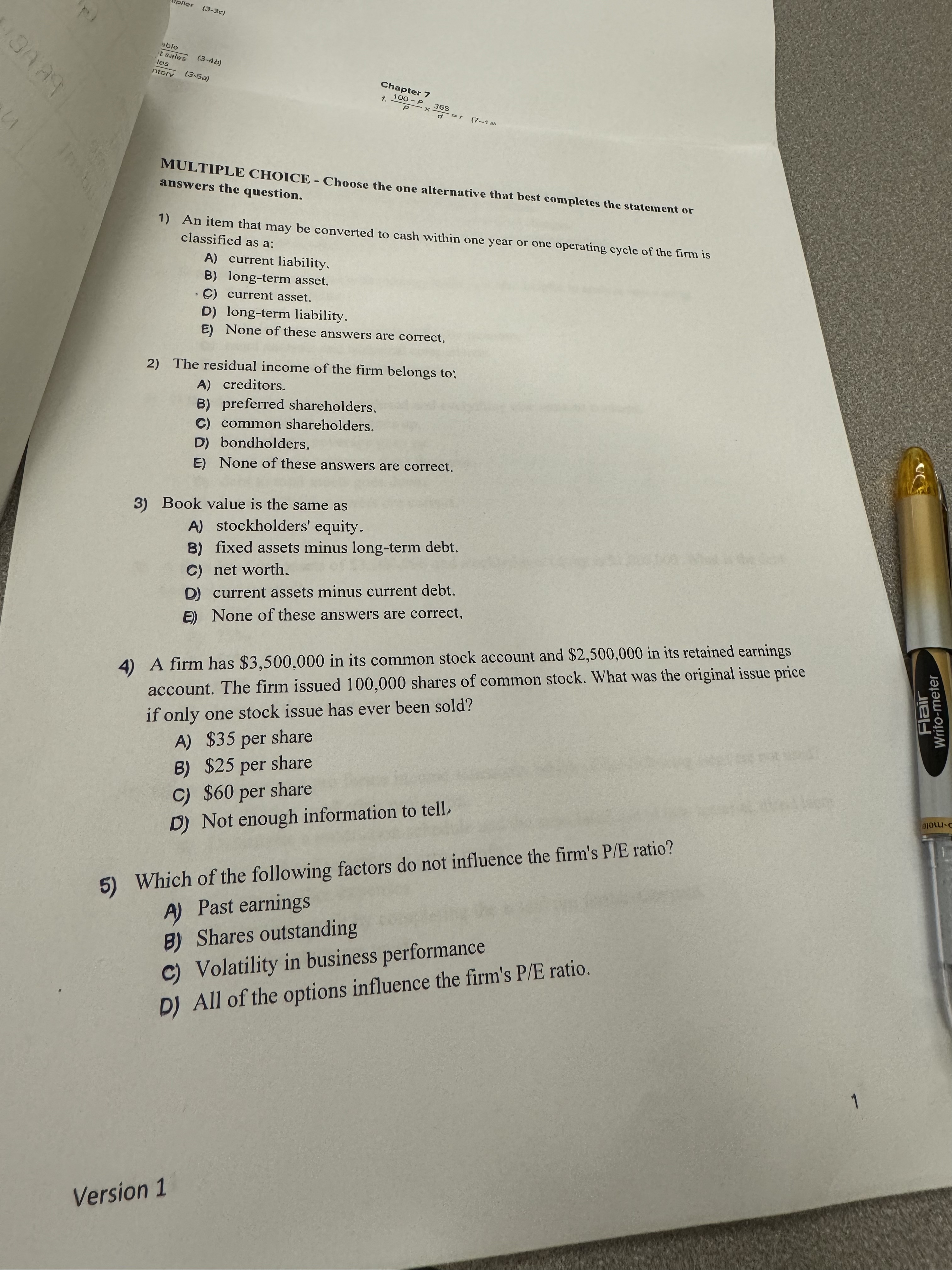

MULTIPLE CHOICEChoose the one alternative that best completes the statement or answers the question.

An item that may be converted to cash within one year or one operating cycle of the firm is classified as a:

A current liability.

B longterm asset.

C current asset.

D longterm liability.

E None of these answers are correct.

The residual income of the firm belongs to:

A creditors.

B preferred shareholders,

C common shareholders.

D bondholders.

E None of these answers are correct.

Book value is the same as

A stockholders' equity.

B fixed assets minus longterm debt.

C net worth.

D current assets minus current debt.

E None of these answers are correct.

A firm has $ in its common stock account and $ in its retained earnings account. The firm issued shares of common stock. What was the original issue price if only one stock issue has ever been sold?

A $ per share

B $ per share

C $ per share

D Not enough information to tell.

Which of the following factors do not influence the firm's ratio?

A Past earnings

B Shares outstanding

C Volatility in business performance

D All of the options influence the firm's ratio.

Version

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started