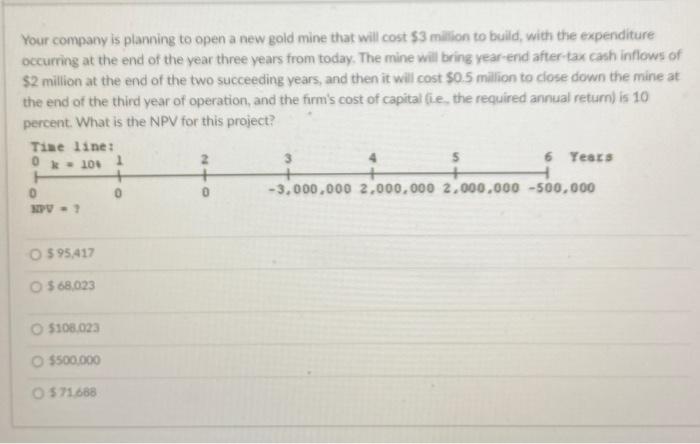

Your company is planning to open a new gold mine that will cost $3 million to build, with the expenditure occurring at the end

Your company is planning to open a new gold mine that will cost $3 million to build, with the expenditure occurring at the end of the year three years from today. The mine will bring year-end after-tax cash inflows of $2 million at the end of the two succeeding years, and then it will cost $0.5 million to close down the mine at the end of the third year of operation, and the firm's cost of capital (ie, the required annual return) is 10 percent. What is the NPV for this project? Time line: k - 104 0 H 0 NPV - ? O $ 95,417 O $68,023 O $108,023 O $500,000 O$71.668 1 0 240 3 5 + -3,000,000 2,000,000 2.000.000 -500,000 6 Years

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

NPV computation a Year NPV ans b PVIF Cas...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started