Question

Mountain Sports Ltd. is a small, Lethbridge-based social enterprise dedicated to the advancement of outdoor fitness activities for children and adults. This retail store operation

Mountain Sports Ltd. is a small, Lethbridge-based social enterprise dedicated to the advancement of outdoor fitness activities for children and adults. This retail store operation is an Alberta Corporation with 20,000 outstanding common shares divided equally amongst five owners. Lisa Marconi, an owner, is the Company President while Jeff Peterson, another owner, holds the position of Marketing Manager. The company was formed in 2001.

Mountain Sports carries a limited line of products and services that can be divided into four segments:

1. Cross-country ski packages (skis, boots, and poles)

2. Mountain bicycles

3. Accessories

4. Repair and service department

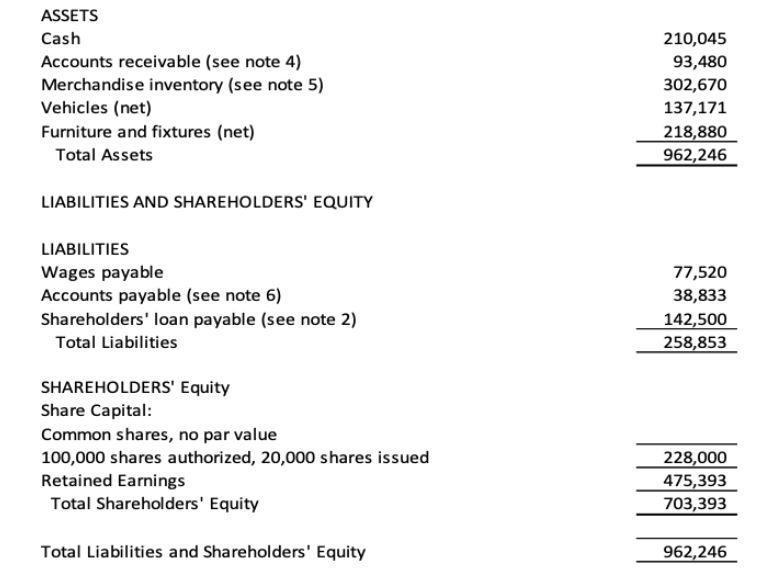

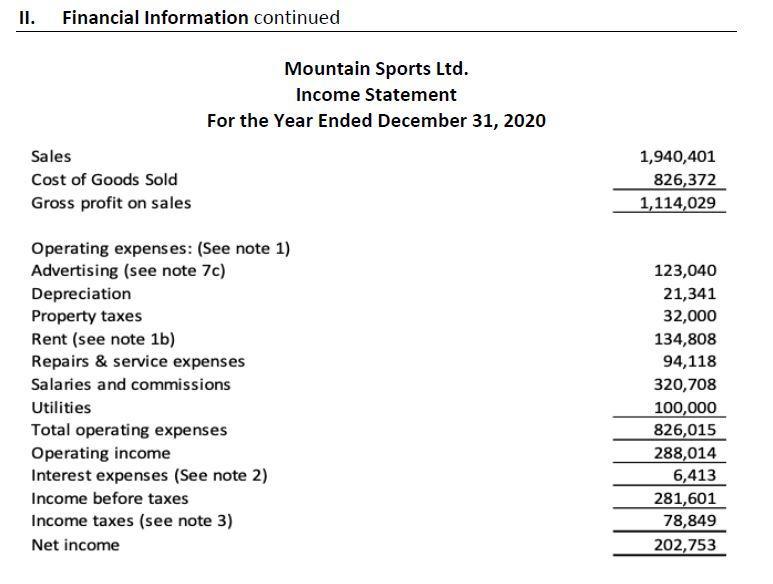

II. Financial Information

Mountain Sports Ltd.

Balance Sheet

December 31, 2020

III. Notes to Financial Information

1. The following information relates to operating expenses:

a) Employees are paid fixed monthly salaries supplemented by a 3% commission on all sales except for the Repair & Service department’s sales.

b) The rent is fixed at $8,000 per month plus 2% of sales.

c) Utilities are fixed costs, even though they will increase significantly next year.

d) Repairs and Service expense varies with sales activity.

e) Depreciation and property taxes are fixed costs.

f) Advertising budgets are committed to at the beginning of each year.

g) Cost of goods sold always varies with sales.

2. The interest expense represents the 4.5% interest charge on the outstanding shareholders' loan.

3. Income taxes are calculated at 28% of income before taxes.

4. Accounts receivable are generated through a small number of large sales to sports rental operations and school boards. Uncollectible accounts have not been a problem and are negligible.

5. Because much of the merchandise inventory is produced in Asia, large orders are placed several months prior to peak seasons. Ordering well in advance saves ordering and shipping costs.

