Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mothebe is evaluating a warehouse property that is expected to generate net operating income of R185,000 next year. This is expected to remain constant

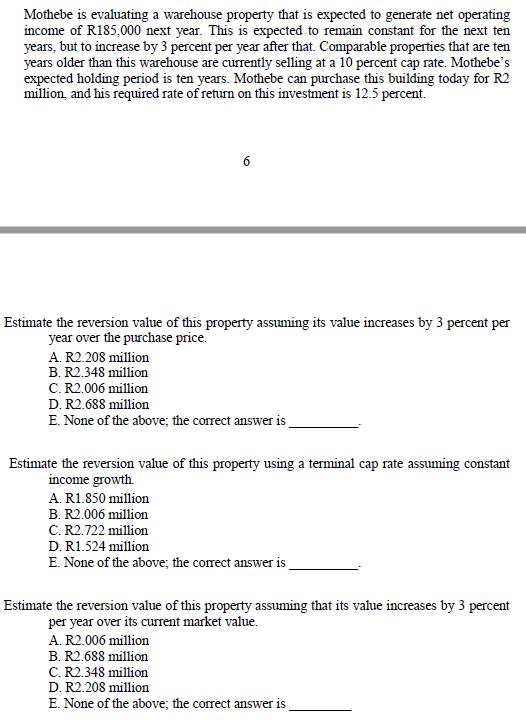

Mothebe is evaluating a warehouse property that is expected to generate net operating income of R185,000 next year. This is expected to remain constant for the next ten years, but to increase by 3 percent per year after that. Comparable properties that are ten years older than this warehouse are currently selling at a 10 percent cap rate. Mothebe's expected holding period is ten years. Mothebe can purchase this building today for R2 million, and his required rate of return on this investment is 12.5 percent. Estimate the reversion value of this property assuming its value increases by 3 percent per year over the purchase price. A. R2.208 million B. R2.348 million C. R2.006 million D. R2.688 million E. None of the above; the correct answer is Estimate the reversion value of this property using a terminal cap rate assuming constant income growth. A. R1.850 million B. R2.006 million C. R2.722 million D. R1.524 million E. None of the above; the correct answer is Estimate the reversion value of this property assuming that its value increases by 3 percent per year over its current market value. A. R2.006 million B. R2.688 million C. R2.348 million D. R2.208 million E. None of the above; the correct answer is

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

i Reversion value of property assuming its price its value increases by 3 per year over the purchase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started