Answered step by step

Verified Expert Solution

Question

1 Approved Answer

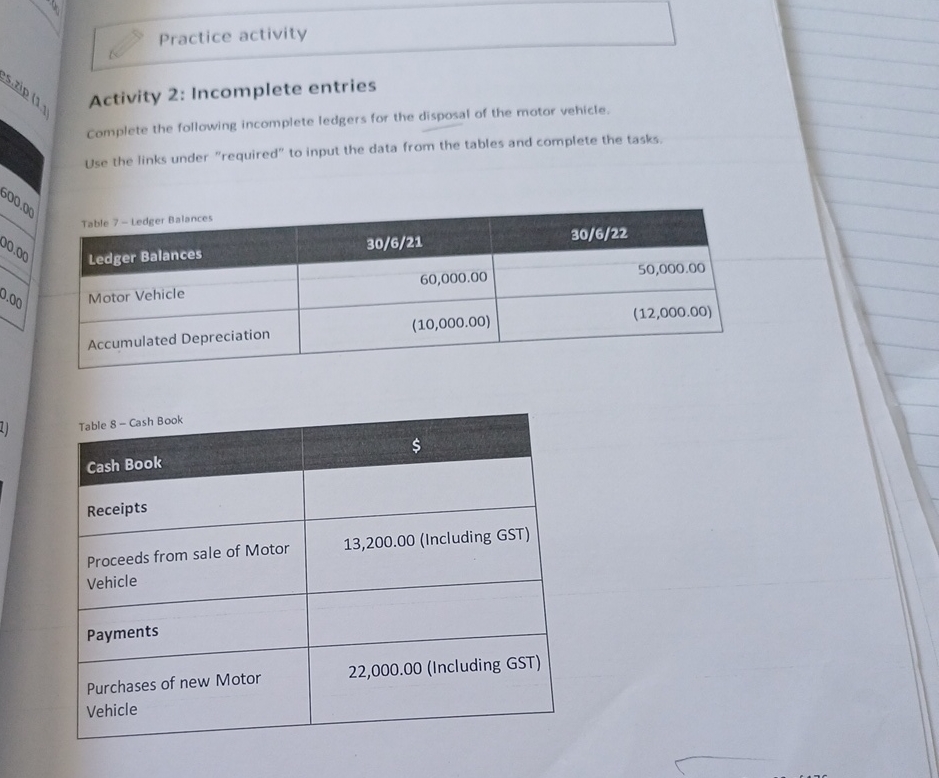

motor vehicle had closing carrying amount at the time of sale of $15000 es.zip (1.1) 600.00 200.00 0.00 Practice activity Activity 2: Incomplete entries Complete

motor vehicle had closing carrying amount at the time of sale of $15000

es.zip (1.1) 600.00 200.00 0.00 Practice activity Activity 2: Incomplete entries Complete the following incomplete ledgers for the disposal of the motor vehicle. Use the links under "required" to input the data from the tables and complete the tasks. Table 7-Ledger Balances Ledger Balances Motor Vehicle Accumulated Depreciation 1) Table 8-Cash Book Cash Book 30/6/21 30/6/22 60,000.00 50,000.00 (10,000.00) (12,000.00) $ Receipts Proceeds from sale of Motor 13,200.00 (Including GST) Vehicle Payments Purchases of new Motor Vehicle 22,000.00 (Including GST)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed journal entries for the disposal of the motor vehicle with stepbystep workings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started