Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Motors, Inc. is considering the acquisition of Rubber Tire Co. Rubber Tire Co currently has total free cash flows to equity of $2 million

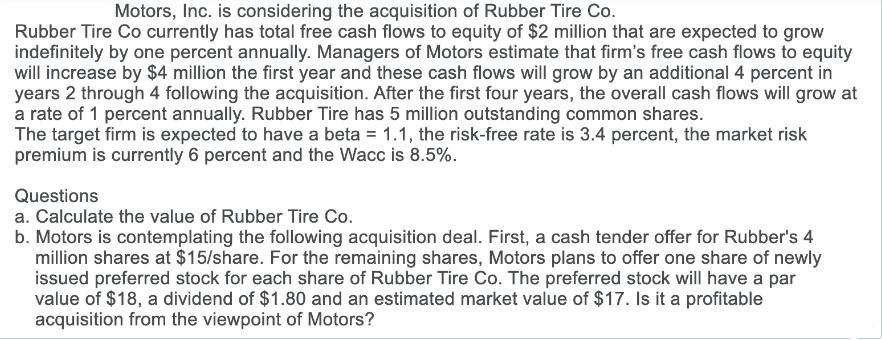

Motors, Inc. is considering the acquisition of Rubber Tire Co. Rubber Tire Co currently has total free cash flows to equity of $2 million that are expected to grow indefinitely by one percent annually. Managers of Motors estimate that firm's free cash flows to equity will increase by $4 million the first year and these cash flows will grow by an additional 4 percent in years 2 through 4 following the acquisition. After the first four years, the overall cash flows will grow at a rate of 1 percent annually. Rubber Tire has 5 million outstanding common shares. The target firm is expected to have a beta = 1.1, the risk-free rate is 3.4 percent, the market risk premium is currently 6 percent and the Wacc is 8.5%. Questions a. Calculate the value of Rubber Tire Co. b. Motors is contemplating the following acquisition deal. First, a cash tender offer for Rubber's 4 million shares at $15/share. For the remaining shares, Motors plans to offer one share of newly issued preferred stock for each share of Rubber Tire Co. The preferred stock will have a par value of $18, a dividend of $1.80 and an estimated market value of $17. Is it a profitable acquisition from the viewpoint of Motors?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the value of Rubber Tire Co Where P0 Current value of the firm D0 Dividend in the first ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started