Question

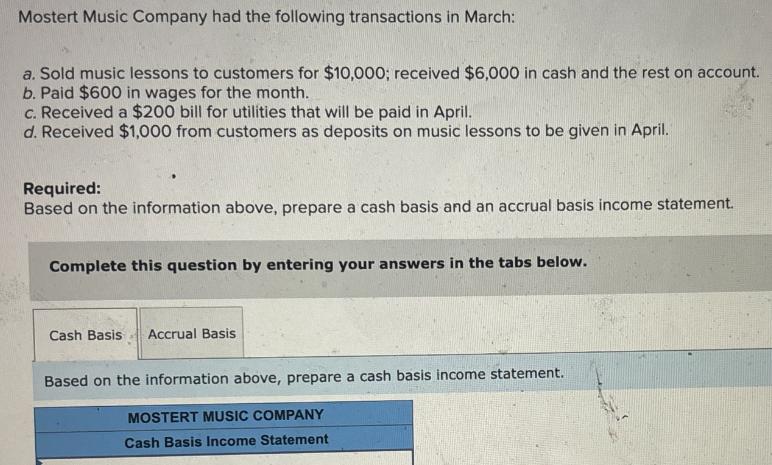

Mostert Music Company had the following transactions in March: a. Sold music lessons to customers for $10,000; received $6,000 in cash and the rest

Mostert Music Company had the following transactions in March: a. Sold music lessons to customers for $10,000; received $6,000 in cash and the rest on account. b. Paid $600 in wages for the month. c. Received a $200 bill for utilities that will be paid in April. d. Received $1,000 from customers as deposits on music lessons to be given in April. Required: Based on the information above, prepare a cash basis and an accrual basis income statement. Complete this question by entering your answers in the tabs below. Cash Basis Accrual Basis Based on the information above, prepare a cash basis income statement. MOSTERT MUSIC COMPANY Cash Basis Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Calculus For Business, Economics And The Social And Life Sciences

Authors: Laurence Hoffmann, Gerald Bradley, David Sobecki, Michael Price

11th Brief Edition

978-0073532387, 007353238X

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App