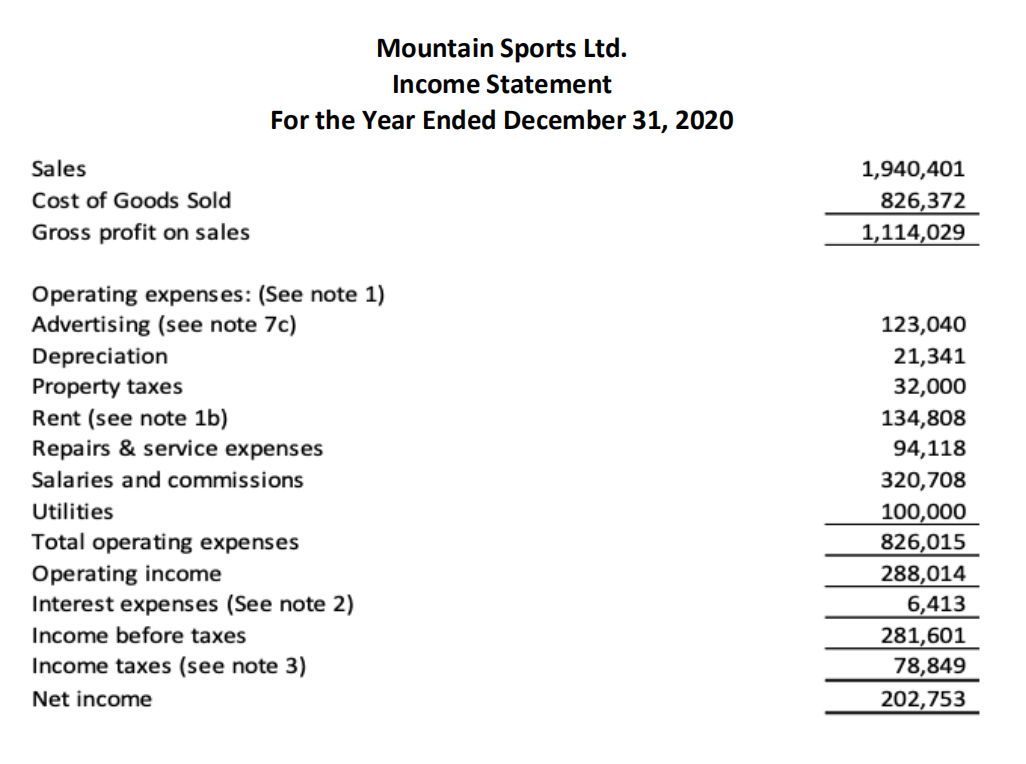

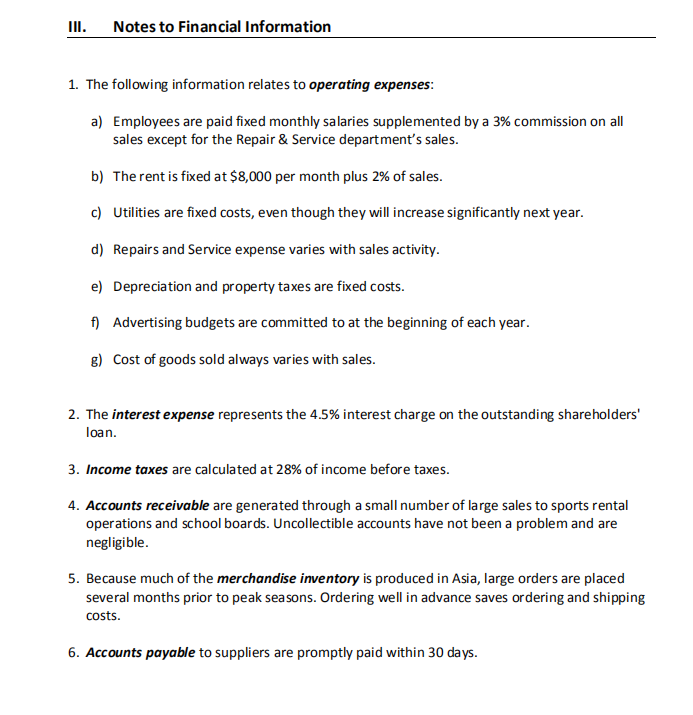

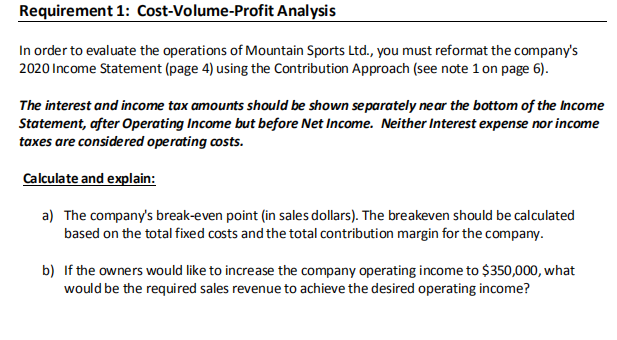

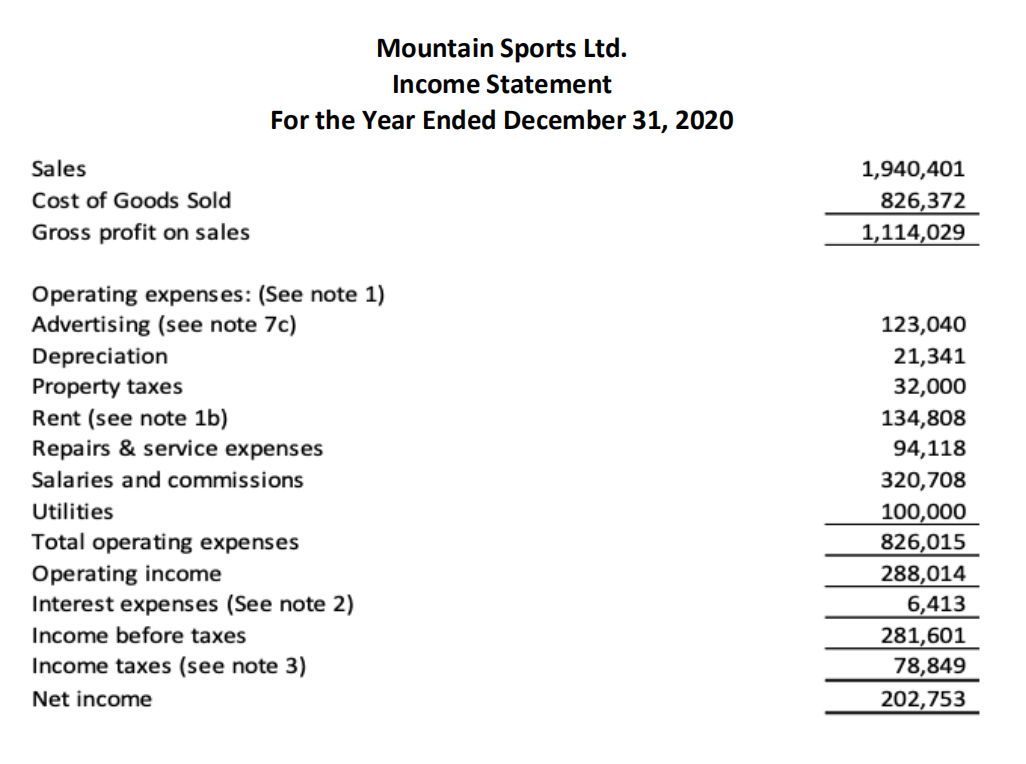

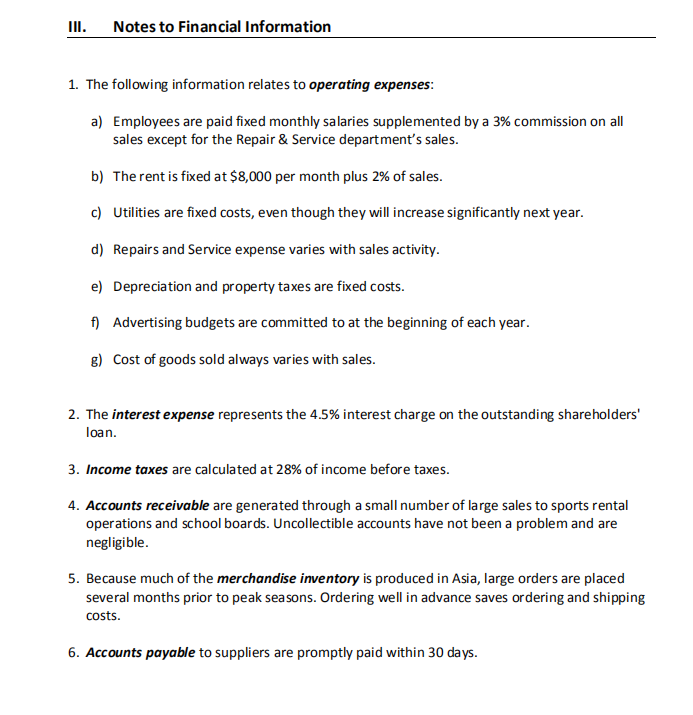

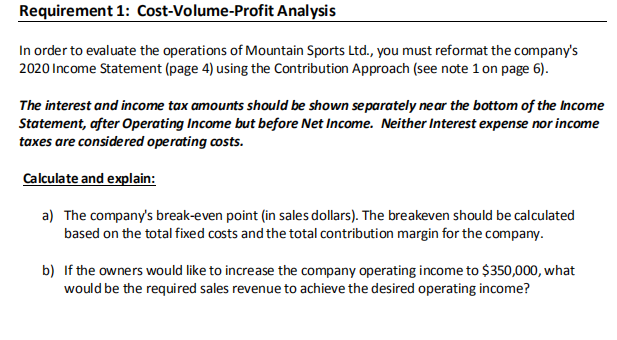

Mountain Sports Ltd. Income Statement For the Year Ended December 31, 2020 Sales Cost of Goods Sold Gross profit on sales 1,940,401 826,372 1,114,029 Operating expenses: (See note 1) Advertising (see note 7c) Depreciation Property taxes Rent (see note 1b) Repairs & service expenses Salaries and commissions Utilities Total operating expenses Operating income Interest expenses (See note 2) Income before taxes Income taxes (see note 3) Net income 123,040 21,341 32,000 134,808 94,118 320,708 100,000 826,015 288,014 6,413 281,601 78,849 202,753 III. Notes to Financial Information 1. The following information relates to operating expenses: a) Employees are paid fixed monthly salaries