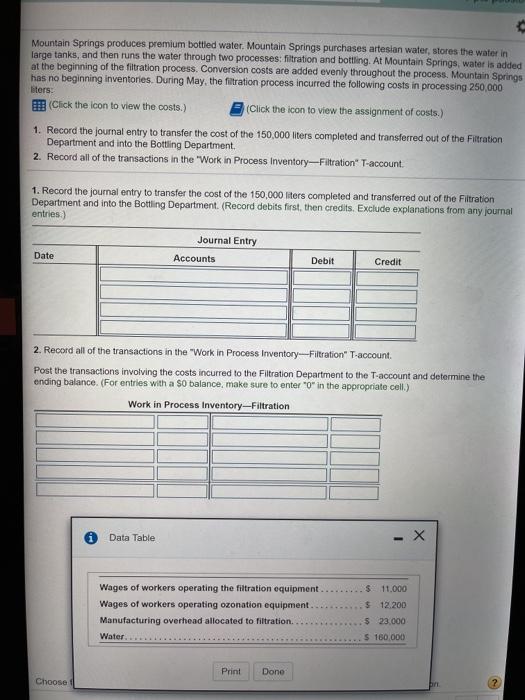

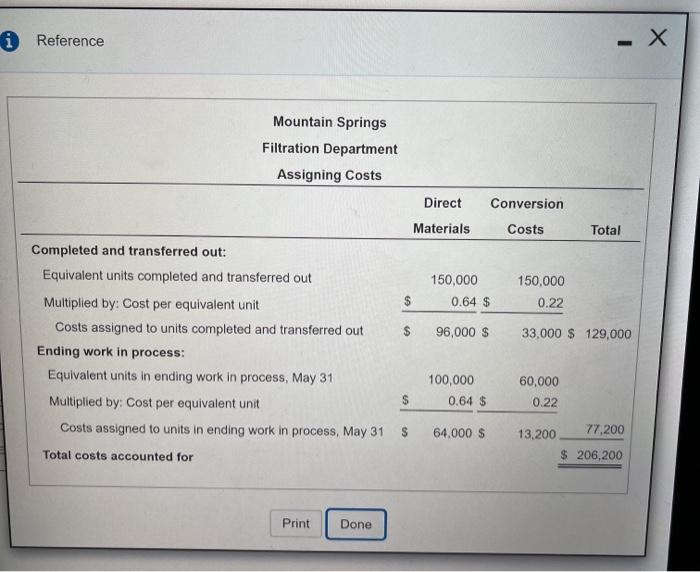

Mountain Springs produces premium bottled water. Mountain Springs purchases artesian water, stores the water in large tanks, and then runs the water through two processes: filtration and bottling. At Mountain Springs, water is added at the beginning of the filtration process. Conversion costs are added evenly throughout the process. Mountain Springs has no beginning inventories. During May, the filtration process incurred the following costs in processing 250,000 ters: Click the icon to view the costs.) (Click the icon to view the assignment of costs.) 1. Record the journal entry to transfer the cost of the 150,000 liters completed and transferred out of the Filtration Department and into the Bottling Department 2. Record all of the transactions in the "Work in Process Inventory--- Filtration T-account 1. Record the journal entry to transfer the cost of the 150,000 liters completed and transferred out of the Filtration Department and into the Bottling Department. (Record debits first, then credits. Exclude explanations from any journal entries) Journal Entry Accounts Date Debit Credit 2. Record all of the transactions in the "Work in Process Inventory--Filtration" T-account Post the transactions involving the costs incurred to the Filtration Department to the T-account and determine the ending balance. (For entries with a $0 balance, make sure to enter "o" in the appropriate cell.) Work in Process Inventory-Filtration Data Table -X $ 11,000 Wages of workers operating the filtration equipment... Wages of workers operating ozonation equipment Manufacturing overhead allocated to Filtration. Water $ 12.200 $ 23,000 $ 160,000 Print Done Choose i Reference - Mountain Springs Filtration Department Assigning Costs Direct Conversion Materials Costs Total 150,000 0.64 $ 150,000 0.22 $ $ 96,000 $ 33,000 $ 129,000 Completed and transferred out: Equivalent units completed and transferred out Multiplied by: Cost per equivalent unit Costs assigned to units completed and transferred out Ending work in process: Equivalent units in ending work in process, May 31 Multiplied by: Cost per equivalent unit Costs assigned to units in ending work in process, May 31 Total costs accounted for 100,000 0.64 $ 60,000 0.22 $ $ 64.000 $ 13,200 77,200 $ 206,200 Print Done