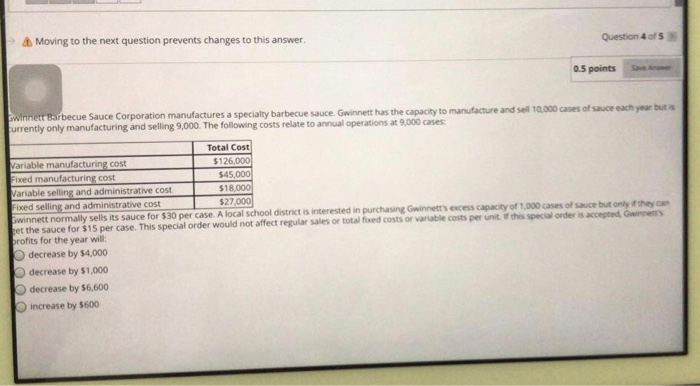

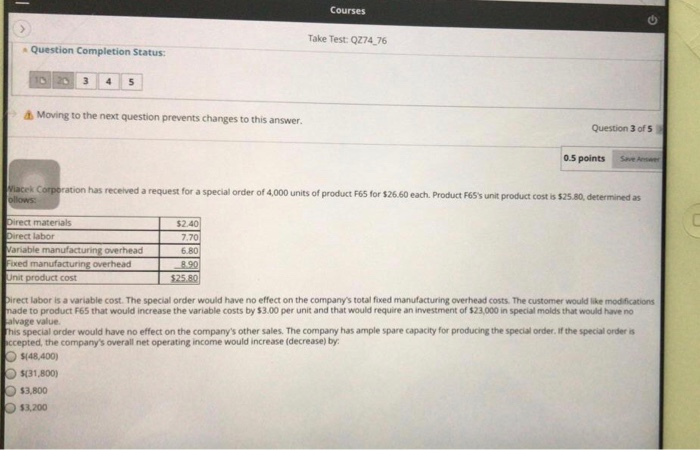

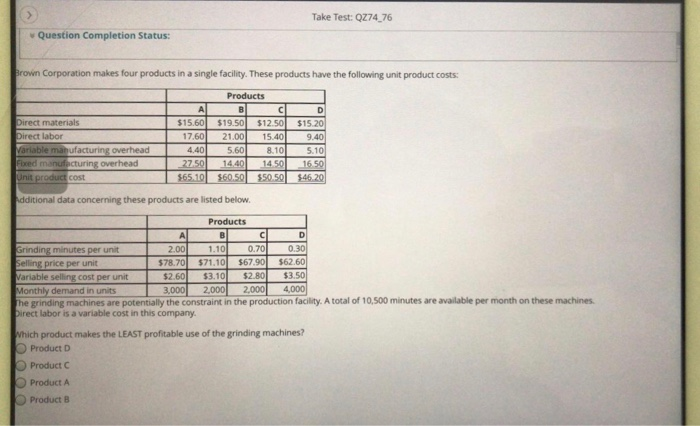

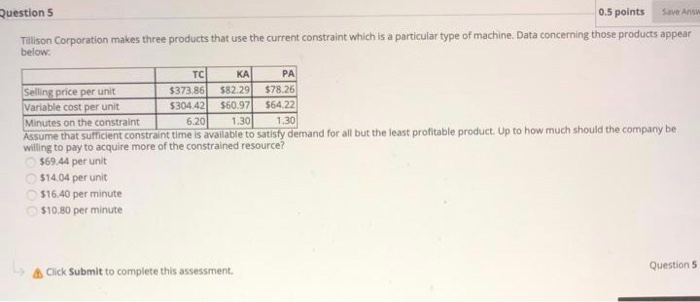

Moving to the next question prevents changes to this answer Question 4 of 5 0.5 points winnett Barbecue Sauce Corporation manufactures a specialty barbecue sauce. Gwinnett has the capacity to manufacture and sell 10.000 cases of suce each year but Currently only manufacturing and selling 9,000. The following costs relate to annual operations at 9.000 cases: 545.000 Total Cost Variable manufacturing cost $126,000 Fixed manufacturing cost Variable selling and administrative cost $18,000 Fixed selling and administrative cost $27.000 Gwinnett normally sells its sauce for $30 per case. A local school district is interested in purchasing w etences capacity of 1000 cases of suce but only they can get the sauce for $15 per case. This special order would not affect regular sales or total fed costs or variable costs per unit this special orders accepted profits for the year will: decrease by $4,000 decrease by $1,000 decrease by 56,600 increase by 5600 Courses Take Test: Q274_76 Question Completion Status: Moving to the next question prevents changes to this answer. Question 3 of 5 0.5 points Viacek Corporation has received a request for a special order of 4,000 units of product F65 for $26.60 each. Product F65's unit product cost is 525.80, determined as ollows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost $2.40 7.70 6.80 890 $25.80 irect labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications I made to product F65 that would increase the variable costs by $3.00 per unit and that would require an investment of $23.000 in special molds that would have no Lalvage value This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by: $(48,400) $(31,800 $3,800 $3,200 Take Test: QZ74_76 Question Completion Status: Brown Corporation makes four products in a single facility. These products have the following unit product costs Direct materials Direct labor Variable manufacturing overhead Fored manufacturing overhead Unit product cost Products ABCD $15.60 $19.50 $12.50 315.20 17.60 21.00 15.40 9.40 4.40 5.601 8.10 5.10 27.50 14.40 1450 1650 $65.10 $60.50 350.50 $46.20 Additional data concerning these products are listed below. Products A B C D Grinding minutes per unit 2.00 1.10 0.70 0.30 Selling price per unit ) $78.70 $71.10 567.901362 601 Variable selling cost per unit $2.60 $3.10 $2.80 $3.50 Monthly demand in units 3,000 2,000 2,000 4,000 The grinding machines are potentially the constraint in the production facility. A total of 10,500 minutes are available per month on these machines Direct laboris a variable cost in this company Vhich product makes the LEAST profitable use of the grinding machines? Product D Product Product A Products Question 5 0.5 points Save Ano Tillison Corporation makes three products that use the current constraint which is a particular type of machine. Data concerning those products appear below: TC KAPA Selling price per unit $373.86 582.29 $78.26 Variable cost per unit 5304.42 $60.97 564,22 Minutes on the constraint 6.20 1.30 1 .30 Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource? $69.44 per unit $14.04 per unit $16.40 per minute 510.80 per minute Click Submit to complete this assessment Question 5