supplemented by a 3% commission on all sales except for the Repair & Service department's sales. b) The rent is fixed at $8,000 per month plus 2% of sales. c) Utilities are fixed costs, even though they will increase significantly next year. d) Repairs and Service expense varies with sales activity. e) Depreciation and property taxes are fixed costs. f) Advertising budgets are committed to at the beginning of each year. g) Cost of goods sold always varies with sales. 2. The interest expense represents the 4.5% interest charge on the outstanding shareholders' loan. 3. Income taxes are calculated at 28% of income before taxes. 4. Accounts receivable are generated through a small number of large sales to sports rental operations and school boards. Uncollectible accounts have not been a problem and are negligible. 5. Because much of the merchandise inventory is produced in Asia, large orders are placed several months prior to peak seasons. Ordering well in advance saves ordering and shipping costs. 6. Accounts payable to suppliers are promptly paid within 30 days. Requirement 1: Cost-Volume-Profit Analysis In order to evaluate the operations of Mountain Sports Ltd., you must reformat the company's 2020 Income Statement (page 4) using the Contribution Approach (see note 1 on page 6). The interest and income tax amounts should be shown separately near the bottom of the Income Statement, after Operating Income but before Net Income. Neither Interest expense nor income taxes are considered operating costs. Calculate and explain: a) The company's break-even point (in sales dollars). The breakeven should be calculated based on the total fixed costs and the total contribution margin for the company. b) If the owners would like to increase the company operating income to $350,000, what would be the required sales revenue to achieve the desired operating income