6. Accounts payable to suppliers are promptly paid within 30 days III. Notes to Financial Information continued

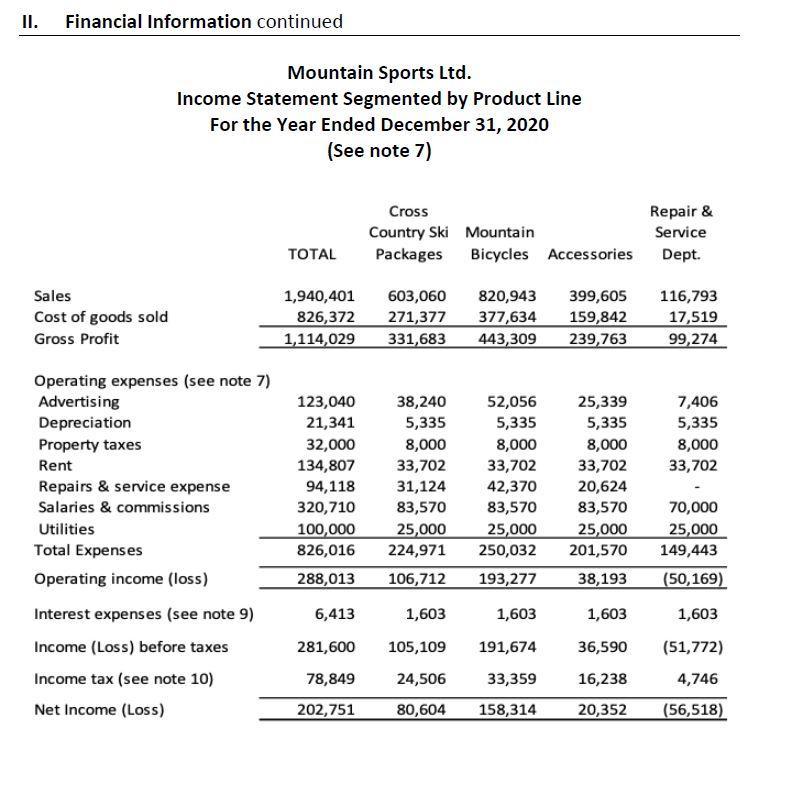

7. The following information relates to the Income Statement Segmented by Product Line:

a) Rent, utilities, depreciation, and property taxes have been allocated equally amongst the 4 product lines. However, if any one of the product lines was eliminated, these costs will remain.

b) Details of salaries and commissions follow (payroll fringe benefits are included):

i. 3% sales commissions were paid on all sales except for the sales of the Repair & Service department.

ii. The two (2) managers are paid $38,000 each per year. Both are responsible for the company as a whole.

iii. Besides sales commissions, the four (4) sales clerks are paid $2,500 each per month. They sell all 3 product lines (skis, bikes and accessories). If any product line is eliminated, the sales clerks will still remain.

iv. During the year, the two (2) Repair & Service technicians combined were paid a total salary of $70,000 for the whole year and are allocated entirely to the R&S department. Thus, if the department was discontinued, the technicians would not be required.

c) Advertising Mountain Sports Ltd. spent advertising on product lines as follows:

For the company as a whole $ 25,000

For the individual product lines:

Cross Country Skis $ 38,190

Mountain Bikes 45,600

Accessories 5,700

Repair & Service 8,550 98,040

Total Advertising Cost $123,040

You will observe that the amounts on the income statement differ for the individual product lines due to the allocation of $25,000 in general company advertising costs.

III. Notes to Financial Information continued

8. Interest expense has been allocated equally to each product line & Repair & Service department. Interest expense is considered a financing cost which benefits the whole operation. Therefore, they are not traceable to any individual product line or department.

9. Income taxes have been allocated based on sales. Income taxes are calculated after all costs, including common costs have been deducted. Therefore, they are not traceable to any individual product line or department.

Requirement 1: Cost-Volume-Profit Analysis

Requirements:

a) In order to evaluate the operations of Mountain Sports Ltd., you must reformat the company's 2020 Income Statement (page 4) using the Contribution Approach (see note 1 on page 6). The interest and income tax amounts should be shown separately near the bottom of the Income Statement, after Operating Income but before Net Income. Neither Interest expense nor income taxes are considered operating costs and should not be allocated to the operating departments.

b) Calculate the company's break-even point (in sales dollars). The breakeven should be calculated based on the total fixed costs and the total contribution margin for the company.

c) If the owners would like to earn a net after-tax income of $350,000, what would be the required sales revenue?

d) What MSL’s degree of operating leverage (DOL)?

e) What is MSL’s margin of safety (MOS) in dollars at the current level of sales?

Requirement 2: Product Line Analysis

The Issues: (Note: Treat each issue below independently)

Required:

In order to resolve two product line issues, first reformat the December 31, 2020 - Income Statement - Segmented by Product Line (Page 5) using the contribution margin approach. Information in note 7 will be helpful in reformatting the income statement. The revised Segmented Income Statement should be consistent with the Contribution Approach format of the overall company prepared in Part A-CVP Analysis.

a) Keep or Close a Department?

