Answered step by step

Verified Expert Solution

Question

1 Approved Answer

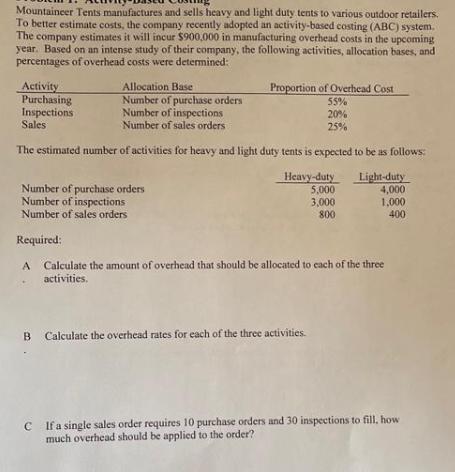

Mountaineer Tents manufactures and sells heavy and light duty tents to various outdoor retailers. To better estimate costs, the company recently adopted an activity-based

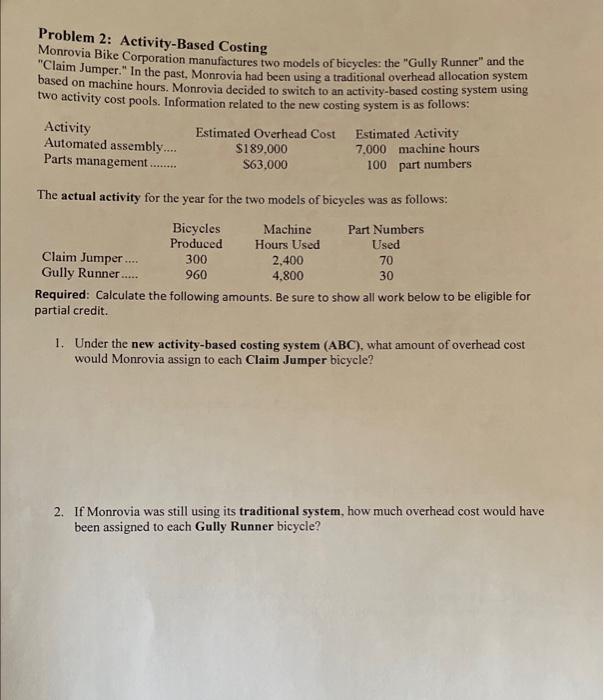

Mountaineer Tents manufactures and sells heavy and light duty tents to various outdoor retailers. To better estimate costs, the company recently adopted an activity-based costing (ABC) system. The company estimates it will incur $900,000 in manufacturing overhead costs in the upcoming year. Based on an intense study of their company, the following activities, allocation bases, and percentages of overhead costs were determined: Activity Purchasing Inspections Sales Allocation Base Number of purchase orders Number of inspections Number of sales orders The estimated number of activities for heavy and light duty tents is expected to be as follows: Heavy-duty Light-duty 5,000 4,000 3,000 1,000 800 400 Number of purchase orders Number of inspections Number of sales orders Required: A Proportion of Overhead Cost 55% 20% 25% Calculate the amount of overhead that should be allocated to each of the three activities. B Calculate the overhead rates for each of the three activities. C If a single sales order requires 10 purchase orders and 30 inspections to fill, how much overhead should be applied to the order? Problem 2: Activity-Based Costing Monrovia Bike Corporation manufactures two models of bicycles: the "Gully Runner" and the "Claim Jumper." In the past, Monrovia had been using a traditional overhead allocation system based on machine hours. Monrovia decided to switch to an activity-based costing system using two activity cost pools. Information related to the new costing system is as follows: Activity Automated assembly..... Parts management.. Estimated Overhead Cost Estimated Activity $189,000 $63,000 7,000 machine hours 100 part numbers The actual activity for the year for the two models of bicycles was as follows: Part Numbers Used 70 30 BEST Bicycles Produced Claim Jumper .... Gully Runner.. Required: Calculate the following amounts. Be sure to show all work below to be eligible for partial credit. Machine Hours Used 2,400 4,800 300 960 1. Under the new activity-based costing system (ABC), what amount of overhead cost would Monrovia assign to each Claim Jumper bicycle? 2. If Monrovia was still using its traditional system, how much overhead cost would have been assigned to each Gully Runner bicycle?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Calculation of overhead allocated to each activity Purchasing Total overhead cost 900000 55 495000 Overhead allocated per purchase order 495000 5000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started