Answered step by step

Verified Expert Solution

Question

1 Approved Answer

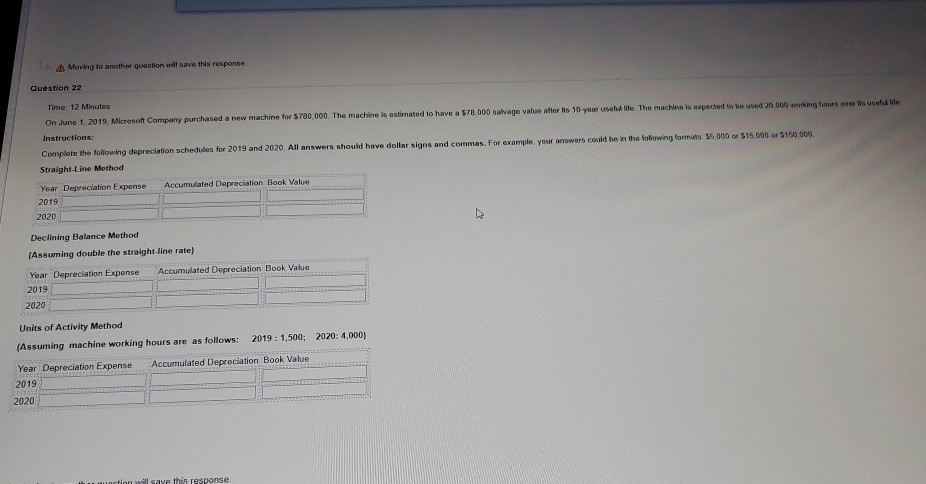

Moving to another question will save this response Question 22 Time: 12 Minutes On June 1, 2019. Microsoft Company purchased a new machine for $760,000.

Moving to another question will save this response Question 22 Time: 12 Minutes On June 1, 2019. Microsoft Company purchased a new machine for $760,000. The machine is estimated to have a $78,000 salvage value after its 10-year lile. The machine is expected to bed 25 000 working hours over muscle Instructions Complete the following depreciation schedules for 2019 and 2020. All answers should have dollar signs and commas. For example, you answers could be in the fofowing formas 55.000 $15.000 or 100.000 Straight-Line Method Year Depreciation Expense Accumulated Depreciation Book Value 2019 2020 Declining Balance Method (Assuming double the straight-line rate) Year Depreciation Expense Accumulated Depreciation Book Value 2019 2020 Units of Activity Method (Assuming machine working hours are as follows: 2019: 1,500; 2020: 4,000) Year Depreciation Expense Accumulated Depreciation Book Value 2019 2020 leave this rescanse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started