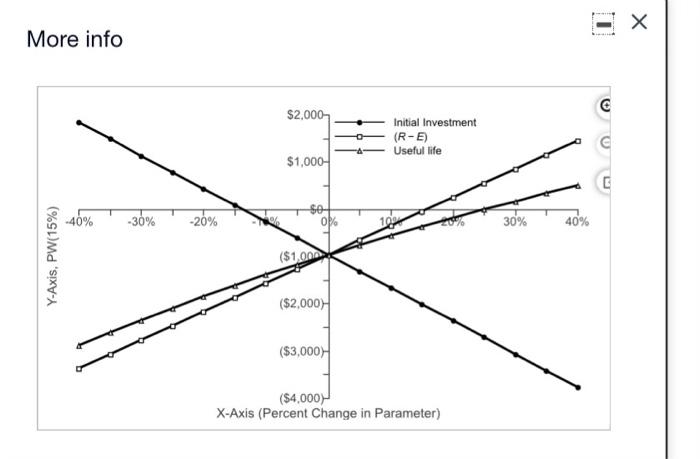

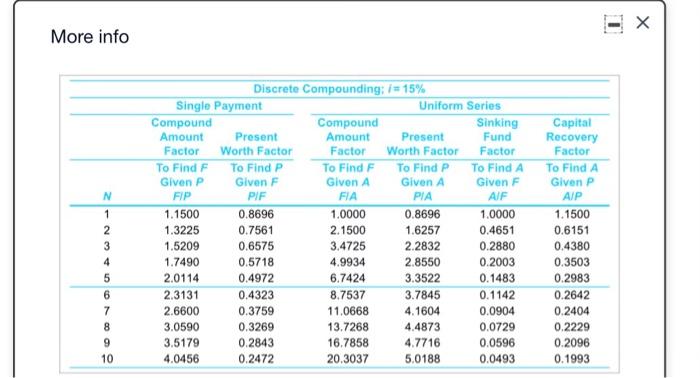

Most likely estimates for a project are as follows MARR 15% per year Useful life 5 years Initial investment $7,000 Receipts - Expenses (R-E) $1,800/year Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false Click the icon to view the relationship between the PW and the percent change in parameter, Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. Choose the correct choice below. False True X More info 6 $2,000 Initial Investment (R-E) Useful life $1,000 -40% -30% -26% op 30% 40% Y-Axis, PW(15%) ($1.00 ($2,000) ($3,000 ($4,000 X-Axis (Percent Change in Parameter) - More info N Discrete Compounding; 1= 15% Single Payment Uniform Series Compound Compound Sinking Capital Amount Present Amount Present Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P FIP PIF FIA PIA AIF AIP 1.1500 0.8696 1.0000 0.8696 1.0000 1.1500 1.3225 0.7561 2.1500 1.6257 0.4651 0.6151 1.5209 0.6575 3.4725 2.2832 0.2880 0.4380 1.7490 0.5718 4.9934 2.8550 0.2003 0.3503 2.0114 0.4972 6.7424 3.3522 0.1483 0.2983 2.3131 0.4323 8.7537 3.7845 0.1142 0.2642 2.6600 0.3759 11.0668 4.1604 0.0904 0.2404 3.0590 0.3269 13.7268 4,4873 0.0729 0.2229 3.5179 0.2843 16.7858 4.7716 0.0596 0.2096 4.0456 0.2472 20.3037 5.0188 0.0493 0.1993 2 3 4 5 6 7 8 9 10 2 NON Most likely estimates for a project are as follows MARR 15% per year Useful life 5 years Initial investment $7,000 Receipts - Expenses (R-E) $1,800/year Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false Click the icon to view the relationship between the PW and the percent change in parameter, Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. Choose the correct choice below. False True X More info 6 $2,000 Initial Investment (R-E) Useful life $1,000 -40% -30% -26% op 30% 40% Y-Axis, PW(15%) ($1.00 ($2,000) ($3,000 ($4,000 X-Axis (Percent Change in Parameter) - More info N Discrete Compounding; 1= 15% Single Payment Uniform Series Compound Compound Sinking Capital Amount Present Amount Present Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P FIP PIF FIA PIA AIF AIP 1.1500 0.8696 1.0000 0.8696 1.0000 1.1500 1.3225 0.7561 2.1500 1.6257 0.4651 0.6151 1.5209 0.6575 3.4725 2.2832 0.2880 0.4380 1.7490 0.5718 4.9934 2.8550 0.2003 0.3503 2.0114 0.4972 6.7424 3.3522 0.1483 0.2983 2.3131 0.4323 8.7537 3.7845 0.1142 0.2642 2.6600 0.3759 11.0668 4.1604 0.0904 0.2404 3.0590 0.3269 13.7268 4,4873 0.0729 0.2229 3.5179 0.2843 16.7858 4.7716 0.0596 0.2096 4.0456 0.2472 20.3037 5.0188 0.0493 0.1993 2 3 4 5 6 7 8 9 10 2 NON