Answered step by step

Verified Expert Solution

Question

1 Approved Answer

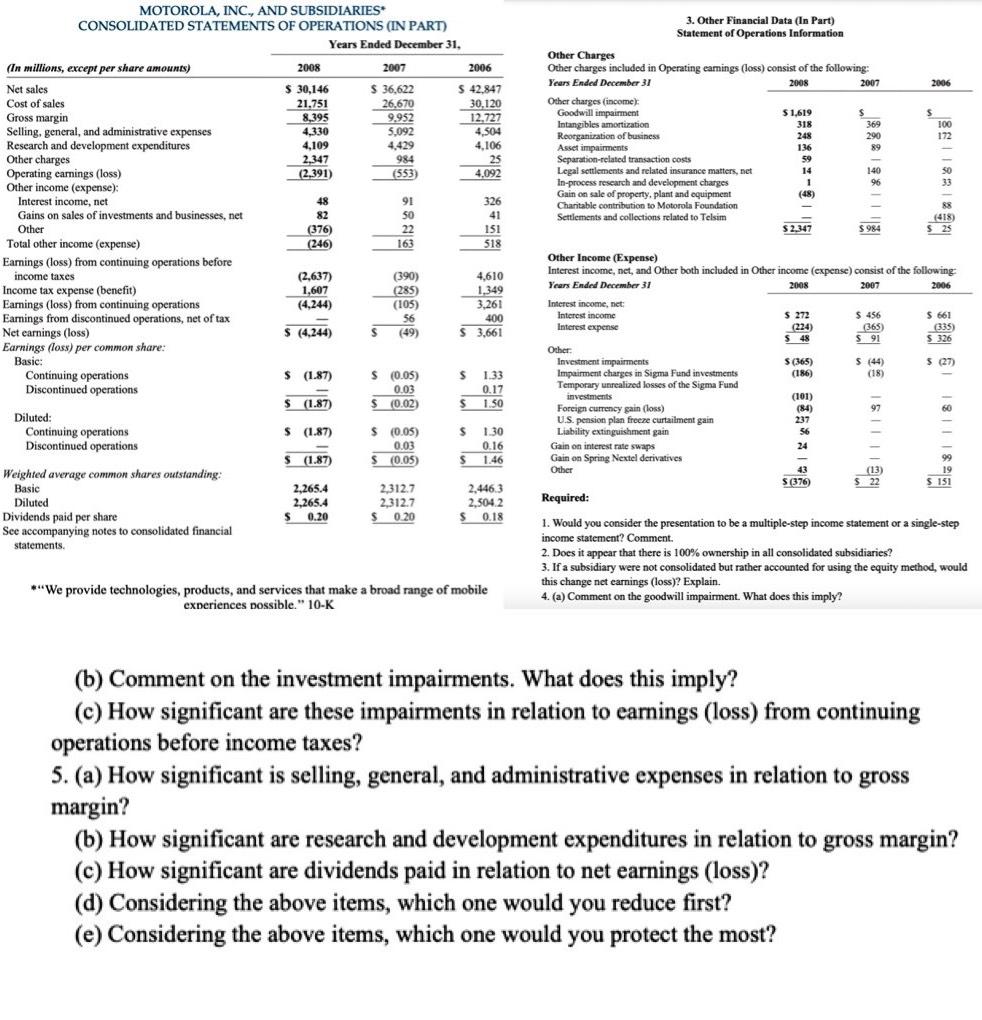

MOTOROLA, INC., AND SUBSIDIARIES* CONSOLIDATED STATEMENTS OF OPERATIONS (IN PART) Years Ended December 31, (In millions, except per share amounts) 2008 2007 2006 Other

MOTOROLA, INC., AND SUBSIDIARIES* CONSOLIDATED STATEMENTS OF OPERATIONS (IN PART) Years Ended December 31, (In millions, except per share amounts) 2008 2007 2006 Other Charges 3. Other Financial Data (In Part) Statement of Operations Information Other charges included in Operating earnings (loss) consist of the following: Years Ended December 31 2008 2007 2006 Net sales Cost of sales Gross margin $ 30,146 $ 36,622 $ 42,847 21,751 26,670 30,120 Other charges (income): 8,395 9,952 12,727 Selling, general, and administrative expenses 4,330 5,092 4,504 Research and development expenditures 4,109 4,429 4,106 Other charges 2,347 984 Operating earnings (loss) (2,391) (553) 25 4,092 Other income (expense): Interest income, net 48 91 326 Gains on sales of investments and businesses, net Other 82 50 41 Goodwill impairment Intangibles amortization Reorganization of business Asset impairments Separation-related transaction costs Legal settlements and related insurance matters, net In-process research and development charges Gain on sale of property, plant and equipment Charitable contribution to Motorola Foundation Settlements and collections related to Telsim (376) 22 151 Total other income (expense) (246) 163 518 Earnings (loss) from continuing operations before income taxes (2,637) (390) 4,610 Other Income (Expense) Interest income, net, and Other both included in Other income (expense) consist of the following: Income tax expense (benefit) 1,607 (285) 1,349 Years Ended December 31 Earnings (loss) from continuing operations (4,244) (105) 3,261 Interest income, net: Earnings from discontinued operations, net of tax 56 400 Interest income Net earnings (loss) $ (4,244) (49) $3,661 Interest expense Earnings (loss) per common share: Basic: Continuing operations Other: $ (1.87) $ (0.05) Discontinued operations 0.03 $ 1.33 0.17 $ (1.87) $ (0.02) 1.50 Diluted: Continuing operations $ (1.87) $ (0.05) $ 1.30 Discontinued operations 0.03 0.16 $ (1.87) (0.05) S 1.46 Weighted average common shares outstanding: Basic 2,265.4 2,312.7 Diluted 2,265.4 2,312.7 2,446.3 2,504.2 Dividends paid per share $ 0.20 $ 0.20 $ 0.18 See accompanying notes to consolidated financial statements. *"We provide technologies, products, and services that make a broad range of mobile experiences possible." 10-K Investment impairments Impairment charges in Sigma Fund investments Temporary unrealized losses of the Sigma Fund investments Foreign currency gain (loss) U.S. pension plan freeze curtailment gain Liability extinguishment gain Gain on interest rate swaps Gain on Spring Nextel derivatives Other Required: (44) $ (27) $151 1. Would you consider the presentation to be a multiple-step income statement or a single-step income statement? Comment. 2. Does it appear that there is 100% ownership in all consolidated subsidiaries? 3. If a subsidiary were not consolidated but rather accounted for using the equity method, would this change net earnings (loss)? Explain. 4. (a) Comment on the goodwill impairment. What does this imply? $ 661 (365) (335) $326 (18) RR : 3(()) 100 172 50 33 (418) $ 25 2006 (b) Comment on the investment impairments. What does this imply? (c) How significant are these impairments in relation to earnings (loss) from continuing operations before income taxes? 5. (a) How significant is selling, general, and administrative expenses in relation to gross margin? (b) How significant are research and development expenditures in relation to gross margin? (c) How significant are dividends paid in relation to net earnings (loss)? (d) Considering the above items, which one would you reduce first? (e) Considering the above items, which one would you protect the most?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started