Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MPI Incorporated has $4 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its return on

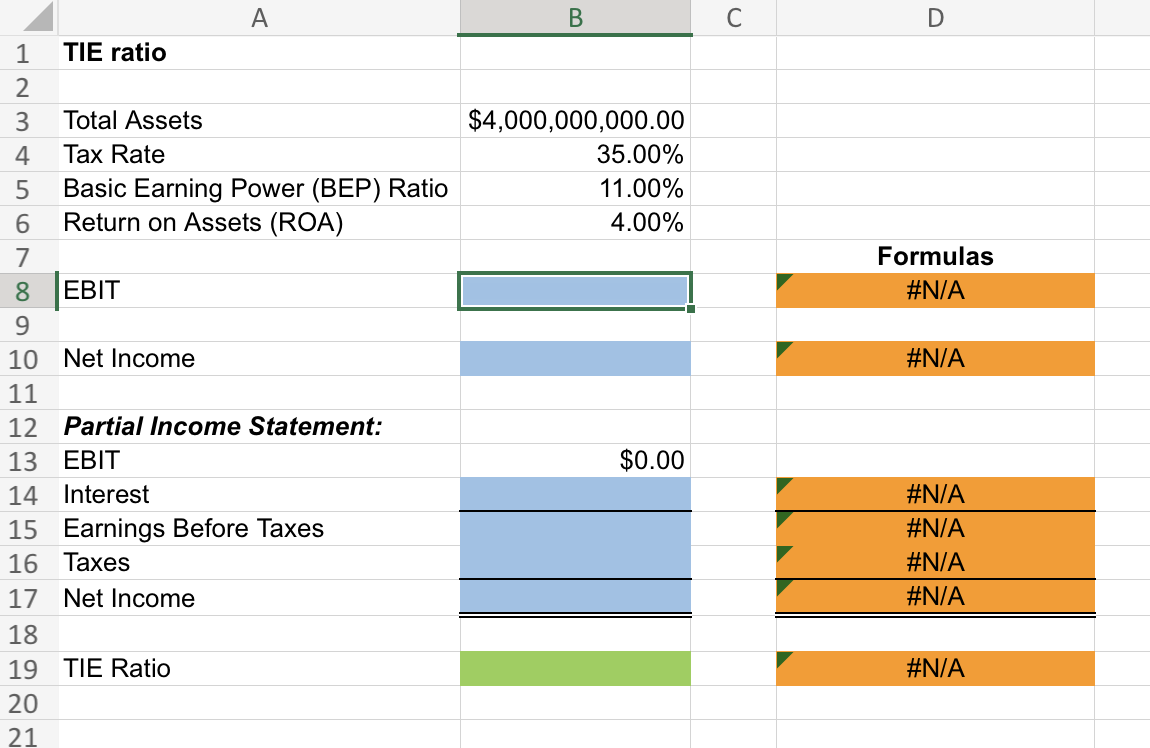

MPI Incorporated has $4 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 4%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places. \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline 1 & TIE ratio & & & \\ \hline \multicolumn{5}{|l|}{2} \\ \hline 3 & Total Assets & $4,000,000,000.00 & & \\ \hline 4 & Tax Rate & 35.00% & & \\ \hline 5 & Basic Earning Power (BEP) Ratio & 11.00% & & \\ \hline 6 & Return on Assets (ROA) & 4.00% & & \\ \hline 7 & & & & Formulas \\ \hline 8 & EBIT & & & \#N/A \\ \hline \multicolumn{5}{|l|}{9} \\ \hline 10 & Net Income & & & \#N/A \\ \hline \multicolumn{5}{|c|}{11} \\ \hline 12 & Partial Income Statement: & & & \\ \hline 13 & EBIT & $0.00 & & \\ \hline 14 & Interest & & & \#N/A \\ \hline 15 & Earnings Before Taxes & & & \#N/A \\ \hline 16 & Taxes & & & #N/A \\ \hline 17 & Net Income & & & \#N/A \\ \hline \multicolumn{5}{|c|}{18} \\ \hline 19 & TIE Ratio & & & \#N/A \\ \hline 20 & & & & \\ \hline \end{tabular}

MPI Incorporated has $4 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 4%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places. \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline 1 & TIE ratio & & & \\ \hline \multicolumn{5}{|l|}{2} \\ \hline 3 & Total Assets & $4,000,000,000.00 & & \\ \hline 4 & Tax Rate & 35.00% & & \\ \hline 5 & Basic Earning Power (BEP) Ratio & 11.00% & & \\ \hline 6 & Return on Assets (ROA) & 4.00% & & \\ \hline 7 & & & & Formulas \\ \hline 8 & EBIT & & & \#N/A \\ \hline \multicolumn{5}{|l|}{9} \\ \hline 10 & Net Income & & & \#N/A \\ \hline \multicolumn{5}{|c|}{11} \\ \hline 12 & Partial Income Statement: & & & \\ \hline 13 & EBIT & $0.00 & & \\ \hline 14 & Interest & & & \#N/A \\ \hline 15 & Earnings Before Taxes & & & \#N/A \\ \hline 16 & Taxes & & & #N/A \\ \hline 17 & Net Income & & & \#N/A \\ \hline \multicolumn{5}{|c|}{18} \\ \hline 19 & TIE Ratio & & & \#N/A \\ \hline 20 & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started