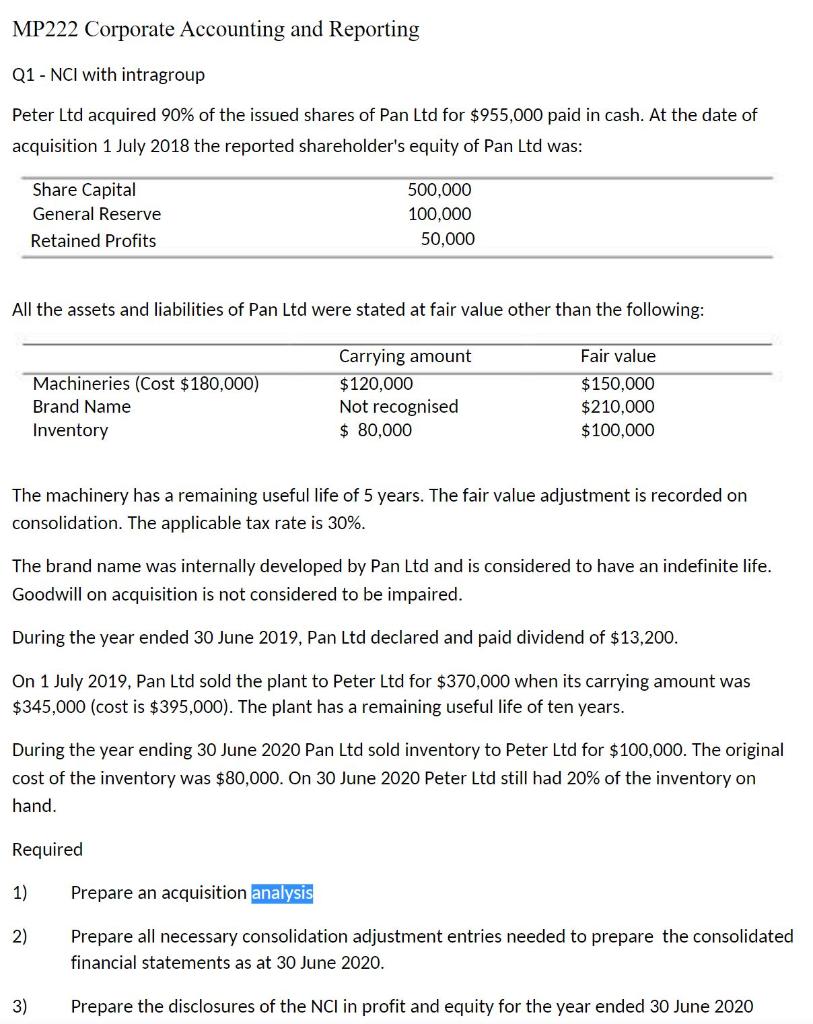

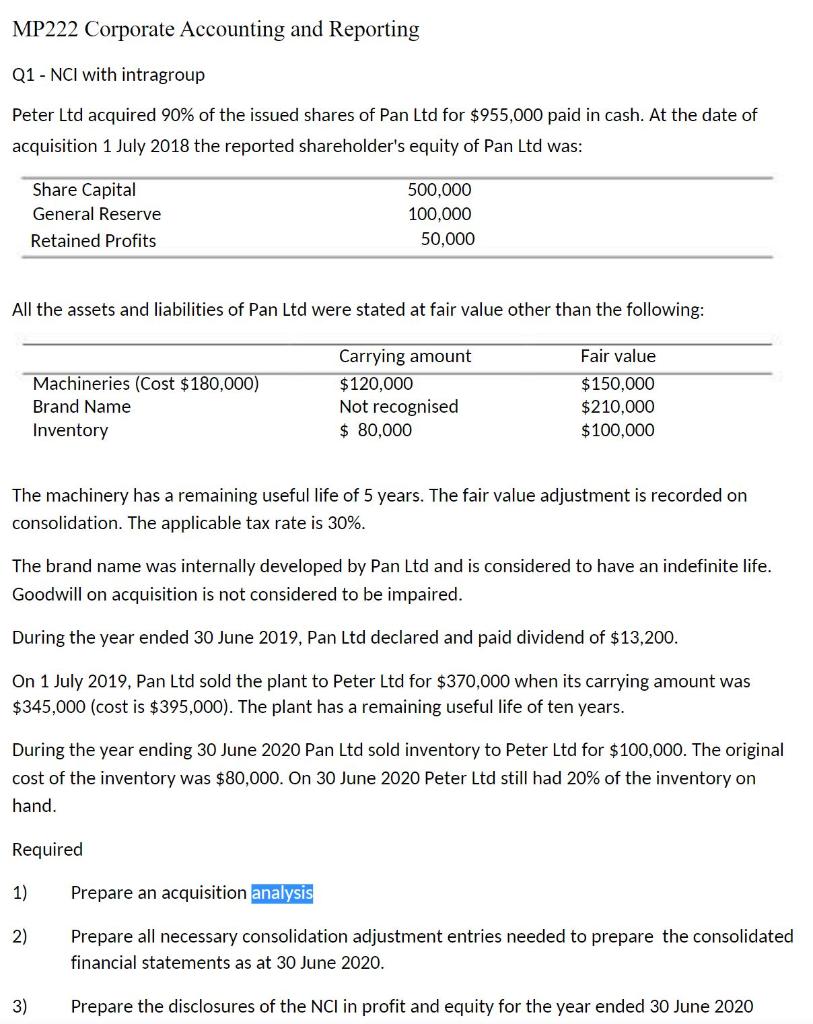

MP222 Corporate Accounting and Reporting Q1 - NCl with intragroup Peter Ltd acquired 90% of the issued shares of Pan Ltd for $955,000 paid in cash. At the date of acquisition 1 July 2018 the reported shareholder's equity of Pan Ltd was: All the assets and liabilities of Pan Ltd were stated at fair value other than the following: The machinery has a remaining useful life of 5 years. The fair value adjustment is recorded on consolidation. The applicable tax rate is 30%. The brand name was internally developed by Pan Ltd and is considered to have an indefinite life. Goodwill on acquisition is not considered to be impaired. During the year ended 30 June 2019, Pan Ltd declared and paid dividend of $13,200. On 1 July 2019, Pan Ltd sold the plant to Peter Ltd for $370,000 when its carrying amount was $345,000 (cost is $395,000 ). The plant has a remaining useful life of ten years. During the year ending 30 June 2020 Pan Ltd sold inventory to Peter Ltd for $100,000. The original cost of the inventory was $80,000. On 30 June 2020 Peter Ltd still had 20% of the inventory on hand. Required 1) Prepare an acquisition 2) Prepare all necessary consolidation adjustment entries needed to prepare the consolidated financial statements as at 30 June 2020. 