Refer to page 5 – Income Statement – Segmented by Product Line. The owners think they should eliminate the Accessories and Repair & Service Departments as they are the least profitable. The segments reported a $20,352 profit and $56,518 loss, respectively (as shown on page 5).

Required:

After reformatting the income statement, what do you recommend to the owners and why? Show relevant (incremental approach) calculations only. Do not redo the income statement.

b) Add a New Product Line?

The owners of Mountain Sports Ltd. are currently reviewing a proposal to adopt a new product line - BMX Bicycles. This new product line will be compatible with the Mountain Bikes and open a new target market--younger customers. It is anticipated that the BMX line will be introduced next spring. Management estimates sales of 300 bikes a year at an average selling price of $450. The bikes will have a per unit purchase cost (COGS) of $160.

Each bike needs about $90 of service time (to assemble and service). Mountain Sports will need to hire another two (2) sales clerks to specialize in BMX bikes at a monthly salary of $1,600 each plus commission (3% of sales). These clerks will be kept on staff for only four months per year (May to August). It is also estimated that advertising costs on the BMX line will be $15,000 annually. The current facilities have enough space to accommodate the new product line.

Required:

Should management adopt this new product line (BMX Bicycles)? Show relevant (incremental approach) calculations only. Do not redo the income statement.

Requirement 3: Branch Expansion Analysis

The president feels very strongly that Mountain Sports should expand operations to a second location. She has even found a prime location in Canmore, Alberta. One of the great things about Canmore is its proximity to the mountains, ski-areas, hiking, biking and only about 10 minutes away from this beautiful, vibrant and internationally known Banff tourist town. A choice retail location is presently available at an annual lease rate of $70,000, paid quarterly. The lease expires in five years. Utilities are included in the lease rate. Research indicates that the Canmore market is well suited to both cross-country skis and mountain bikes and that competition is fairly limited.

Operation Estimates for Years One through five Initial annual sales projections are $700,000 per year. Cost of Goods Sold is expected to average 35% of sales. Staffing needs are estimated at two full-time individuals plus four, part-time clerks. Full-time salaries will be $2,000 per month per person. Part-time clerks will be paid $12.00 per hour with each clerk putting in an average of 37 1/2 hours per week, 52 weeks a year. 3% sales commissions will be paid. Advertising is budgeted at $800 per month. City property taxes in Canmore are estimated at $5,130 annually, paid quarterly.

Investment

The owners will initially need $260,000 of equipment to open this new Canmore location. At the end of 5 years the capital assets will have a salvage value of $40,000. The income tax rate is 28% for all years.

Requirements:

a) Create a 5-year Pro-Forma income statement for this project.

b) Provide a recommendation to the president regarding whether or not Mountain Sports should expand into Canmore.

Requirement 3: Branch Expansion Cash Budget

Financing a Bank Loan

Assume that the five owners of Mountain Sports Ltd. decide to collectively invest $114,000 of personal funds into the Canmore expansion. Mountain Sports will require an open line of credit up to a maximum of $350,000. It will be necessary to convince the bank manager of this new Canmore branch ability to repay its line credit plus interest within a year.

Additional Information:

a) Sales by quarter are 15%, 5%, 25%, and 55% of annual sales.

b) 60% of all sales are cash. The rest are credit sales which will be collected in the following quarter.

c) Merchandise purchases (or cost of goods sold) are all paid in the quarter following purchase. All purchases are made in the same quarter that sales occur.

d) The beginning cash balance is $114,000. This is the amount the owners are capable of investing in this new venture. A minimum of $25,000 balance is needed at the end of each quarter. If any interest is payable on credit line borrowings, you may assume a reasonable interest rate. Borrowings are assumed to be at the beginning of the quarter and repayments at the end allowing for a calculation of interest based on the previous quarter’s borrowing and is paid at the beginning quarter following the borrowings.

e) In year 1, income tax installments of $9,500 per quarter will be made.

Required:

Prepare a Cash Budget for the first year of operation of Canmore by quarter and in total. Show clearly on your budget the quarter(s) in which borrowing will be needed and the quarter(s) in which repayments can be made, as requested by the company’s bank. You may assume a reasonable interest rate for any interest repayments required on borrowings. Clearly state assumptions made.

ASSETS Cash Accounts receivable (see note 4) Merchandise inventory (see note 5) Vehicles (net) Furniture and fixtures (net) Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY LIABILITIES Wages payable Accounts payable (see note 6) Shareholders' loan payable (see note 2) Total Liabilities SHAREHOLDERS' Equity Share Capital: Common shares, no par value 100,000 shares authorized, 20,000 shares issued Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 210,045 93,480 302,670 137,171 218,880 962,246 77,520 38,833 142,500 258,853 228,000 475,393 703,393 962,246

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started