Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moses, a qualified motor mechanic with 22 years of experience, began his own business, Command Vehicle Repairs. On 1 March 2023, Moses withdrew money from

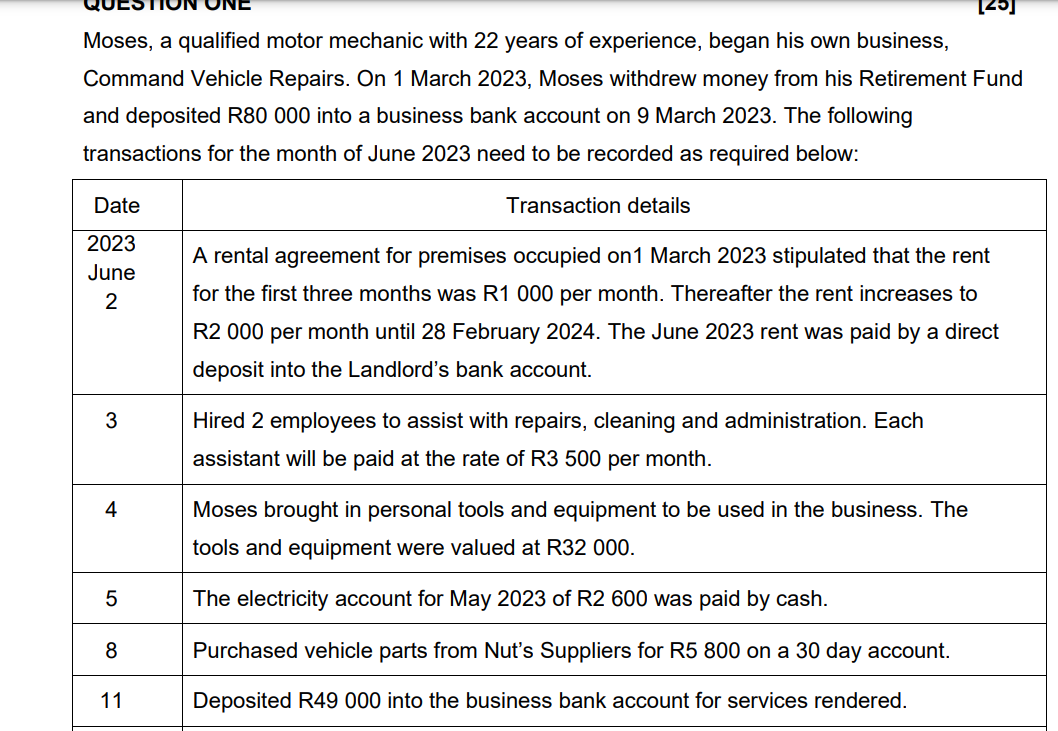

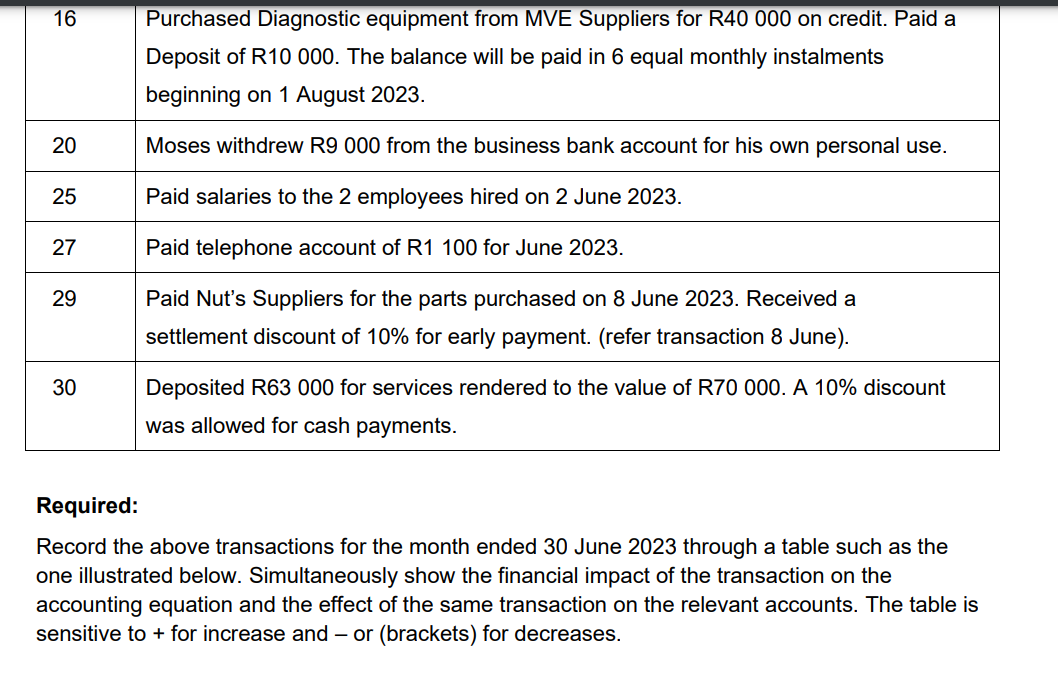

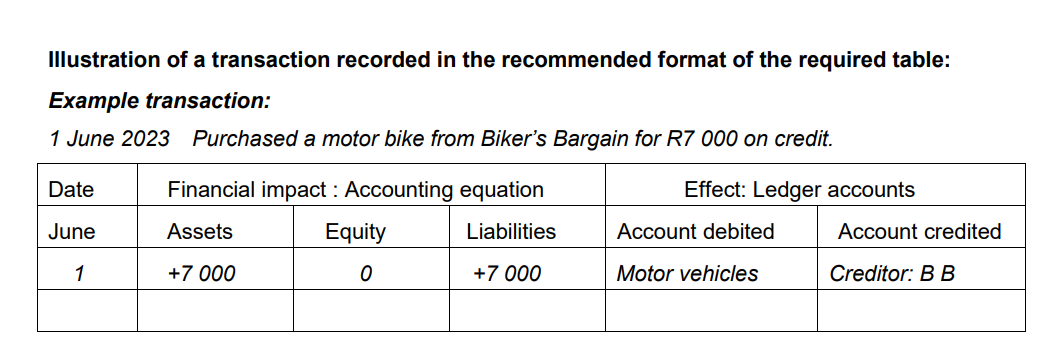

Moses, a qualified motor mechanic with 22 years of experience, began his own business, Command Vehicle Repairs. On 1 March 2023, Moses withdrew money from his Retirement Fund and deposited R80 000 into a business bank account on 9 March 2023. The following transactions for the month of June 2023 need to be recorded as required below: Required: Record the above transactions for the month ended 30 June 2023 through a table such as the one illustrated below. Simultaneously show the financial impact of the transaction on the accounting equation and the effect of the same transaction on the relevant accounts. The table is sensitive to + for increase and - or (brackets) for decreases. Illustration of a transaction recorded in the recommended format of the required table: Example transaction: 1 June 2023 Purchased a motor bike from Biker's Bargain for R7 000 on credit

Moses, a qualified motor mechanic with 22 years of experience, began his own business, Command Vehicle Repairs. On 1 March 2023, Moses withdrew money from his Retirement Fund and deposited R80 000 into a business bank account on 9 March 2023. The following transactions for the month of June 2023 need to be recorded as required below: Required: Record the above transactions for the month ended 30 June 2023 through a table such as the one illustrated below. Simultaneously show the financial impact of the transaction on the accounting equation and the effect of the same transaction on the relevant accounts. The table is sensitive to + for increase and - or (brackets) for decreases. Illustration of a transaction recorded in the recommended format of the required table: Example transaction: 1 June 2023 Purchased a motor bike from Biker's Bargain for R7 000 on credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started