3) Prepare the disclosures of the NCl in profit and equity for the year ended 30 June 2020 MP222 Corporate Accounting and Reporting Q1 - NCl with intragroup Peter Ltd acquired 90% of the issued shares of Pan Ltd for $955,000 paid in cash. At the date of acquisition 1 July 2018 the reported shareholder's equity of Pan Ltd was: All the assets and liabilities of Pan Ltd were stated at fair value other than the following: The machinery has a remaining useful life of 5 years. The fair value adjustment is recorded on consolidation. The applicable tax rate is 30%. The brand name was internally developed by Pan Ltd and is considered to have an indefinite life. Goodwill on acquisition is not considered to be impaired. During the year ended 30 June 2019, Pan Ltd declared and paid dividend of $13,200. On 1 July 2019, Pan Ltd sold the plant to Peter Ltd for $370,000 when its carrying amount was $345,000 (cost is $395,000 ). The plant has a remaining useful life of ten years. During the year ending 30 June 2020 Pan Ltd sold inventory to Peter Ltd for $100,000. The original cost of the inventory was $80,000. On 30 June 2020 Peter Ltd still had 20% of the inventory on hand. Required 1) Prepare an acquisition 2) Prepare all necessary consolidation adjustment entries needed to prepare the consolidated financial statements as at 30 June 2020. 3) Prepare the disclosures of the NCl in profit and equity for the year ended 30 June 2020